Thursday’s troubles in Japan started when the nation’s ten-year bond yield reached 0.88 percent on Wednesday. It was as recent as April 5 when the nation’s ten-year bond yield was just over 0.31 percent. At that point, the Bank of Japan revved-up the printing press for the latest phase in the quantitative easing program at the core of Prime Minister Shinzo Abe’s “Abenomics” agenda.

The jump in Japan’s ten-year bond yield motivated Bank of Japan governor Haruhiko Kuroda to discuss the issue at the conclusion of the BOJ two-day policy meeting which ended on Wednesday. Mr. Kuroda attempted to convey reassurance that JGB (Japanese government bond) yields were under the bank’s control, adding that he did not believe that the recent rise in JGB yields was having a big impact on the economy.

Japanese investors had a different opinion, which was expressed by a massive display of risk aversion during the final three hours of Thursday’s trading session on the Tokyo Stock Exchange. Within a period of less than 200 minutes, the Nikkei 225 Stock Average took a 7.32 percent nosedive to 14,483. During that time, the yen had strengthened to approximately 101.7 per dollar from 103.57 earlier in the session. A stronger yen results in less-competitive prices for Japanese exports in foreign markets.

Meanwhile, as JGB yields continued to climb during Thursday’s trading session, the BOJ turned on its fire hose and injected 2 trillion yen ($19.7 billion) into the nation’s financial system to stabilize volatility in long-term JGB yields.

After the market close, Japanese officials made a series of reassurances, which followed the theme of “Pay no attention to that man behind the curtain”. Chief Cabinet Secretary Yoshihide Suga attempted to blame the stock market swoon on China’s weakening economy, which caused Chinese stock indices to sink on Thursday because the HSBC Flash Manufacturing PMI report for May fell into contractionary territory at 49.6 (a seven-month low) from 50.4 in April.

Akira Amari, Japan’s Minister of State for Economic Revitalization insisted that there was “no need to be perturbed” because the Japanese economy has been “recovering soundly”.

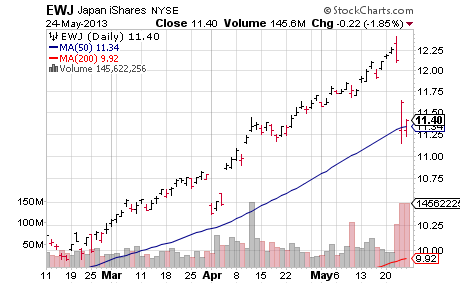

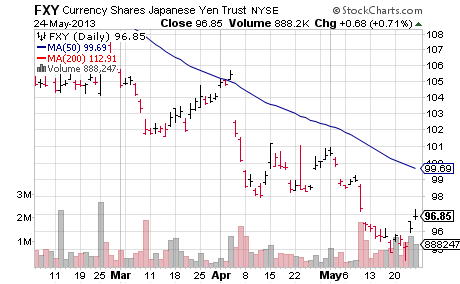

Investors in the ProShares UltraShort Yen ETF (YCS) saw their position sink in value by 2.25 percent on Thursday afternoon. Despite the fact that YCS is leveraged to obtain results which correspond to twice the inverse of the daily performance of the U.S. Dollar price of the Japanese Yen, investors who had positions in the iShares MSCI Japan Index Fund (EWJ) fared worse. EWJ – a non-leveraged ETF – sank 4.20 percent during Thursday’s session. Many investors who believed in Abenomics (at least, until Thursday) held positions in both of these ETFs.

On Friday, the Nikkei 225 Stock Average rebounded by 0.89 percent. The Nikkei spent most of Friday’s session in the range of 14,900 – which was where the Nikkei was briefly trading during the surge on May 15. During the second half of the session the Nikkei sank as low as 13,981 before climbing back to end the week at 14,612.

Investors interested in trading the chaos in Japan could consider the following ETFs:

iShares MSCI Japan Index Fund (EWJ) – This ETF is designed to obtain results which correspond generally to performance of the MSCI Japan Index. The MSCI Japan Index consists of stocks traded primarily on the Tokyo Stock Exchange. Components primarily include consumer discretionary, financial and industrial companies.

CurrencyShares Japanese Yen Trust ETF (FXY) – This ETF is designed to track the price of the Japanese Yen.

Bottom line: Turmoil in financial markets always yields both opportunity and danger and so the outcome of the current crisis in Japan will produce both winners and losers in both Japan’s stock market and the Yen.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector's Disclaimer, Terms of Use, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Thursday’s Savage Sell-Off In Japan Shocks Global Markets

Published 05/24/2013, 01:09 AM

Thursday’s Savage Sell-Off In Japan Shocks Global Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.