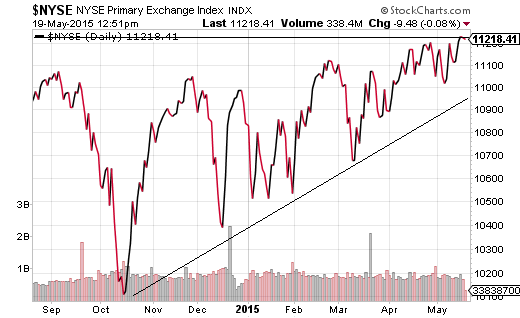

The broader stock market (as measured by the NYSE Composite) may be making marginal progress. A 2.5% appreciation in price over the last nine months is mildly positive. Similarly, higher lows are typically indicative of ongoing strength.

It would be reasonable, however, to discuss whether the risk of participation is worthy of the potential reward. Retail sales in the warm weather month of April were flat; clearly, consumers have not been spending their windfalls from the gasoline pump since 2015 began. Moreover, views on the U.S. economy in Bloomberg’s Consumer Comfort Index sank to a five-month low. If the trend towards saving over consumption continues, exports and investment by businesses would need to pick up the slack. Unfortunately, the strong U.S. dollar has crucified exports in recent months and durable goods sales excluding aircraft/defense have been tepid. These are trends that do no bode well for corporate revenue growth.

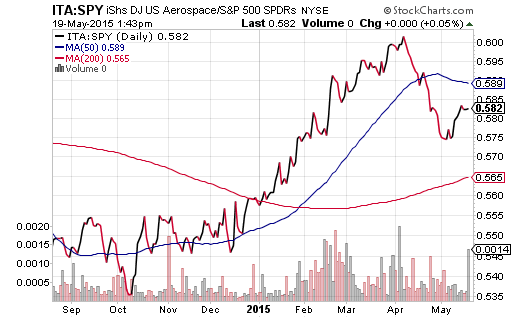

Another way to look at the discrepancy between the broader market and revenue winners is through the use of price ratios. For example, the iShares DJ Aeropsace and Defense ETF (NYSE:ITA):SPDR S&P 500 Trust (ARCA:SPY) price ratio demonstrates the momentum that has been building for defense/aerospace contractors for the better part of nine months. In addition, SPY sports an astronomical P/S ratio of 1.8 whereas ITA boasts a more fundamentally sound P/S of 1.3.

Granted, rising bond yields and a slow growth economy produce fewer tax dollars for government authorities to spend on the defense of the country; more tax dollars will go to paying the interest on Treasury debt obligations, leaving Democrats and Republicans to wrangle over where remaining funds should be allocated. Yet the recent military conquests by the Islamic State in Iraq and Syria suggest to me that dollars will be found or created to finance operations that would undercut advances by radical elements in the Middle East.

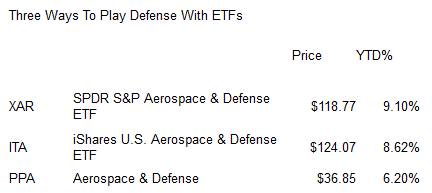

There are three ETFs that cover the Defense/Aerospace arena. Both ITA and the longer-running Powershares Aerospace & Defense (NYSE:PPA) tend to track one another fairly closely. Over the past 3 years, each has posted annualized gains of approximately 23.5%.

The SPDR Aerospace & Defense ETF (NYSE:XAR) tracks a modified equal weight index such that market cap giants like Lockheed Martin (NYSE:LMT) and United Technologies (NYSE:UTX) do not steal the entire limelight. The fact that XAR has a number of smaller companies with higher weight in the fund performance contributes to a bit more risk, though the reward has been commensurate with a 3-year trailing result of 25.5%.

Purchasing any stock asset near all-time record highs can be tricky. It may be even trickier when any additional economic downgrade would likely be accompanied by more earnings and revenue warnings; any economic uptick would give the Fed reason to hike borrowing costs. In essence, buying before a pullback may not be advisable. Nevertheless, if one has the confidence in the sector’s ability to weather cyclical storms in the economy, one might be compensated for recognizing why defense/aerospace contractors are likely to prosper for years to come.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.