Volatility will always provide a degree of opportunity, currently something that investors cannot complain about. Last week, capital markets were exposed to massive sovereign bond yield swings that supported directional play in both the forex and equity space. European government debt markets are usually considered relatively stable with intraday yields moving only a few hundredths of a percentage point a day. In less than three weeks, the “trade of a lifetime” saw German 10-Year bund yields rally +75 basis points from record low yields (+0.05%). This price move is equivalent to three-rate hikes and then some. If it’s not political (surprise UK election outcome and Greece), fundamental (non-farm payrolls and China rate cuts), then it’s been the positional play (record short EUR positions on rate divergence) that has had required many investors to be prudent and rather agile.

Three regions and three trading themes will dominate the markets this week. The PBoC cuts rates over the weekend, which indicates their concern about a protracted slowdown in their economy. Investors will have a ringside seat and get to see data on fixed asset investment, industrial production and retail sales from the world’s second largest economy. Are we in the middle of a PBoC easing rate cycle or do we have much further to go?

In the eurozone, there is mounting optimism over an improving regional economy – that is to be confirmed in Q1 data this week. However, the tense Greek negotiations will be capable of trumping everything at the moment. Does Greece have the IMF Tuesday payment?

In the U.S, is the Q1 slowdown a part of a longer-term trend or a weather-influenced blip? Retail sales and industrial production data this week should go a long way in explaining to capital markets if the Fed is on course to hike rates by year-end.

Greek Default Risk Heightened

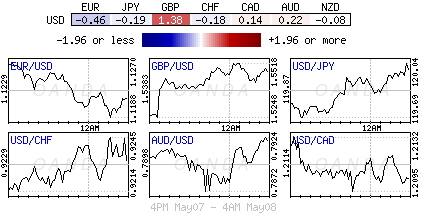

Friday’s end of week price action in a number of major USD pairings could be interpreted as signaling that the recent dollar selloff is perhaps stalling. Obviously Friday’s, as expected, U.S. non-farm payroll print (+223k and +5.4%) helped stop some of the recent dollar bleeding.

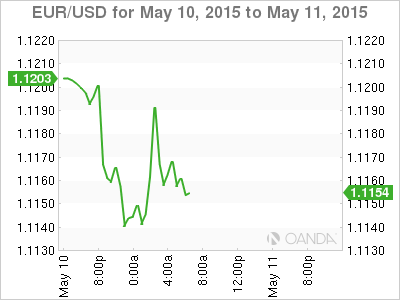

The EUR starts this week on the back foot as nerves have convinced some longs to liquidate ahead of today’s Eurogroup meeting. Renewed concern over Greece’s future in the eurozone will always remain a headwind for the euro currency.

No agreement is seen on Greece at this time, but EU members are expecting progress to be evident in the negotiation process. The talk between the Greek government and its international partners are entering a crucial phase, overshadowed by a precarious fiscal situation, heavy debt redemption (Greek payment to the IMF due Tuesday €750m – do they have the cash?) and concerns about the stability of the banking system. A majority of the market expects a deal to be reached, but the failure to reach an agreement in the coming weeks could firmly put Greece on the Grexit path.

With the fixed income market leading the forex moves of late, the EUR bull will be looking towards the rates market for support. A pleasant surprise for EUR long positions is that 2-year US/German yield spread has narrowed -5pb since Friday’s jobs report and with 10’s at +158bp are in -3pb today and remain close to last week’s +152bp low. The EUR bear is required to break €1.1135 support with momentum before pointing to further losses towards €1.1055 and €1.0850.

PBoC Pull the trigger again

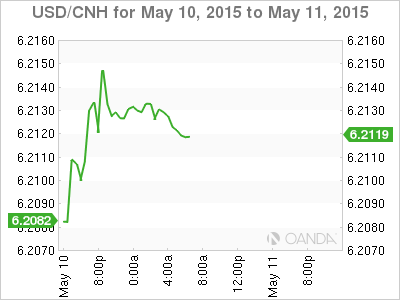

Chinese policy makers cut rates again over the weekend, its third in seven months. This time around it has caused little market reaction, mostly because of the size. The PBoC cut its main policy rate after soft trade and underwhelming CPI data.

April CPI inflation rose by a decimal to a four-month high of +1.5%, but still missed market expectations. The year-to-date CPI of +1.3% was also underwhelming, as it remains well below the official 2015 target of +3.0%. It’s worth noting that food CPI was once much higher at +2.7% vs. +0.9% for non-food. Officials do indicate that supply of meat and fresh vegetables has been stable, so there are no expectations of a sharp jump in food prices in the near term.

The easing – a -25bp cut in deposit and lending rates to +2.25% and +5.10% respectively – was widely expected by the market following last week’s downbeat trade numbers, though PBoC also noted it will continued to “promote real interest rates back towards reasonable levels” in response to the economy facing downward pressure.

Commodity currencies on their own

The consensus is for further easing by the PBoC. But, will looser policy in China provide support for commodity and interest rate sensitive currencies like the AUD, NZD or CAD? The initial market reaction does not expect a looser policy in China to feed through to commodity currencies. The fixed income market is pricing in a -50bp rate cut by the RBNZ by year-end. Governor Stevens at the RBA continues his “dovish” talk, projecting higher unemployment, lower business investment and a currency that’s overvalued. The BoC’s governor Poloz is sitting on the sidelines, waiting out H1 and projecting a pick up in the second half of the year. Canada’s jobs report last Friday did produce a negative headline; however, the bulk of the job losses were in the part time sector. The only plus for the loonie is that crude oil prices have stabilized for the time being.