The markets moved higher yesterday because, frankly, Tuesday's the day for upside moves: thus far in 2013, we’ve had 13 straight Tuesday gains. This, combined with the very short-term oversold basis of several markets -- mainly gold and commodities -- gave the risk-on trade a bump.

S&P Watch

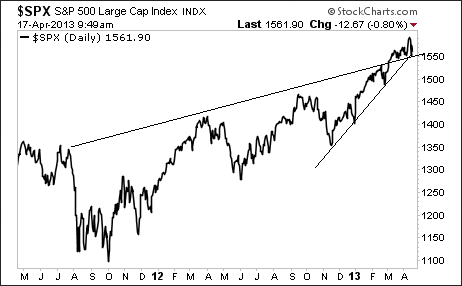

From a technical perspective, the S&P 500 is in danger of breaking several critical trendlines.

Can Go Either Way

The rising-wedge pattern is a consolidation pattern that can break either up or down. One of the trickiest issues is a “false breakout,” which occurs when the initial move out the pattern proves to be short-lived. False breakouts are usually followed by violent moves in the opposite direction as traders realize the initial move was false.

In today’s market, that direction would be down.

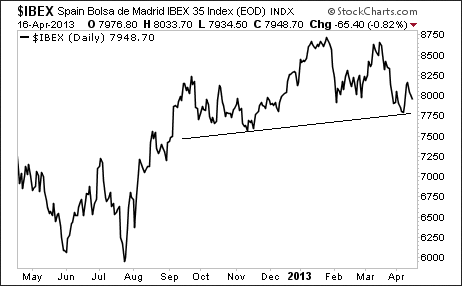

We get additional signs of trouble from Spain. It was Spain that nearly took down Europe last year. In this sense, the Spanish stock market, the Ibex, has become the proverbial “canary in the coalmine” for Europe. If the Ibex is rallying, investors believe Europe is alright. If the Ibex breaks down, then the European Crisis is back.

The Ibex has stalled and is in danger of breaking critical support.

Then There's Eqrnings

Final indications of trouble come from earnings. We’ve had a slew of corporations beating earnings guidance (which isn’t too difficult given how easy it is to manipulate profits) but missing revenues.

Coke, Goldman Sachs (GS), Yahoo! (YHOO) all did this yesterday. They join Blackberry (BBRY), US Bancorp (USB), St Jude Medical (STJ) and others.

Revenues are much harder to fudge than profits. They are more closely tied to the economy. So if revenues are missing estimates, it can be a warning that the economy is slowing.

Investors Take Note

The markets are sending multiple signals that things are not going well in the world.

Best Regards, Graham Summers

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Three Signals Investors Are Ignoring

Published 04/17/2013, 11:27 AM

Updated 07/09/2023, 06:31 AM

Three Signals Investors Are Ignoring

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.