Investing.com’s stocks of the week

Regular TA had been good in a two way market. But in a one way market it has failed miserably. And yet we are looking for an advance look into the future. All sorts of obscure and unheard of models are going round.

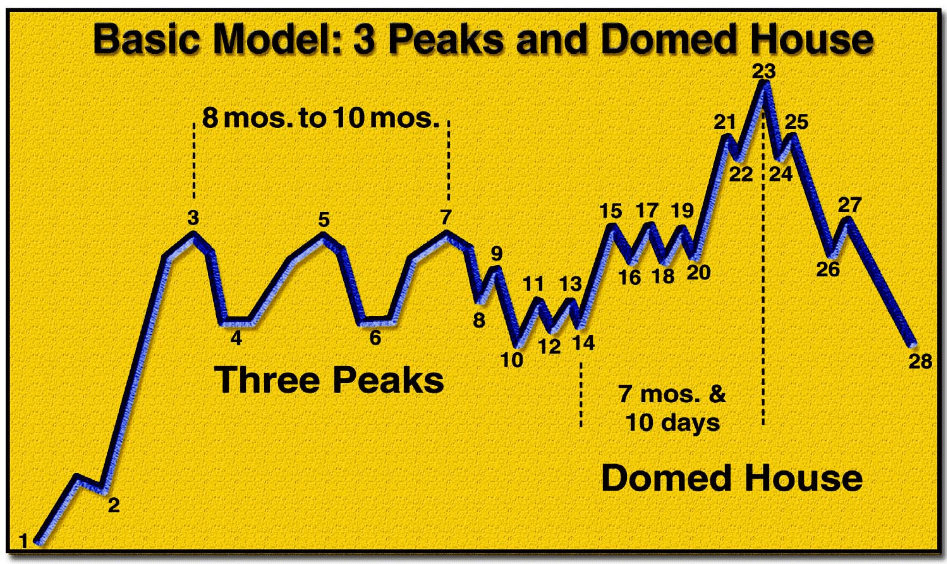

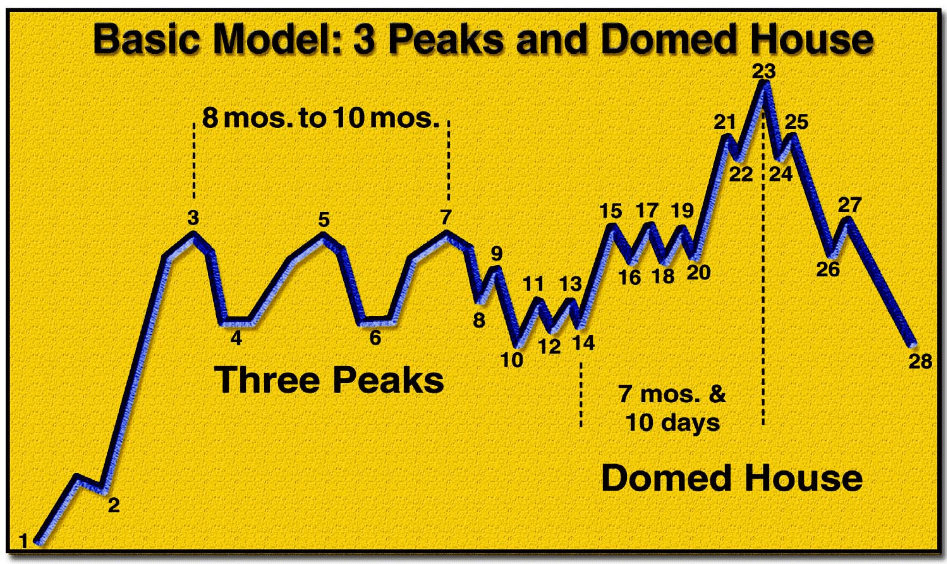

One such model is Lindsay’s Three Peak and Domed House. There are people who have made a career out of it by writing book on it, giving lectures and writing newsletters. Personally, I think it is something like Elliot Wave where you can make the wave counts fit after things have happened. The 3PDH goes like this:

Some of the respected and well know market technicians like Jeffrey Hirsch of Stock Traders Almanac and Doug Kass of Seabreeze Partners, who between them have more years of trading experience than my total age, have been following 3PDH for some time. According to Jeffrey, we are now reaching point 21 and it will be followed by a small correction by end of March, which will be point 22. From there he expects one final move up to point 23 sometimes in April and then down to lows of October.

To a certain extent, this theory fits with my cycle analysis. I have been calling for a small weakness by end of March and a rally thereafter. I wrote in the past that SPX has another 30-50 points left before this Bull Run ends for a while. I still have not worked on the downside target but I expect a major bottom in May.

But we still have to get through the triple witching tomorrow. I have been twitting before the market open and during the session not to short the market even when it appears that the internals are weak. May be next week will a short term opportunity but it is too risky from my perspective. Yesterday I wrote that it is just a pause and the market proved me right.

So trade safe and be very careful out there.

One such model is Lindsay’s Three Peak and Domed House. There are people who have made a career out of it by writing book on it, giving lectures and writing newsletters. Personally, I think it is something like Elliot Wave where you can make the wave counts fit after things have happened. The 3PDH goes like this:

Some of the respected and well know market technicians like Jeffrey Hirsch of Stock Traders Almanac and Doug Kass of Seabreeze Partners, who between them have more years of trading experience than my total age, have been following 3PDH for some time. According to Jeffrey, we are now reaching point 21 and it will be followed by a small correction by end of March, which will be point 22. From there he expects one final move up to point 23 sometimes in April and then down to lows of October.

To a certain extent, this theory fits with my cycle analysis. I have been calling for a small weakness by end of March and a rally thereafter. I wrote in the past that SPX has another 30-50 points left before this Bull Run ends for a while. I still have not worked on the downside target but I expect a major bottom in May.

But we still have to get through the triple witching tomorrow. I have been twitting before the market open and during the session not to short the market even when it appears that the internals are weak. May be next week will a short term opportunity but it is too risky from my perspective. Yesterday I wrote that it is just a pause and the market proved me right.

So trade safe and be very careful out there.