I thought I’d seen the most shocking gold chart this year. Turns out I was wrong.

Lately, I’m seeing one chart after another that paints a picture in stark contrast to current low prices in the metal.

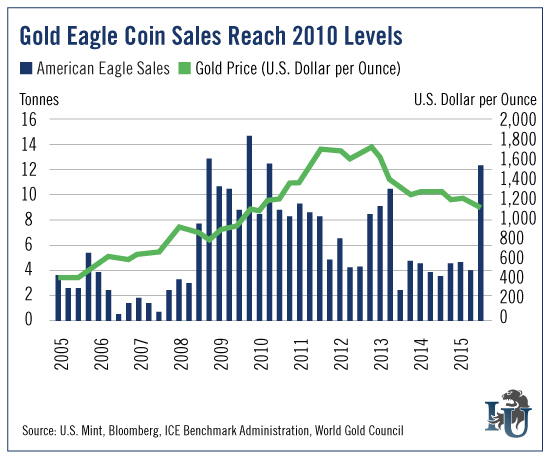

Sales of U.S. Gold Eagles Are Soaring... And So Is Global Demand

Let’s start with the big one...

According to a new report from the World Gold Council, Americans are snapping up physical gold. Investment demand in the third quarter was astounding, with U.S. retail demand jumping to 32.7 metric tons.

That’s growth of more than 200% year on year.

“Demand for newly minted coins surged across all key product lines: sales across all denominations were many multiples of their long-term average levels,” the report adds.

The World Gold Council also noted that global demand for the yellow metal soared 33%...

After the U.S., the next biggest surge in demand was in China. Third quarter demand for gold in China jumped 70% to 52 metric tons.

China’s buying spree can be traced back to its surprise devaluation of the yuan this year. In addition, the roller-coaster ride in the Chinese stock market sent investors scurrying for a place to shelter their wealth. This one-two combo triggered a buying spree.

Europe also saw investors load up on gold, up 35% in the quarter to 61 metric tons. Europe has its own problems: The slumping euro... a misfiring economy... and a surge of refugees from the Middle East.

Buy gold? Damned straight!

Central Banks Are Buying Gold Hand Over Fist

In a move that surprises no one (except government economists who insist gold is a barbarous relic), central banks added to their gold reserves for the 19th quarter in a row.

Central banks added 175 metric tons to their reserves in the most recent quarter. That’s HUGE.

A big part of this was the People’s Bank of China, which added 50.1 metric tons of gold to its holdings between July and September.

You’ll remember that in July, China’s central bank confirmed that its gold reserves had expanded by more than 50% since it last announced its holdings in 2009. The Chinese seem disposed to more regular updates now.

Another big buyer was Russia. At 77 metric tons, it was the quarter’s largest purchase. Vladimir Putin seems determined to have a currency that can’t be threatened by any manipulative move on the part of the Western powers.

And now to our last chart...

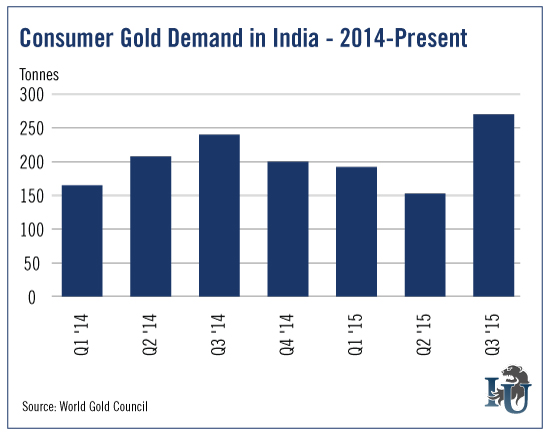

India Is Buying Lots of Gold Again

Gold demand in India jumped to 268.1 metric tons in the third quarter. That’s up 13% year over year. Consumers stocked up on gold after the yellow metal fell to a five-year low in July.

India’s demand for jewelry rose 15% in the third quarter. That was most of the rise in demand, which shows India’s consumers are back in a big way.

Upside Surprise

Let me give you one more bullish note...

October marked three months in a row that money has flowed into SPDR Gold Shares (N:GLD) ETFs. What’s more, between January and October this year, ETF holdings dropped 54 metric tons. That’s way down from the 133 metric tons during the same period in 2014. And it’s a huge drop from the 780 metric tons sold during the same period in 2013.

Bottom line: Demand for gold is coming back strong. Producers have been beaten over the head with shovels for so long that they won’t turn bullish until far too late. The potential for a big upside surprise in price is definitely there.

We don’t know when such a rally will come. But you’ll want to be well positioned when it does.