Those who do not wish to draw any parallels between today’s stock market and the 1999-2000 tech stock bubble typically claim that “all of those turn-of-the-century dot-coms weren’t making any money. Today’s 2017 superstars — Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google/Alphabet (NASDAQ:GOOGL) — make money hand over fist!”

The problem with this rationalization is threefold. First, the 1999-2000 tech balloon was not an online-only phenomenon. The ‘Four Horsemen’ that controlled more than half of the market capitalization for the ill-fated NASDAQ — Microsoft (NASDAQ:MSFT), Intel (NASDAQ:INTC), Cisco (NASDAQ:CSCO) and Dell — were exceptionally profitable. They were also extremely overvalued at a combined price-to-earnings ratio (P/E) of 60. It follows that the notion that Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google/Alphabet (GOOGL) represent something entirely different in terms of profitability is flawed, especially when one considers an average P/E of 130 for ‘FANG.’

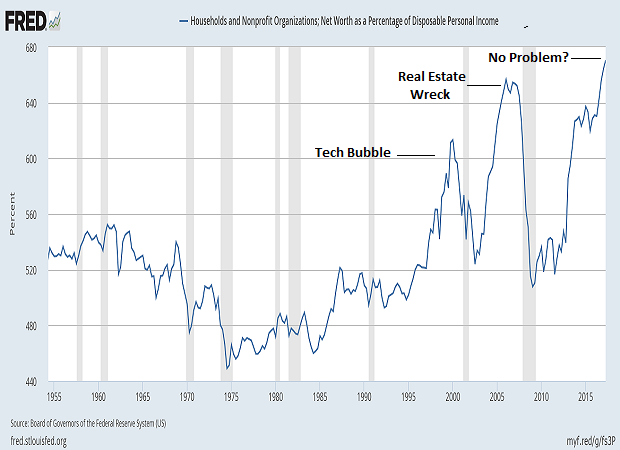

Second, the ratio of American households’ net worth to disposable income in 2000 hit 620% due primarily to an eighteen year secular bull market and tech stock euphoria. It was unsustainable, however, largely because the ratio had rarely deviated more than 1 standard deviation from its mean and because asset prices had frequently correlated with after-tax wage growth.

Similarly, the ratio hit 650% on residential housing jubilation prior to the financial collapse in 2008. That too was unsustainable. Now we have ‘FANG’ stocks emulating the ‘Four Horsemen,’ the median stock bubbling over with froth, and real estate prices in key parts of the country stretching affordability. Should investors really be dismissive of the 670% ratio in 2017?

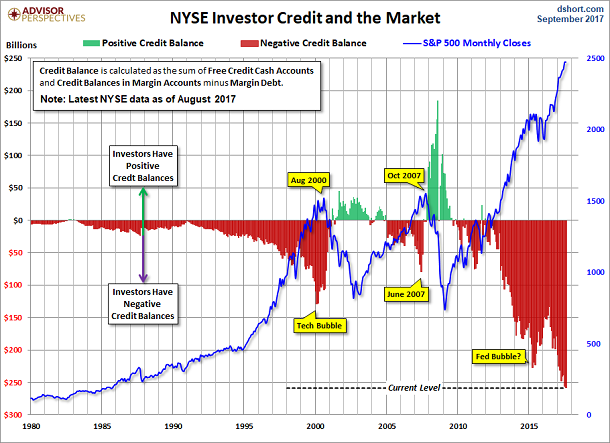

Third, one of the more prominent reasons for the tech implosion in 2000 had been the effect of margin debt. Many investors had been betting the proverbial farm on a “New Economy” paradigm, leveraging their stake in the tech revolution by purchasing stock on margin. Gains were amazing on the way up. However, once the tide turned, ‘margin calls’ unleashed the forced selling of the very same companies to replenish margin account reserves. In other words, the greater the leverage on the most popular stocks, the greater the downside destruction… no matter how profitable the companies.

Now take a look at the picture of leverage in 2017, an enormous percentage of which is concentrated in tech darlings like ‘FANG.’ You simply won’t find another time in history when folks were more levered up. The negative credit balances in margin accounts (Free Credit Cash + Credit Balance – Margin Debt) by the year 2000 had unhinged from reality; meanwhile, the subsequent reversal was exceedingly painful. It leads one to wonder, will history not find itself rhyming when margin calls for Facebook (FB) and Amazon (AMZN) eventually come calling?

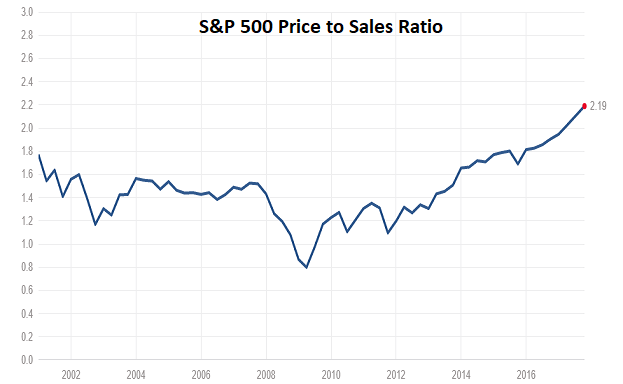

The stock market has been thriving in spite of margin debt getting more and more excessive. Additionally, stock prices have been rising at a much quicker clip than the growth of earnings, book value and/or corporate revenue. Even the highest price-to-sales ratio in market history has been routinely brushed aside.

In essence, the bull market in equities does not care if one is taking exorbitant risk for the reward potential. It just cares about climbing higher. And for those with heavy allocations to stock, they may not believe it could ever go the other way.

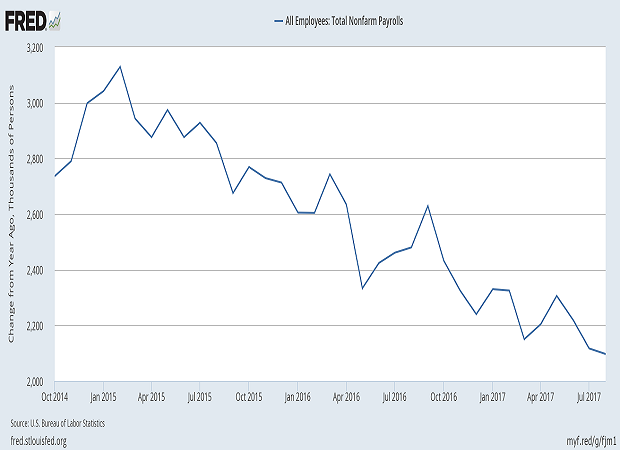

On the other hand, there are plenty of markers to suggest that the asset price balloon in stocks, bonds and real estate could deflate. For instance, job growth has been on the decline since it peaked in the 1st quarter of 2015. Where is the evidence that jobs can serve as a tailwind for risk assets going forward?

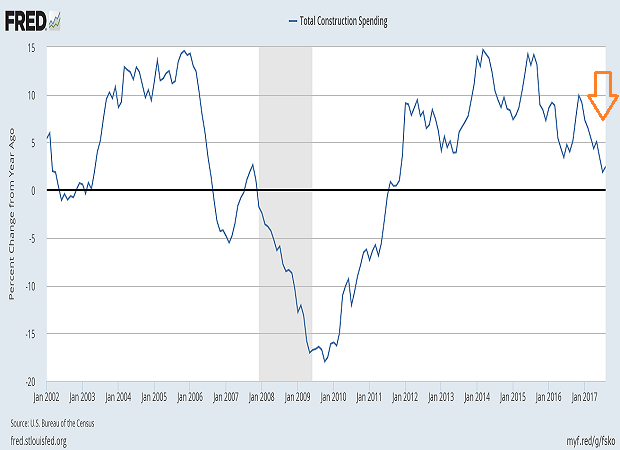

In the same vein, construction spending tends to strengthen as an economy expands; it tends to weaken as an economy wanes. In fact, on a year-over-year basis, total construction spending had catapulted higher from the beginning of 2009 through the beginning of 2015. Since then, residential and non-residential construction spending has slowed considerably.

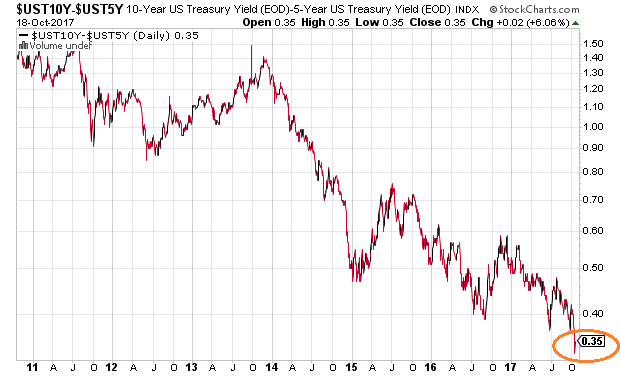

Last, but hardly least, the yield curve continues to flatten. This simply does not ‘square’ with the idea that the economy is preparing for take off. On the contrary. The flattening, as opposed to steepening, is a sign of wariness with respect to Federal Reserve balance sheet reduction in October (a.k.a. ‘quantitative tightening’) and pending tax reform legislation.

Should you continue to ride the stock wave if you have been riding it? Absolutely. Should you add to broad market positions? Probably not.

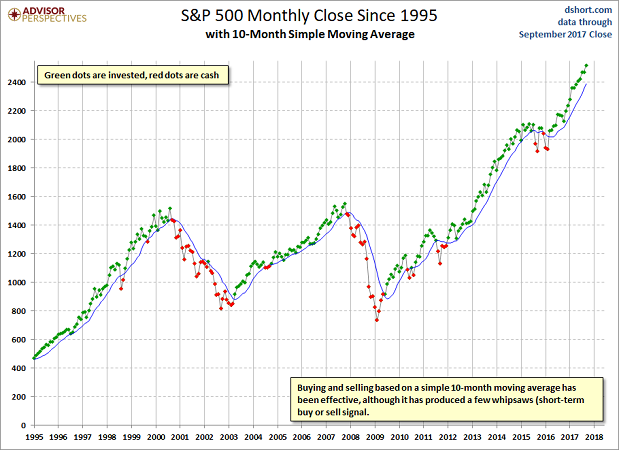

For the bulk of our retiree and near-retiree client base, we have maintained a more conservative 50%-55% allocation. And that will likely continue. On the flip side, we are likely to reduce the equity component when the monthly close on the 10-month simple moving average (SMA) drops below its trendline.

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.