Summary

High Margin Lithium Sales to drive FMC Corp (NYSE:FMC) Higher.

King-of-the-Hill DowDuPont Inc (NYSE:DWDP) diversification covers its bases.

Vulcan Materials Company (NYSE:VMC) sees benefits from Trumps Infrastructure and Tax Bill.

Materials equities look ready to gain as inflation pressures build.

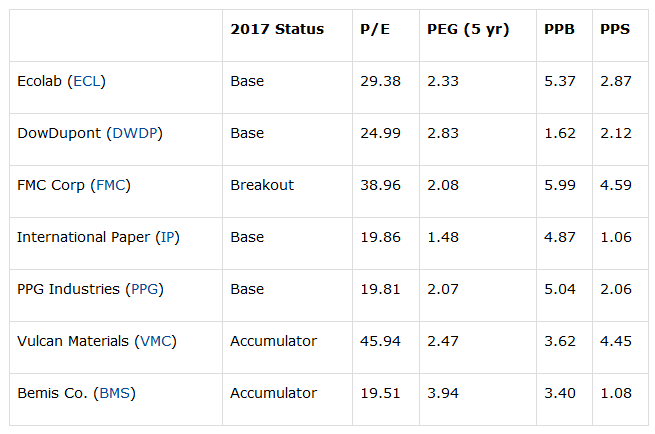

The Candidate Pool

Since Donald Trump’s election there has been a sharp divergence in the performance of S&P equities relative to Commodity prices. Traditionally, profitable companies sell more goods and services and enjoy higher equity prices; increased production of goods and services drive higher commodity prices as demand on finite resources increases. However, commodity prices have struggled to return to levels 20 years ago despite the S&P trading at new multi-year highs and at multiples it traded at 20 years ago. The divergence between commodity and equity prices since Trump’s election has be driven by the removal and weakening of environmental standards by the current Administration following the appointment of climate-change sceptic and industrial fave, Scott Pruit, to the EPA. But as with any legislative change, real change comes slowly and it’s unlikely the current commodity discount and divergence can continue without some form of re-alignment.