The U.S. stock markets have again “made good of bad news.” It’s something investors are used to seeing, but on the most recent selloff most investors stood their ground and the smart ones even bought more.

And you know what? They got paid for their risk. After a near 6% decline in the S&P the index sits only 0.50% off its all-time contract highs. The Dow Jones at its close on Friday was just 2.6% away from its all-time high.

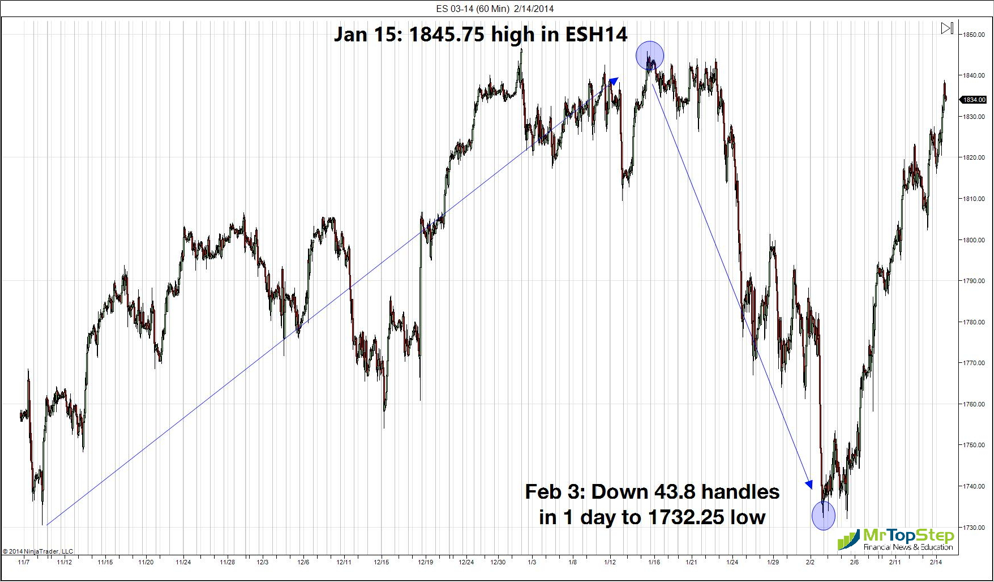

E-mini S&P 500 run up to January’s high and double top

The net changes are great, but it all comes down to price action and again the S&P has resumed its favored direction. It’s hard to argue the overall price action of the chart above. A big selloff, a “double bottom” and then a big rip to the upside.

The question you have to ask yourself is, are you still as you sure as you were about the Fed tapering? Well you may still think the taper spells doom, but the charts are not confused.

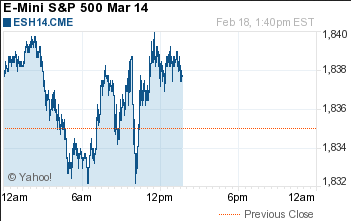

10 consecutive higher closes

While we won’t say we’ve never seen them before, we should say we have not seen moves like this in a very long time. After a big down move the S&P comes flying back to its best weekly gain since December.

Fear has again turned into a buying opportunity as investors move out of emerging markets and back into U.S. stocks.

What else can we say? The Pit Bull gave us fair warning about what to look for and the S&P did exactly that.

MrTopStep Trading Rules: The Thursday / Friday low the week before the February expiration is a Pit Bull trading rule. We did not make that one up but this particular Thursday-Friday low didn’t just work well, it worked great. Last Wednesday the Pit Bull was concerned that with the S&P going up as it was … why stop now? He added that Friday may see mid-month rebalancing as the middle of February was a big dividend reinvestment period. Before the close on Friday the Pit Bull said “anyone who knows about the rebalance will get out of the futures late in the day.” He was right again.

Moral of the story? Don’t forget about the Thursday-Friday rule and you won’t get run over.

The Asian markets closed mostly higher (Nikkei +3.13%) and the European markets are trading mostly lower. Today’s economic schedule starts with Empire State mfg survey, Treasury international capital, housing market index, E-commerce retail sales. Last week Fed Chairwoman Janet Yellen’s testimony actually smoothed the stock market out. While she said that she doesn’t see any policy change to the Fed taper, that does not mean she won’t take a step back from the removal either. Right now the S&P is going up in a big way.

Our view

The warning lights are flashing but no one cares; the S&P has closed up 10 days in a row. Today is going to be a battle of good and evil. The good is Turnaround Tuesday and the bad is the S&P cash study showing today as being down 20 / up 10 of the last 20 occasions.

The S&P is very overbought short term, but the volumes are so low, it seems able to turn any news in its favor. We have some economic numbers to get past but to tell the truth the only thing we can say is the S&P is long overdue for a pullback but “everyone” thinks that! Whether that same “everyone” act on their belief and actually pull it back remains to be seen. Sell the early rallies …

As always, keep an eye on the 10-handle rule and please use protective stops when trading futures and options.

- In Asia, 9 of 11 markets closed higher : Shanghai Comp. -0.77% , Hang Seng +0.23%, Nikkei +3.13%

- In Europe 7 of 11 markets are trading lower: DAX -0.21% , FTSE +0.15%

- Morning headline: “S&P Futures Seen Lower Ahead of Coca-Cola Earnings”

- Total volume: LOW 1.36 Mil ESH14 and 8K SPH14 contracts traded )Fridays volume)

- S&P Fair Value: 1835.28 (futures only 0.47 above as of 7:14 AM ET

-

- E-mini S&P 500 1837.75+2.75 - +0.15%

- Crude 98.55-0.22 - -0.22%

- Shanghai Composite 0.00N/A - N/A

- Hang Seng 22587.721+51.781 - +0.23%

- Nikkei 225 14843.24+450.13 - +3.13%

- DAX 9659.78+3.021 - +0.03%

- FTSE 100 6796.43+60.43 - +0.90%

- Euro 1.3757Economic calendar: Empire State mfg survey, Treasury international capital, housing market index, E-commerce retail sales and a 3- and 6-month bill auction.