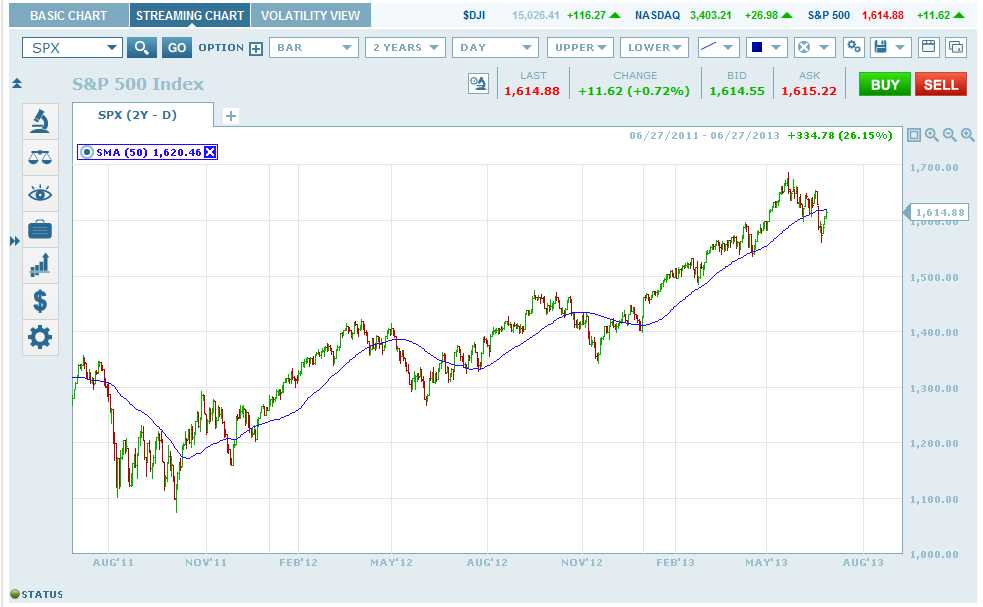

The broad market (S&Ps) are right back to the 50-day moving average. Congrats.

That was/is the longest stretch below the 50 day since the November election. Depending on today's close it will be either 5 days below or 6. The level on the September futures = 1612 (highs = 1614). August Nat Gas is trading at the lowest level since late February following today's inventory day (injection of 95bCf, slightly greater than 91bCf expectations). In my estimation, the risk v. reward on long deltas in NG is fairly compelling.

Elsewhere in the Energy complex, some relationship spreads are at multi-month wides including Gasoline v. Heating Oil (Aug RB trading at a 16.50 cent discount to Heating Oil). While it's counter intuitive, Heating Oil has a tendency to OUTPERFORM gasoline into July. I believe this spread could snap back before too long, but it's not for the faint of heart. Every penny = $420 (plus frictional costs).

The August Gasoline Crack spread (Gasoline relative to WTI) is also finding new lows (Gasoline is underperforming against WTI).

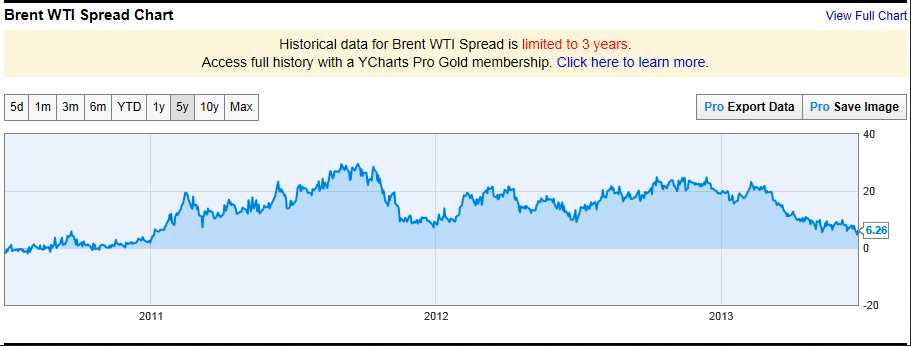

Much of this is related, but WTI continues to gain on Brent Crude. Generally when Brent is leading, the products tend to do well (RB and HO). Since late February, WTI has narrowed the gap with Brent by $11.00. On 2/25, the spread was about $17 wide and this morning it was $6 wide. This is the narrowest the spread has been since the onset of the Arab Spring in early 2011 (and it puts considerable pressure on refining margins).

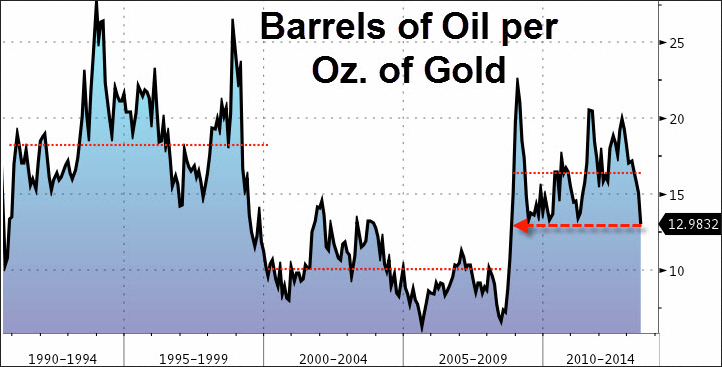

Also, the ratio of Gold or Silver to Oil is wider than it's been in years (essentially, how many barrels of Oil - WTI you can purchase with an ounce of Gold or how many ounces of Silver it takes to buy a barrel).

As of today's trade this spread is 1225/97=12.70.

WTI in Silver terms = 97/18.60 or 5.25 oz of Silver for a barrel of Oil. Clearly both of these relationships were way different before the financial crisis, but it speaks to the bigger issue about alternative Currencies (Race to Debase and Inflation fears, which right now are non existent).

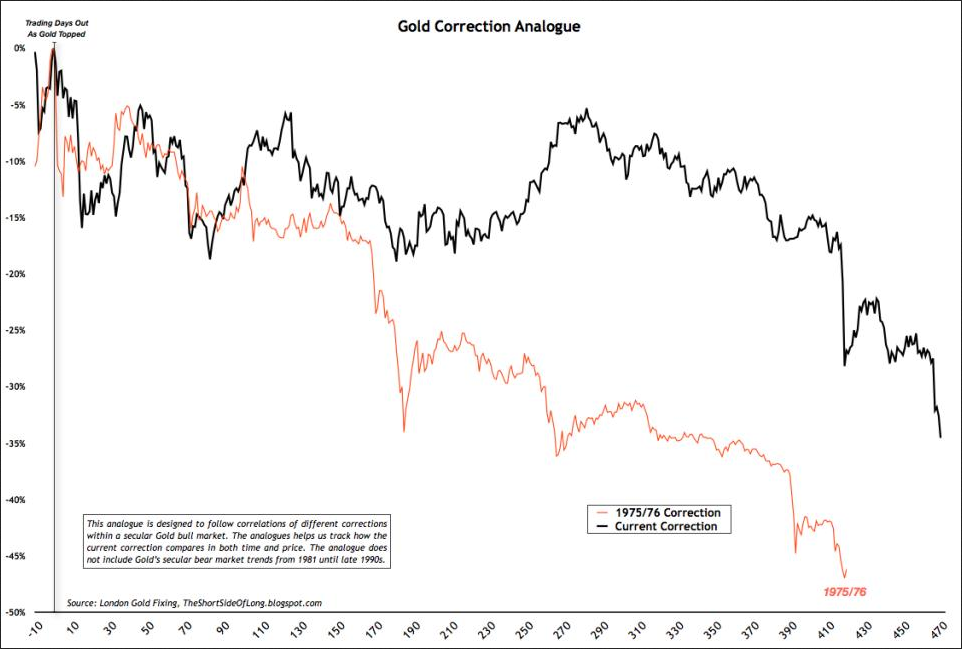

Finally, here's an interesting chart/analogue between the ongoing liquidation in Gold and the bloodbath the Yellow metal endured in the middle of the 70s (Ford Administration). In the 70s it was more vicious, falling about 45% over a year and a half. At this point, Gold is 37% off the 2011 highs and it's a year and nine months later.

USDA report tomorrow is important for Grain guys.

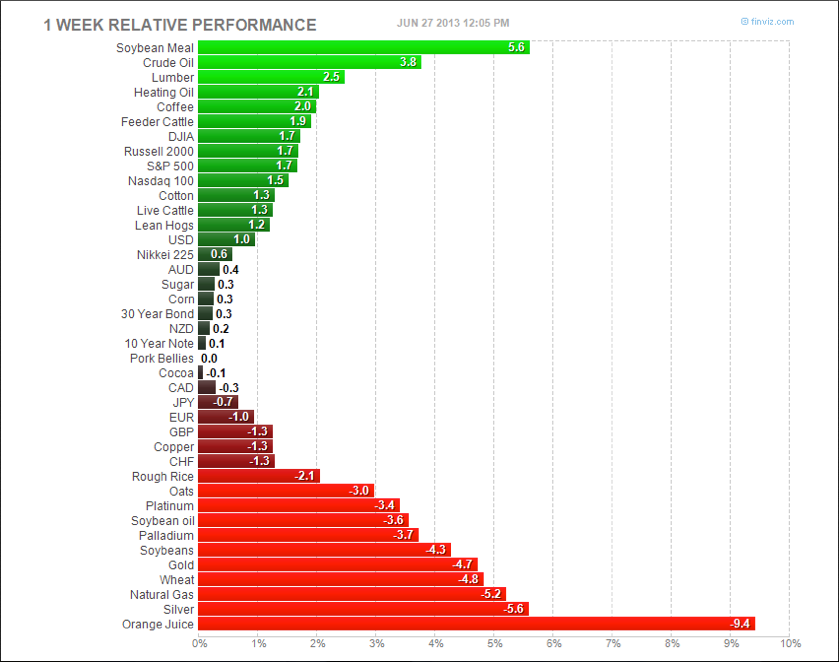

In esoteric markets, Lumber has rallied considerably over the past 2-3 sessions and Orange Juice has been annihilated over the same time frame.

Platinum tested Tuesday lows, but held and didn't break $1300. Maybe interesting.

The spread between month 1- and 2-month VIX futures has widened considerably since I mentioned it late last week. It rarely inverts and it traded up to EVEN last week. It got back out to .90 wide this morning.

In my opinion, there is an unusually high degree of risk no matter where you look. As always, don't let the S&P be your only guide.

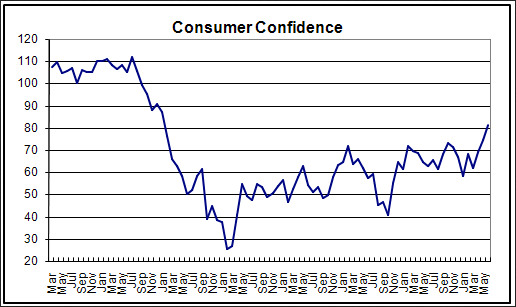

The divergence between Bean meal and oil is intriguing. Again....USDA tomorrow. Fed Speak continues on Friday with Stein, Lacker, and Williams. Chicago PMI and Consumer Confidence also out. Speaking of which Consumers are (surprisingly?) more confident than they have been in YEARS. This is more about perception than reality/fundamentals. Be very careful if that worm turns.

Risk Disclaimer: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities and/ or financial products herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed to be accurate. You should fully understand the risks associated with trading futures, options and retail off-exchange foreign currency transactions (“Forex”) before making any trades. Trading futures, options, and Forex involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more than your initial investment. Opinions, market data, and recommendations are subject to change without notice. Past performance is not necessarily indicative of future results. This report contains research as defined in applicable CFTC regulations. Both RCM Asset Management and the research analyst may have positions in the financial products discussed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Thursday's Market Thoughts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.