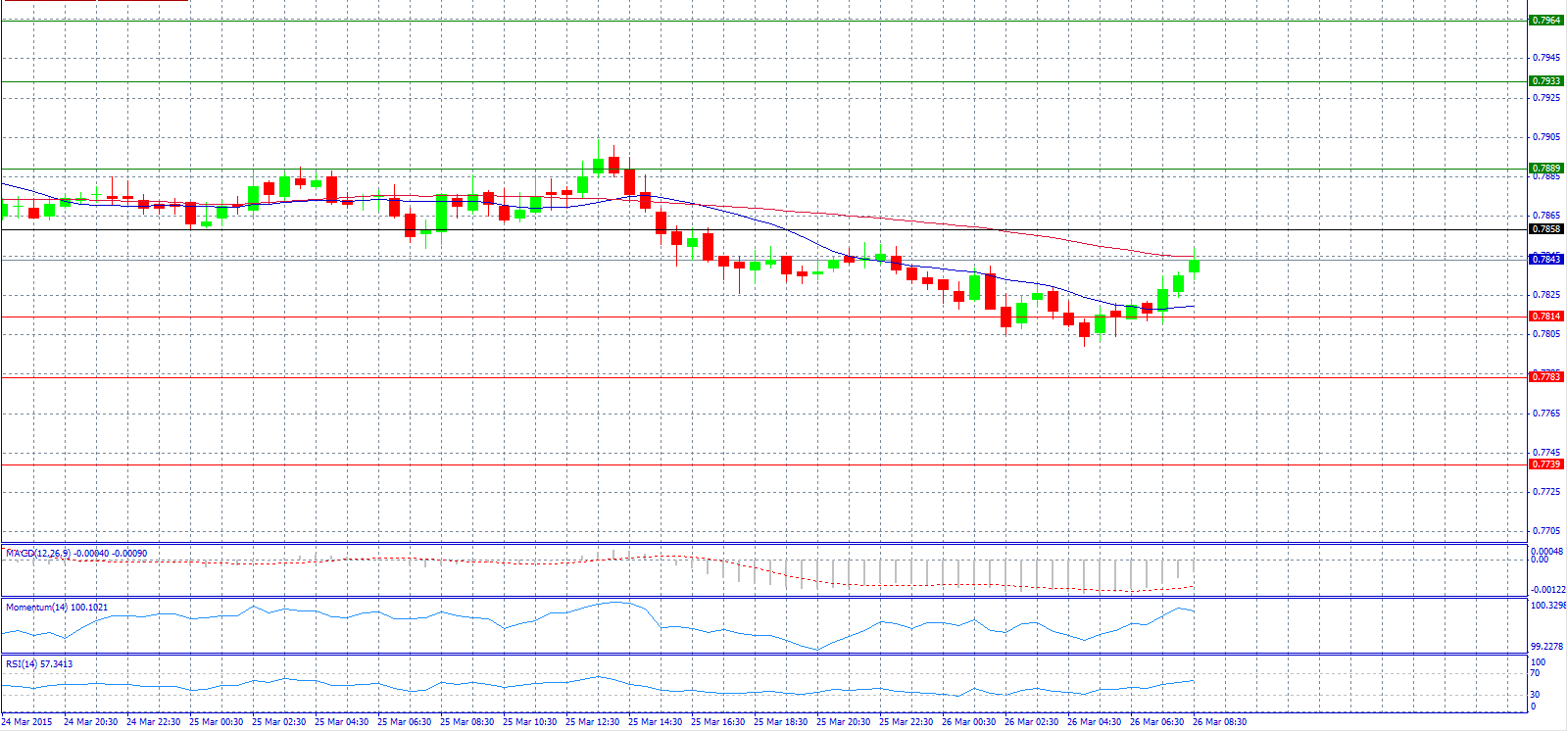

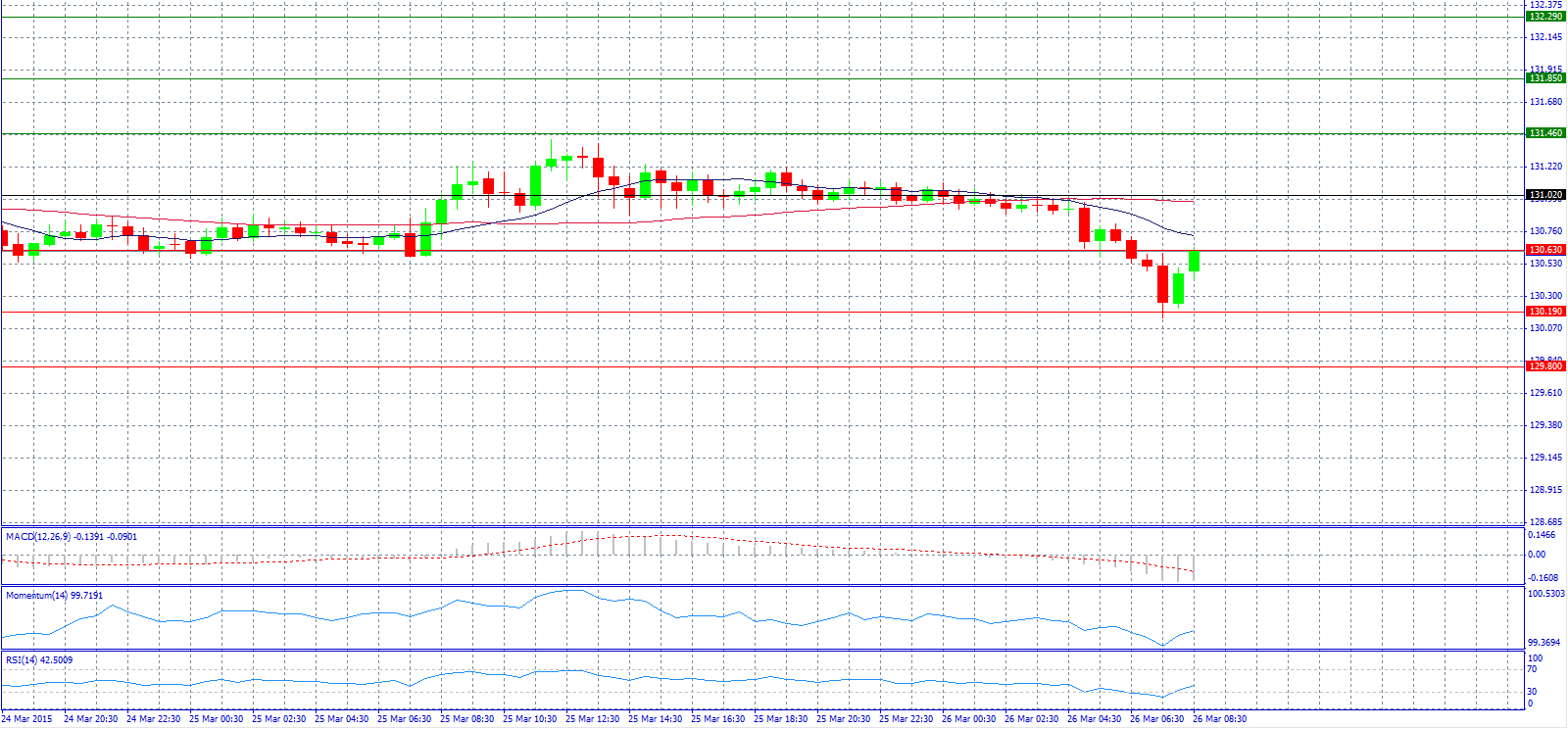

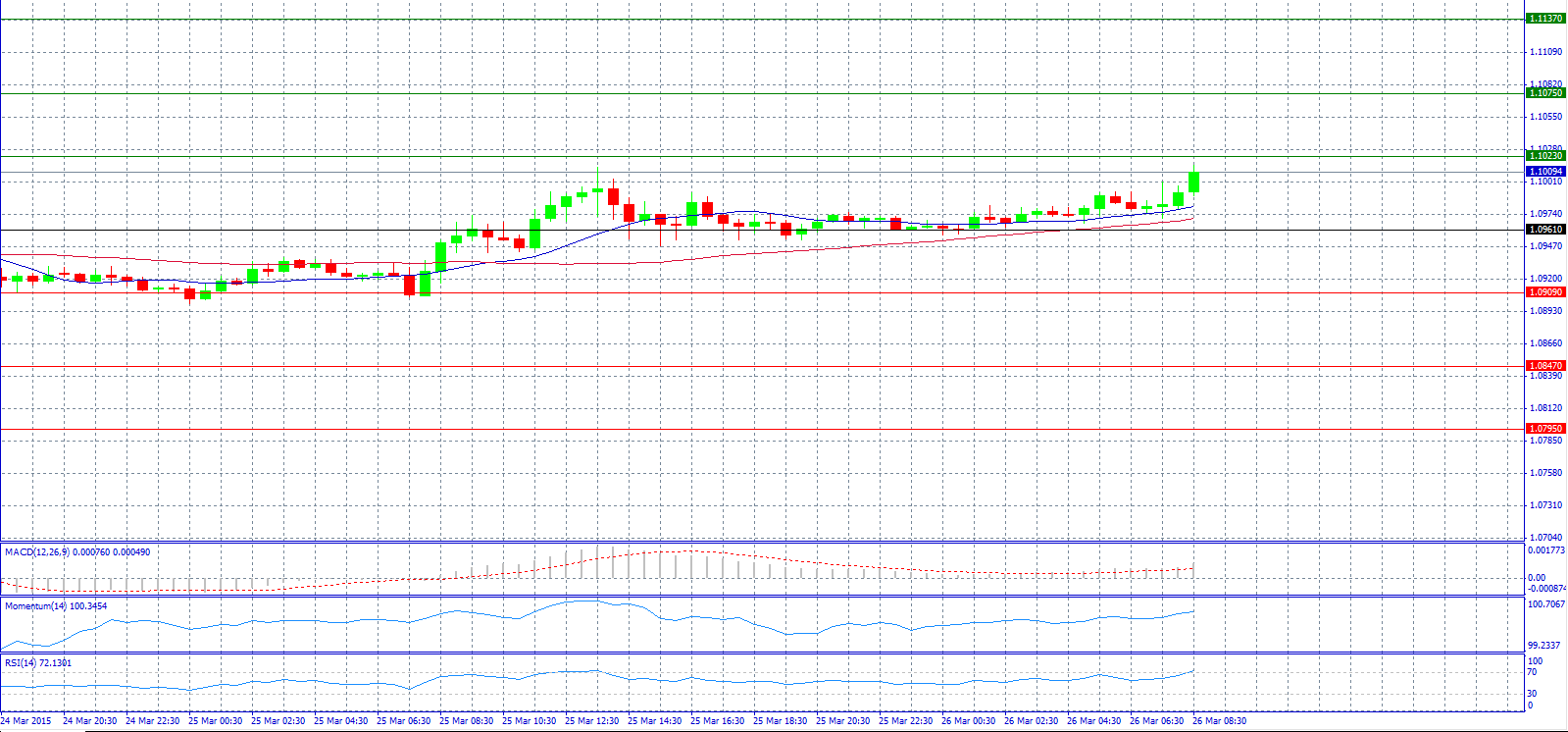

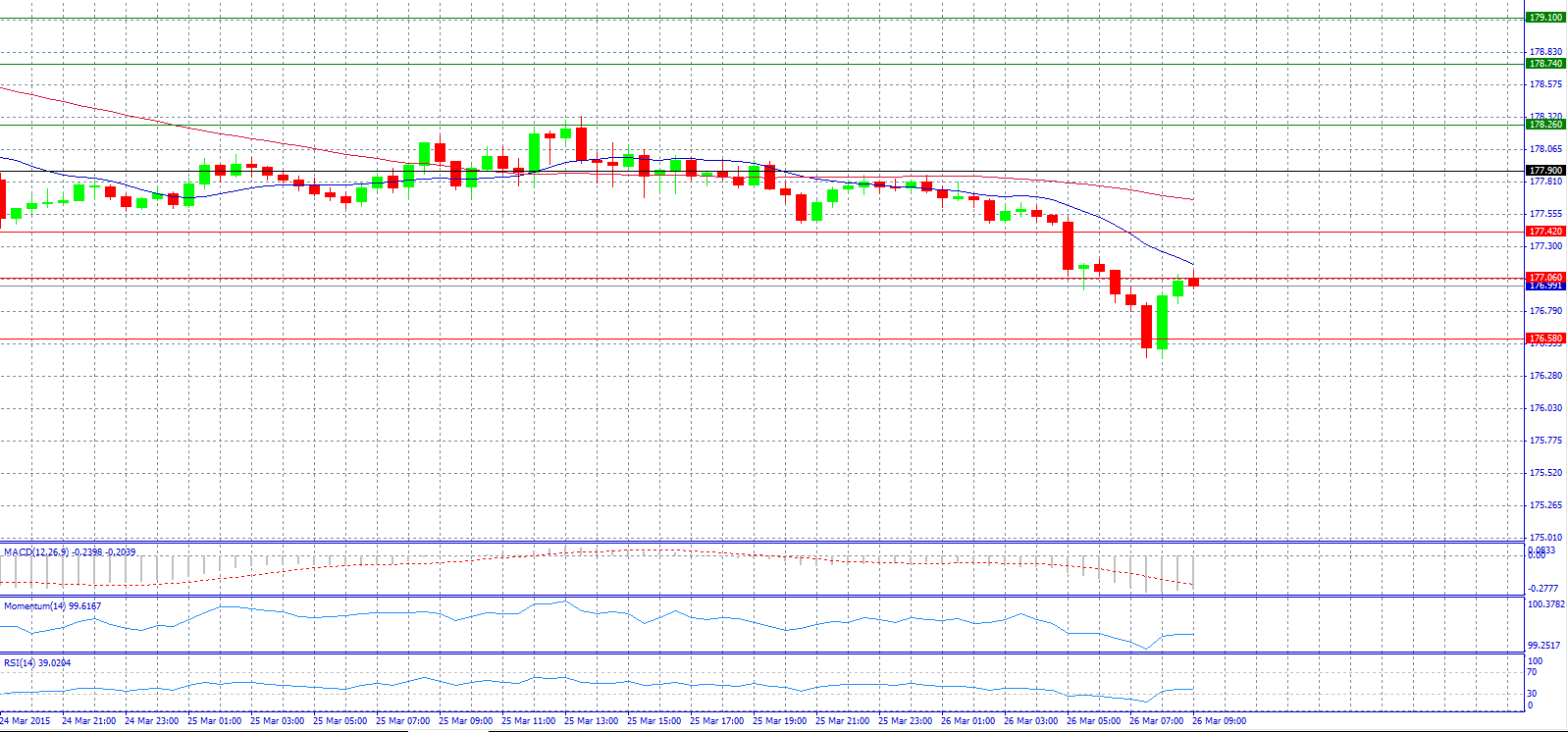

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7858 with target @ 0.7889.

Market Scenario 2: Short positions below 0.7858 with target @ 0.7783.

Comment: The pair found a bottom at 0.7800 and now it’s advancing again.

Supports and Resistances:

R3 0.7964

R2 0.7933

R1 0.7889

PP 0.7858

S1 0.7814

S2 0.7783

S3 0.7739

Market Scenario 1: Long positions above 131.02 with target @ 131.46.

Market Scenario 2: Short positions below 131.02 with target @ 130.19.

Comment: The pair trades at 130.63 for now and bulls are poised to push the pair higher towards the 133.00 level.

Supports and Resistances:

R3 132.29

R2 131.85

R1 131.46

PP 131.02

S1 130.63

S2 130.19

S3 129.80

Market Scenario 1: Long positions above 1.0961 with target @ 1.1075.

Market Scenario 2: Short positions below 1.0961 with target @ 1.0909.

Comment: The pair surpassed 1.1000 level after ECB raised the ELA limit for Greek Banks.

Supports and Resistances:

R3 1.1137

R2 1.1075

R1 1.1023

PP 1.0961

S1 1.0909

S2 1.0847

S3 1.0795

Market Scenario 1: Long positions above 177.90 with target @ 178.26.

Market Scenario 2: Short positions below 177.90 with target @ 176.58.

Comment: The pair trades near the second support level 177.06.

Supports and Resistances:

R3 179.10

R2 178.74

R1 178.26

PP 177.90

S1 177.42

S2 177.06

S3 176.58

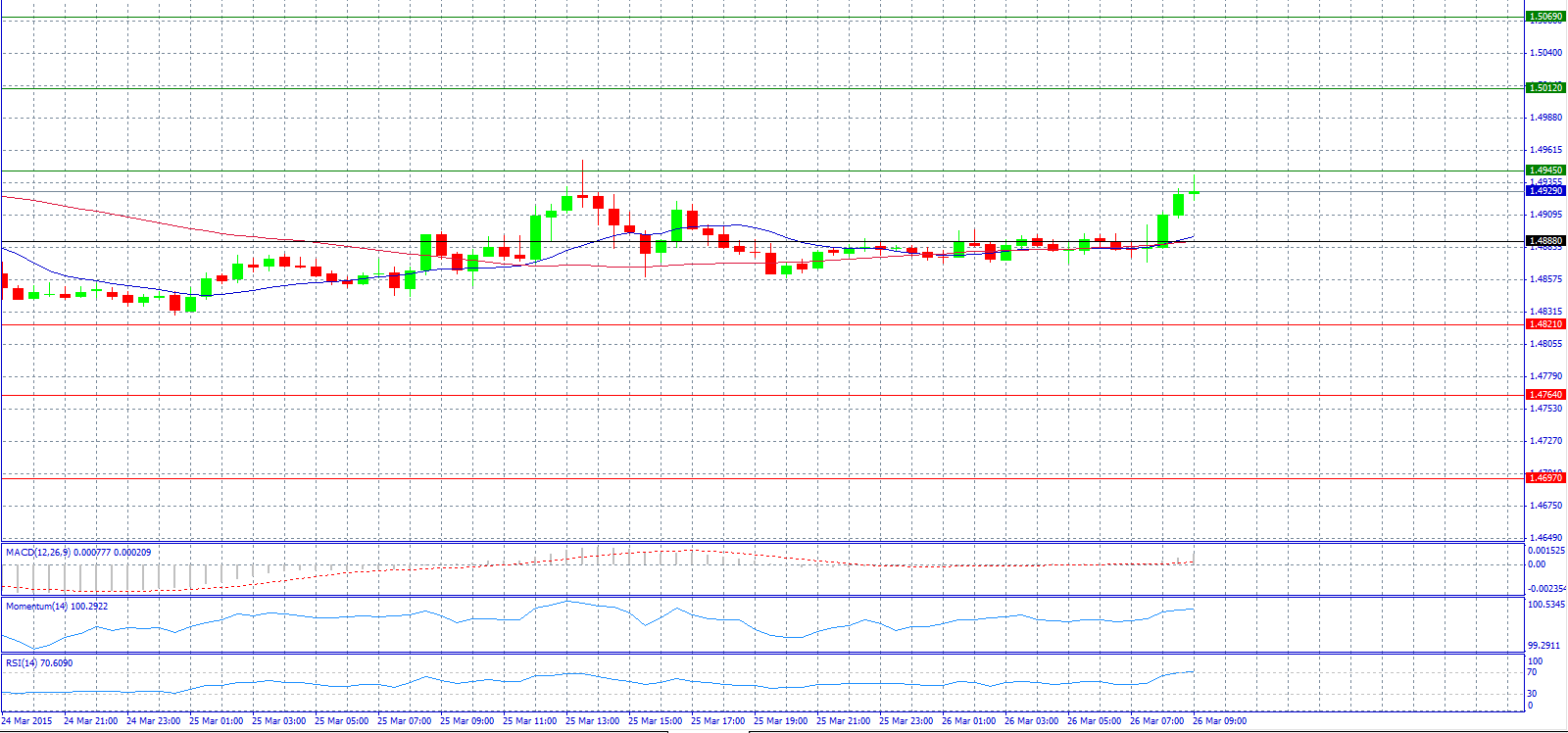

Market Scenario 1: Long positions above 1.4888 with target @ 1.5012.

Market Scenario 2: Short positions below 1.4888 with target @ 1.4821.

Comment: The pair might reach 1.5075 level if it surpasses 1.4984/90 level according to analysts.

Supports and Resistances:

R3 1.5069

R2 1.5012

R1 1.4945

PP 1.4888

S1 1.4821

S2 1.4764

S3 1.4697

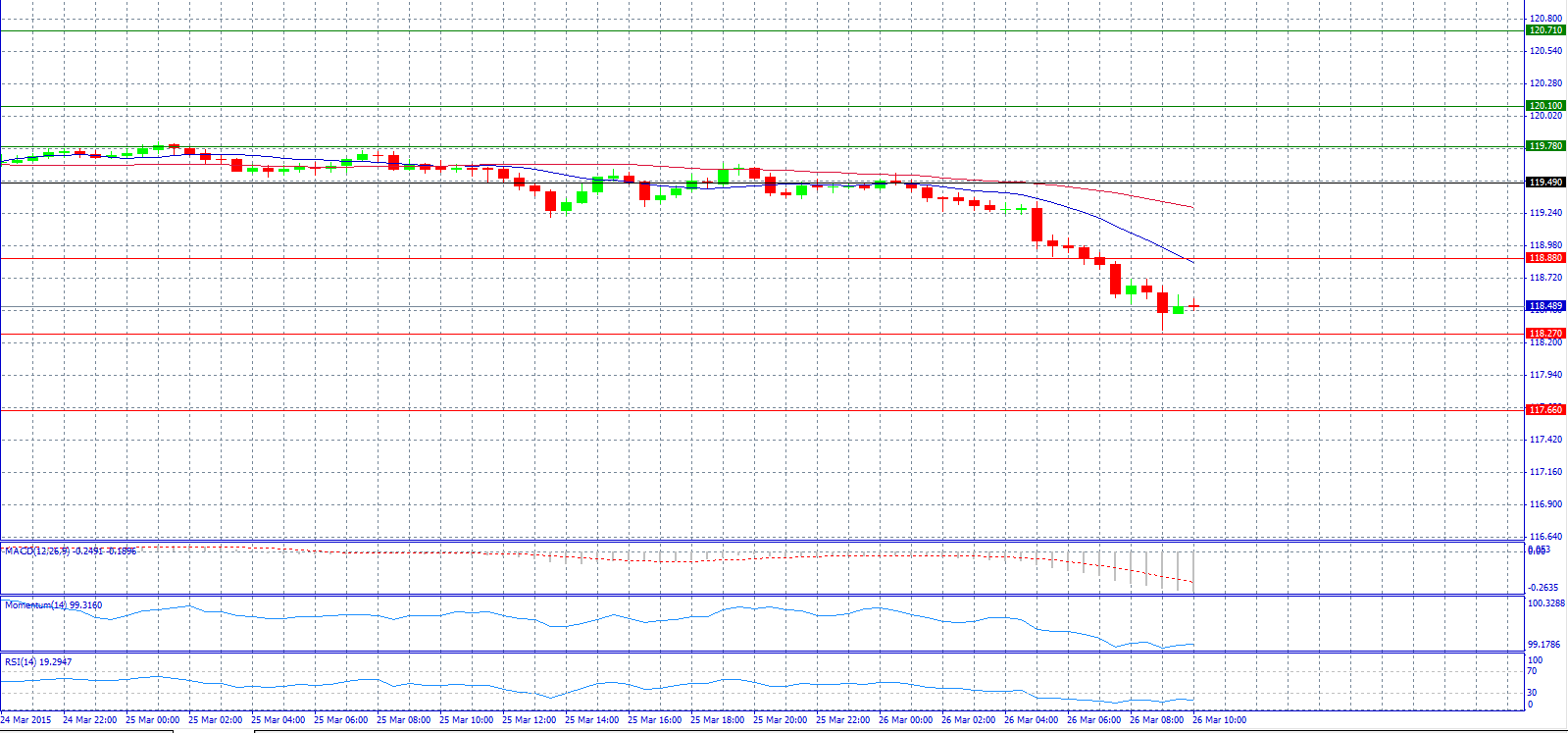

Market Scenario 1: Long positions above 119.49 with target @ 119.78.

Market Scenario 2: Short positions below 119.49 with target @ 117.66.

Comment: The pair is dragged nearly 1% lower to fresh five week lows, on increased safe-haven demand for the Japanese currency amid ongoing geopolitical crisis between Yemen and Saudi Arabia.

Supports and Resistances:

R3 120.71

R2 120.10

R1 119.78

PP 119.49

S1 118.88

S2 118.27

S3 117.66

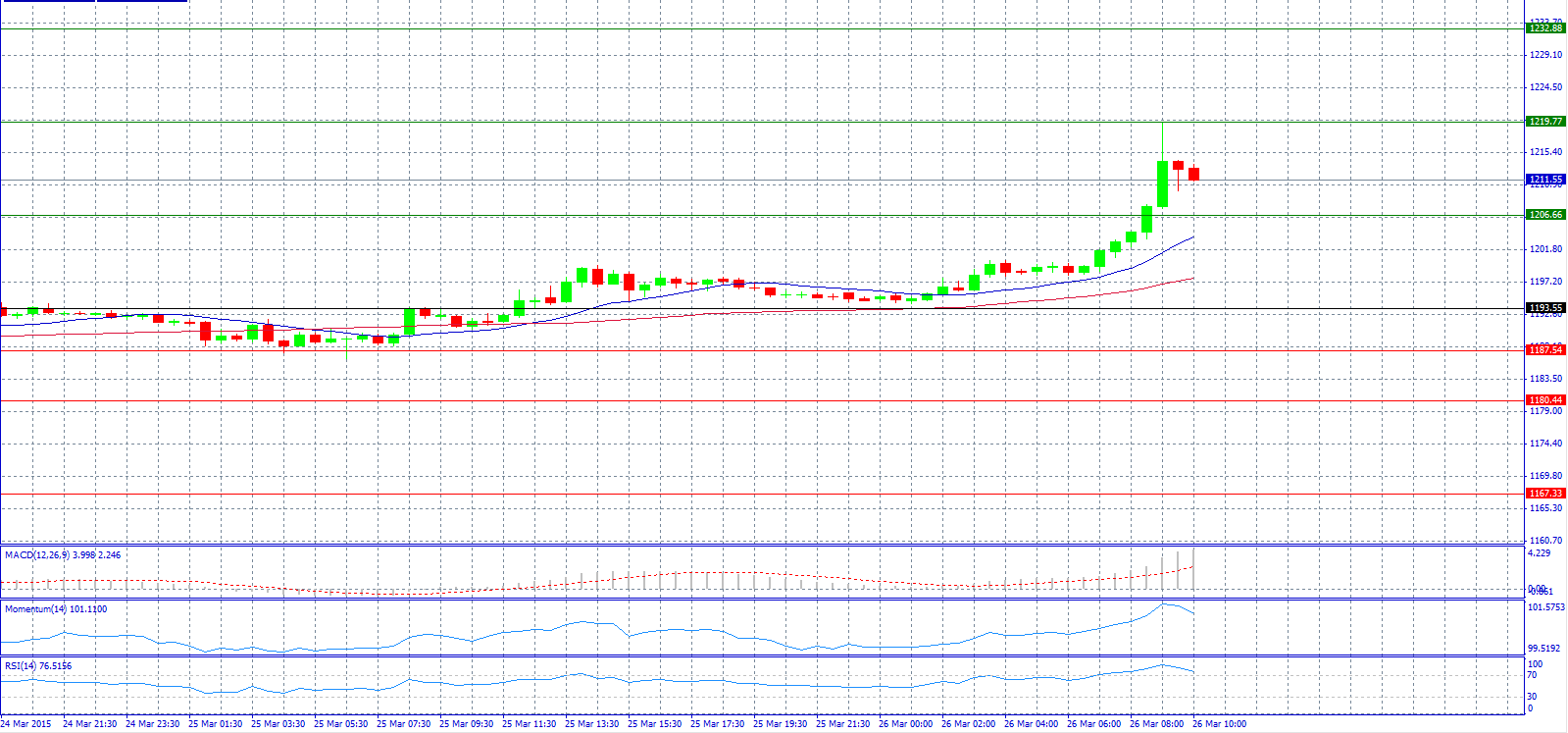

Market Scenario 1: Long positions above 1193.55 with target @ 1232.88.

Market Scenario 2: Short positions below 1193.55 with target @ 1187.54.

Comment: Gold prices backed-off slightly from the session high to trade below 1215.00 level.

Supports and Resistances:

R3 1232.88

R2 1219.77

R1 1206.66

PP 1193.55

S1 1187.54

S2 1180.44

S3 1167.33

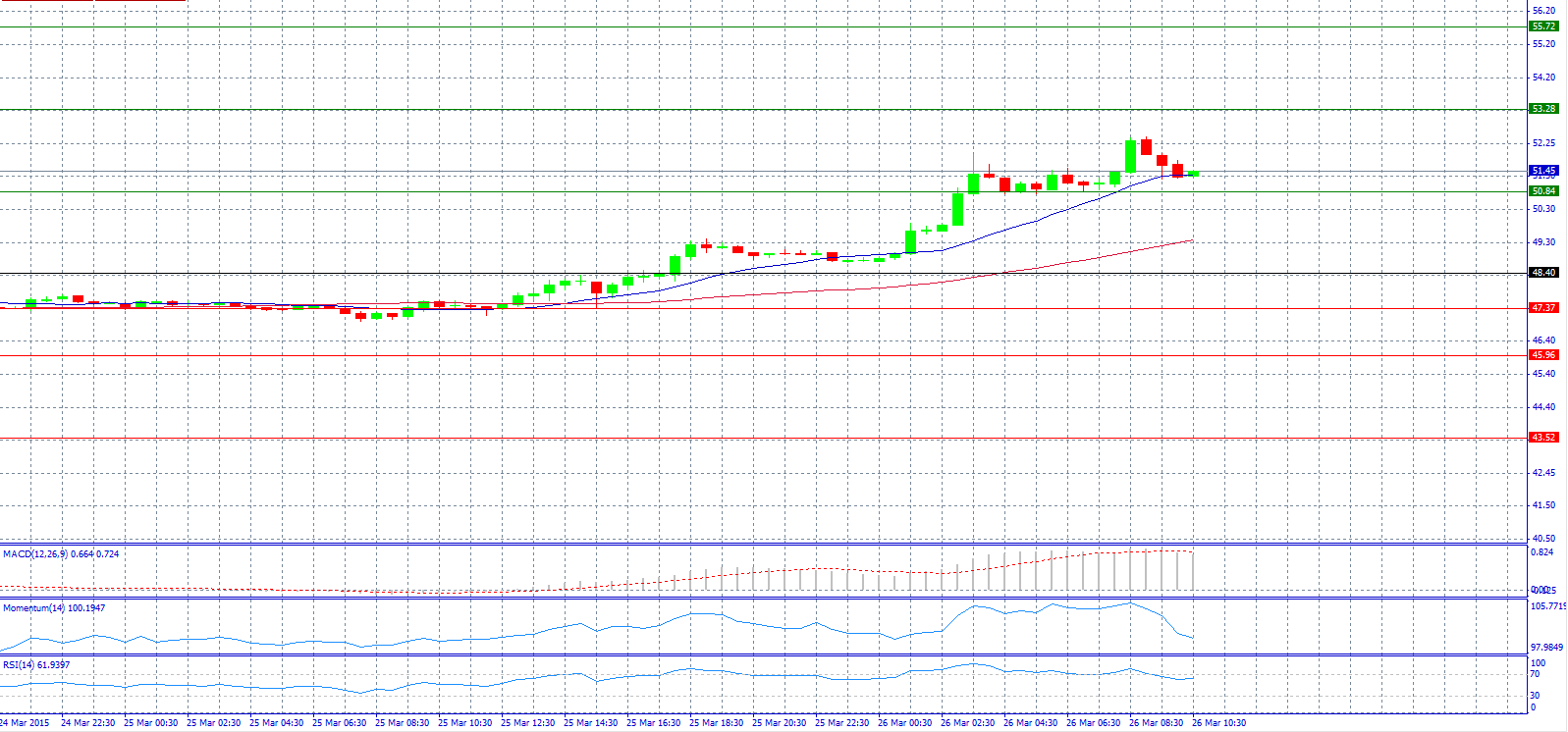

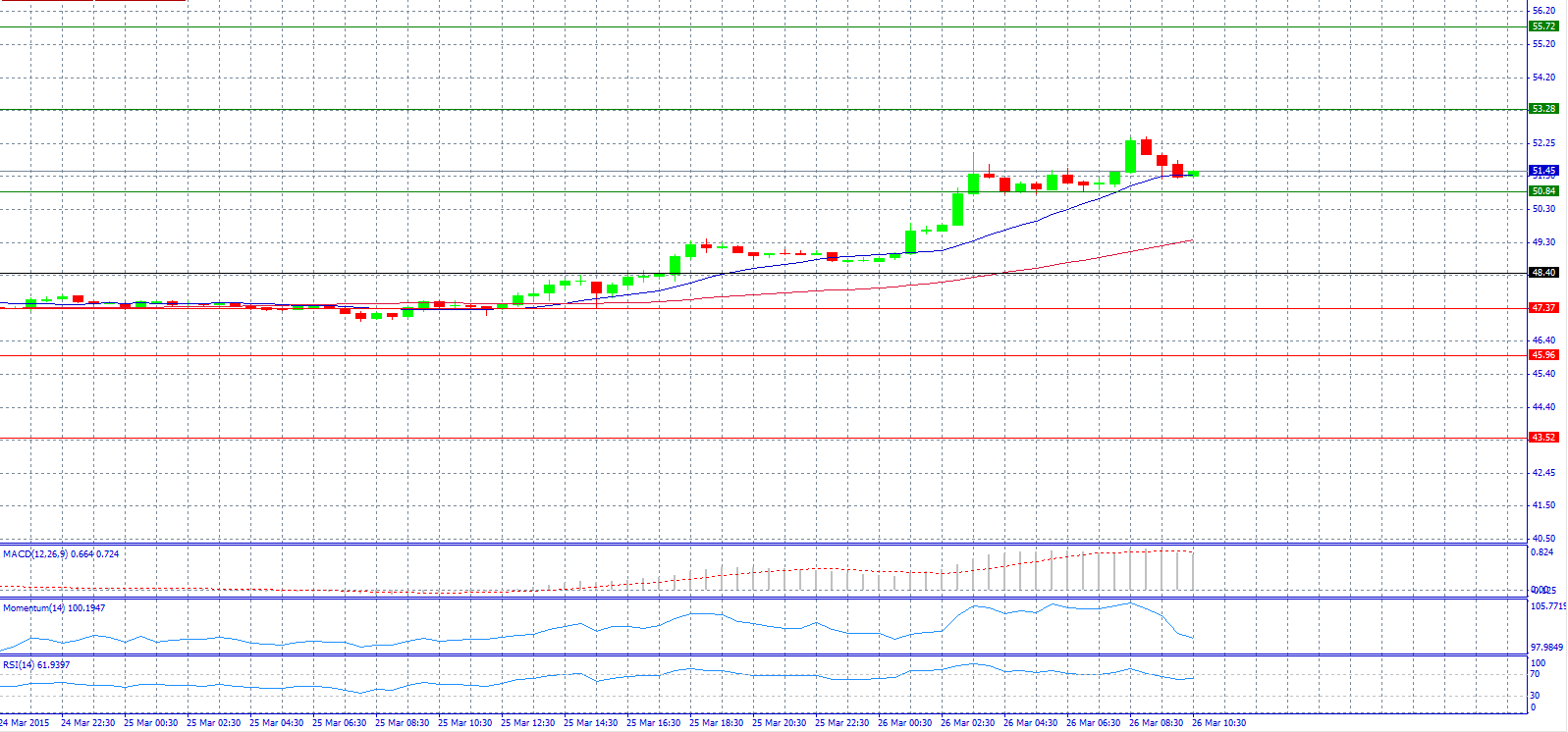

Market Scenario 1: Long positions above 48.40 with target @ 53.28.

Market Scenario 2: Short positions below 48.40 with target @ 47.37.

Comment: Crude oil prices jumped after Saudi air strikes in Yemen.

Supports and Resistances:

R3 55.72

R2 53.28

R1 50.84

PP 48.40

S1 47.37

S2 45.96

S3 43.52

Market Scenario 1: Long positions above 56.360 with target @ 57.097.

Market Scenario 2: Short positions below 56.360 with target @ 53.588.

Comment: The ruble is gaining further ground following the Russia-Ukraine deal, which ensures natural gas supply for Ukraine during March, and directly avoids at the same time potential disruption in the gas supply for the EU.

Supports and Resistances:

R3 59.132

R2 57.746

R1 57.097

PP 56.360

S1 55.711

S2 54.974

S3 53.588