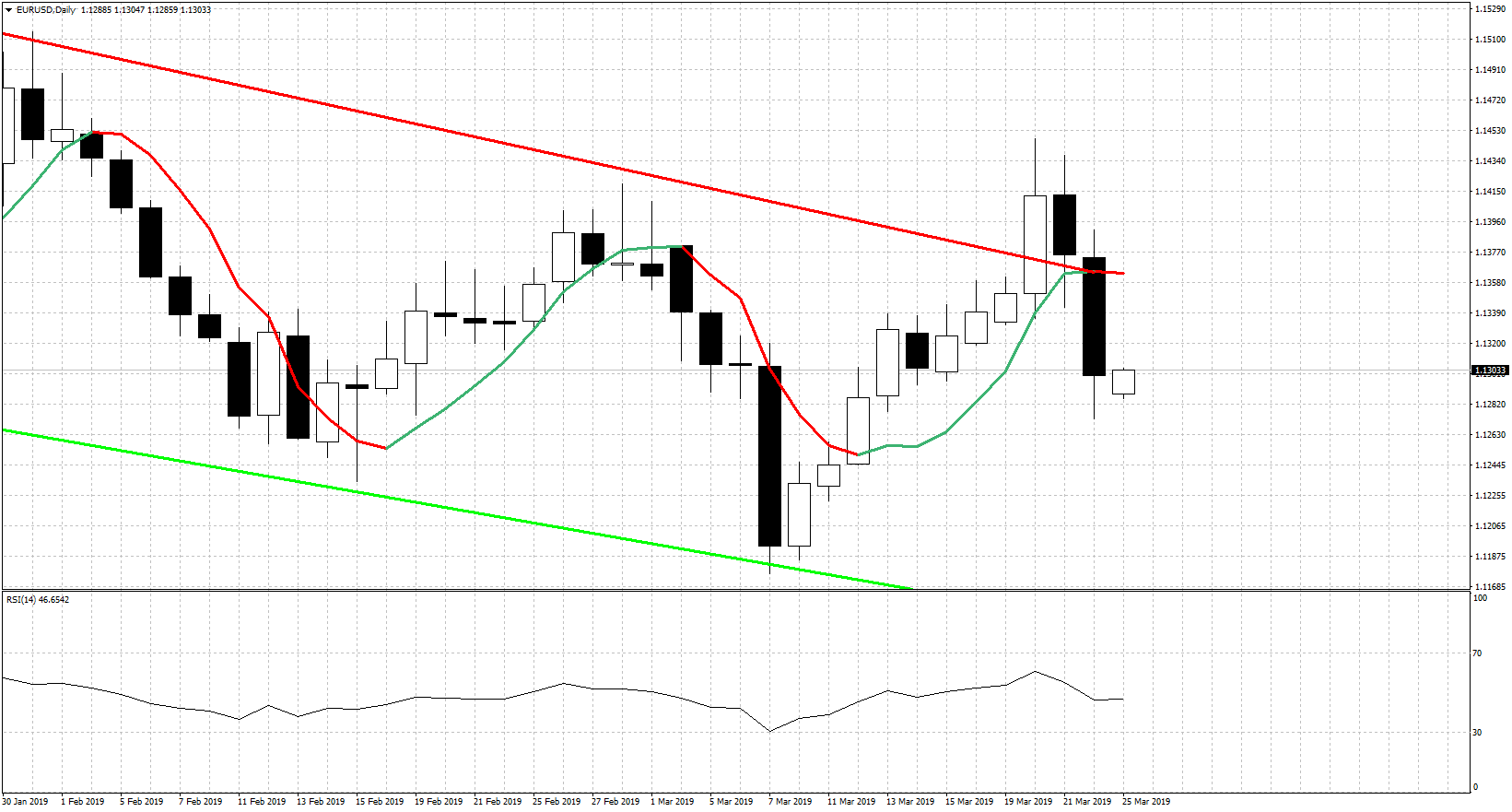

There was a lot of volatility in the past week for the EUR/USD. The bulls partied all the way to 1.1450, but the bears had the last word. The pair ended the week at 1.13 having lost most of the gains. The weekly chart shows weakness from the bulls and inability to hold above 1.14. The weekly chart is bearish. The trend remains bearish and is set to remain so after challenging important resistance levels.

The price remains below the red trend line resistance and the next target should now be 1.1140 as long as we see no close above the red trend line.

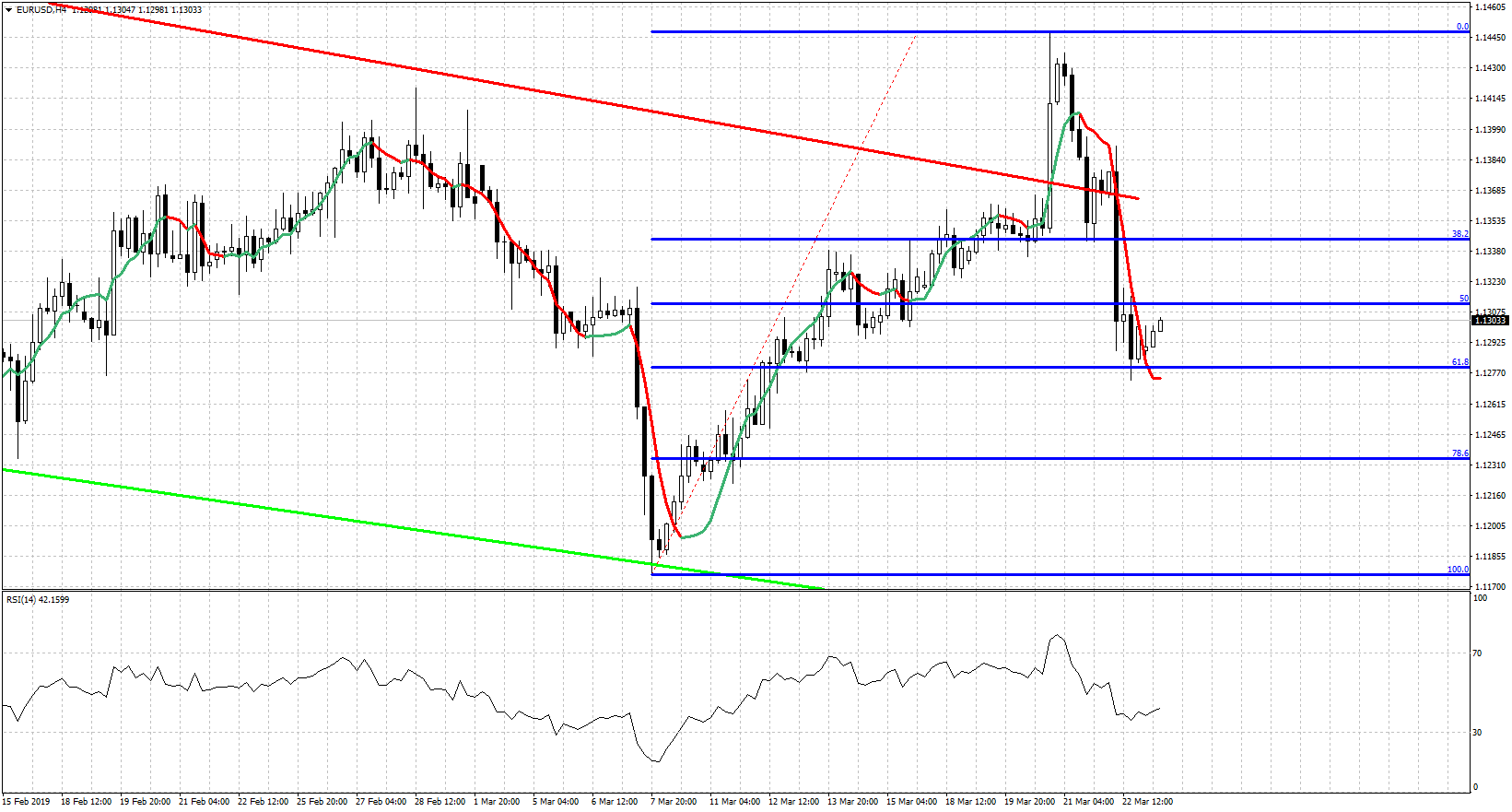

The Daily chart shows the false break out above the red trend line resistance. As long as price remains below 1.1370 short-term trend remains bearish. Support is here at 1.13-1.1285 area and this might be the last stand for bulls. Why? Because this is also the 61.8% Fibonacci retracement level of the entire rise from 1.1175.

This Fibonacci level has so far been respected and the price shows signs of a bounce ahead. As we previously said, bulls wanted a pullback as a backtest and a higher low. The backtest pulled back more than expected. However, a higher low could also be in place right now. This would be ideal for bulls and the next leg could start any minute to unfold. The first sign of strength would be for price to break above 1.1370 and then recapture 1.14 and stay above it. On the other hands, bears want to see price bounce towards resistance of 1.1370-1.14 and get rejected making a lower high. Eventually, their bearish view will be confirmed on a break below 1.13-1.1285.

Trading Setups

Although the short-term trend is bearish, bulls could enter long here with a tight 30-40 pip stop at current 1.13 level. The Target would initially be 1.1360-70 with the potential of much higher if the bullish scenario plays out. Opening short positions here is wrong unless you are willing to use 1.1450 as the stop.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.