On Friday, March 6 the US jobs report hit the wires. Equities were trading higher in premarket, and during the previous session we had seen a strong sell-off followed by an equally strong high-volume rally. No one was expecting the massive sell-off that was about to hit the stock market when the good jobs numbers were posted.

Later that day, after 6 1/2 hours of heavy volume selling in the stock market, the closing bell rang. The big sell-off pulled most stocks and commodities into an extremely oversold market condition. Traders were waiting all day for some type of bottom to be put in place so they could re-enter a long position and day trade the rebound.

But as we learned when the closing bell rang, there was no bottom and there were no bounds in equities. From looking at my trading platform dashboard, virtually every stock sector, country and commodity ETF was trading sharply lower.

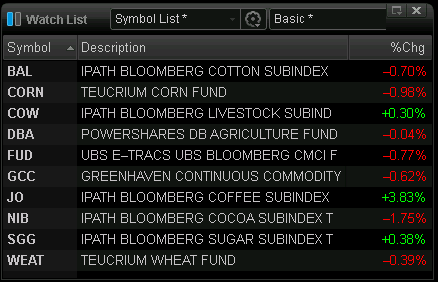

Only four things were green on my dashboard. The first one was the VIX which makes sense. When people become fearful they sell stocks and the volatility index rises. But what was interesting was that the other three were food commodities.

The first commodity trading higher was coffee (via iPath Bloomberg Coffee TSub-Index (NYSE:JO)). This makes sense because it was a stressful day and everyone was drinking coffee. The second was sugar (via iPath Bloomberg Sugar Subindex TR (NYSE:SGG)). Obviously the majority of coffee drinkers enjoy sugar in their coffee.

The last commodity which rallied late in the day was the iPath DJ-UBS Livestock TR SubIndex (NYSE:COW). The COW ETF is a livestock commodities fund. And so it seems after a long hard day in the financial markets we find comfort in a big juicy steak. Readers of my newsletter and I just happened to get long this fund recently. The chart from a technical stand point is very bullish.

Overall though, I believe the stock market is still in an uptrend. Friday’s news was a surprise and surprise data will always cause a severe reaction in the market. History has proven that news based sell-offs tend to be a blip on the chart; The market recovers within a couple days and the previous trend once again continues.