It’s hard to argue that the housing market isn’t recovering. Not when months and months of indicators -- including new home sales, prices and construction -- keep coming in on the positive side.

That said, many investors do believe the recovery won’t last very long. But this couldn’t be further from the truth. And I don’t mind setting the record straight (again).

I declared that the real estate market hit rock bottom in February. Nobody wanted to hear it, though. How do I know? Because subscribers lambasted me from far and wide for bloviating.

That is, until the data proved that real estate prices did, indeed, bottom out that very month.

I say this not to brag, but to point out that I don’t mind going out on a limb to make a bold prediction. As long as the data warrants it.

On such merits, I have no problem predicting that real estate will be one of the economy’s strongest growing sectors in 2013.

And here are the three most potent forces underpinning my bullish stance.

~ Affordability

Mortgage rates haven’t been this low. Ever. Median home prices are back to late 1970s levels. And that’s driven the mortgage-to-rent ratio down to a record low (under 0.70).

In other words, there’s never been a more affordable time to buy a house. And a gradually improving labor market promises to encourage more and more Americans to take advantage of the once-in-a-lifetime bargains.

Especially since banks are bound to start loosening their “overly tight” borrowing requirements, in the words of Fed Chairman Ben Bernanke. Sounds like a direct order to me.

~ Underinvestment

It’s simple arithmetic: More households (i.e. – family units) in America means that we need more houses.

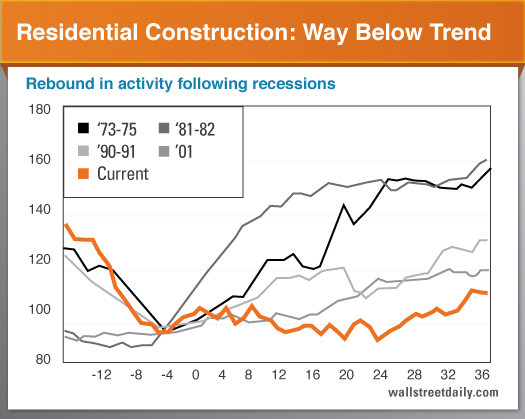

But we haven’t been building them.

While the number of households has increased by over one million in the last year, housing starts were actually the lowest in 52 years in 2008, 2009, 2010 and 2011.

Put simply, we’ve got a lot of catching up to do on new home construction just to reach equilibrium with the market. And JP Morgan (JPM) estimates that we’ll need six million more homes between now and 2017 just to keep up with population growth.

Let the building begin!

~ Momentum

Real estate tracker Zillow (Z) reported that prices bottomed out for 71% of U.S. housing markets by the end of the third quarter. Many markets are now witnessing price increases.

And the one thing I know about rising prices? They encourage even more increases.

Or as Joshua Steiner and Robert Belsky of Hedgeye put it, “Housing is highly auto-correlated. Strength in prices will feed back into strengthening demand, which will further reinforce prices.”

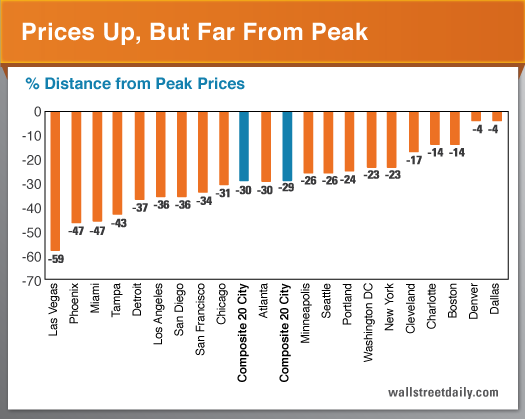

The good news is, even after the latest price increases, we’re still nowhere near the peak levels. So there’s still plenty of room for even more price momentum to take hold.

Bottom Line

Housing’s back -- and there’s no question that this recovery has legs. Invest accordingly.

Ahead of the tape,

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Three Factors Driving U.S. Real Estate's Recovery

Published 12/13/2012, 10:15 AM

Updated 05/14/2017, 06:45 AM

Three Factors Driving U.S. Real Estate's Recovery

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.