The US employment report will be a difficult read after an enormous positioning squeeze on both USD/JPY and EUR/CHF longs. The EUR/USD and GBP/USD shorts unfolded on Thursday ahead of the ECB meeting.

Thundering silence from the ECB sees Euro squeeze

The ECB meeting on Friday saw an extremely loud silence from Draghi and company on the policy initiative front – as it was only due to prodding during the Q&A period that Draghi addressed the issue of using ABS for SME credit initiatives and the potential for negative rates: the first of these is much farther off than we’ve been led to believe, as Draghi said this was a medium to long term proposition and remains “on the shelf”.

On the issue of negative deposit rates, Draghi said the ECB is technically ready but sees no reason to act. The market took this as euro-positive because of the lack of new easing impetus, but the equity markets weren’t happy in Europe. The banks and the peripheral spreads were just as upset, widening rather sharply. In other words, this ECB meeting brought nothing to the table for jump starting peripheral economies and essentially a shrugging of the shoulders on any further action at this time. It’s euro-positive from a “hard money” perspective, but EU economy negative in the short run. It will be interesting to see how much upside the Euro can squeeze out before we start to worry about systemic implications or tail risks.

Chart: EURUSD

There’s wasn't much of technical interest in the EUR/USD to the upside, save for the 1.3342 61.8% Fibo and 1.3480 76.4% Fibo retracement levels if 1.3300 from Thursday's falls. Anything beyond is very difficult to contemplate with the euro so strong across the board, as this would begin to exert very significant pressure to talk down the currency from the ECB and European politicians. To the downside, the obvious support level is the 1.3200/1.3180 flatline area and the rising 200-day moving average beyond. Only a massive reversal on Friday that could have immediately reversed Thursday's's rally, would put a decisive cap on the upside risk.

USD/JPY touches below 96.00

Overnight on Thursday, Japanese authorities were forced to trot out the line that they weren’t contemplating any intervention at this time. A move after the tremendous JPY weakening would not be in compliance with the clear rhetoric from the G-7 that intervention is a no-no. It’s very difficult to say whether the move bottomed.

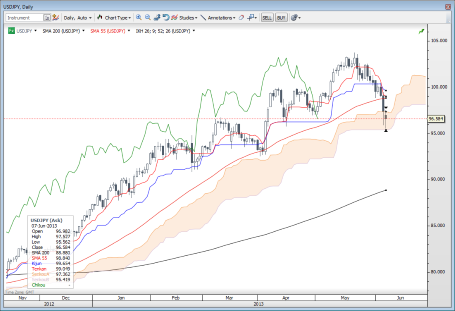

Chart: USD/JPY

Note those Ichimoku levels that I’ve pointed out on several occasions – the pair closed very close to the upper bound of the Ichimoku cloud above 97.00, while the overnight low was near the bottom bound of the cloud. Note that the blue Kijun line turned lower for the first time since last fall.  USD/JPY" title="USD/JPY" width="455" height="311">

USD/JPY" title="USD/JPY" width="455" height="311">

Commodity currencies

Commodity currencies were quick to weaken anew after the initial bounce, at least against the U.S. dollar. It would appear that a positioning squeeze at some point down the road may be the only way to get these currencies to rally for more than a day or so.

Looking ahead

The U.S. employment report will be difficult to gauge after such significant volatility. Things may calm a bit if it is completely in line with expectations. One would expect that a strong report (anything approaching or above 200k) would see bonds snapping back lower and possibly triggering a sudden rush higher in the USD/JPY as those who were forced out of their positions on the way down rush to get back in. An especially weak report, on the other hand, could see further rallying in fixed income and further USD weakness as the taper theme recedes further off on the horizon, and as the JPY heads stronger once again.

The broad USD rally has gone pear shaped, and the damage inflicted will take some time to address technically before it is back on track, unless we see an absolutely sizzling rally from the greenback in the near future that rejects what unfolded in recent days.

Note that the Canadian employment data was also up Friday - looking for the USD/CAD to rally again soon almost outside of what happens in the oddball strong EUR-JPY-GBP trio. A close well above 1.0300 would be a nice start to emphasize that solid support has been found.

Note that there a G20 meeting of finance ministers and CB deputy governors Friday which snuck up on us, though it’s not at all in focus. Ar aft of Chinese data was set for release over the weekend. The trade balance data there will be interesting, as the latest word is that authorities are looking to crack down on over-reported exports.

On Monday, we’ve got interesting Japanese trade data for April and the latest Consumer Confidence survey numbers.

Economic Data Highlights

- Australia May AiG Performance of Construction Index out at 35.3 vs. 35.2 in Apr.

- Japan May Official Reserve Assets out at $1250.2B vs. $1258.0B in Apr.

- Germany Apr. Trade Balance out at +18.1B vs. +17.0B expected and +18.8B in Mar.

- France Apr. Trade Balance out at -4515M vs. -4500M expected and -4556M in Mar.

- Switzerland May Foreign Currency Reserves out at 441.4B vs. 440.5B expected and 436.1B in Apr.

- China May CPI and PPI (Sun 0130)

- China May Industrial Production and Retail Sales (Sun 0530)

- New Zealand Q1 Manufacturing Activity (Sun 2245)

- Japan Apr. Current Account/Trade Balance (Sun 2350)

- Japan May Consumer Confidence (Mon 0500)