The S&P 500 is down -3.5% since its early September highs. And many fear that a “fiscal cliff” stalemate will send stocks significantly lower in the weeks ahead.

However, there are a variety of ETF categories that have not only remained resilient in the wake of U.S. legislative uncertainty, but they’ve been exceptionally profitable. In fact, on Monday (12/10), prominent screening sites list roughly 60 individual ETFs hitting 52-week highs.

Here's A Breakdown Of Several Prominent Categories

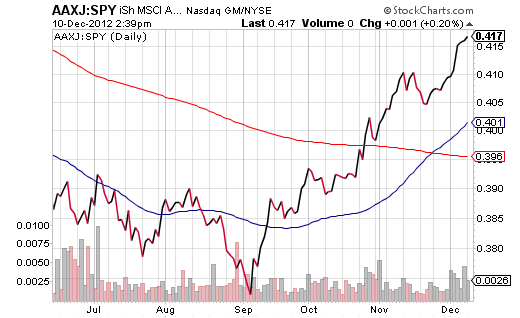

1. Asia Pacific ETFs. I discussed the region’s revival in great detail at the start of Q4. In essence, the area is largely benefiting from a stabilizing Chinese economy and a commitment by the mainland’s leadership to provide stimulus when necessary. What’’s more, Asia Pacific equities have been demonstrating remarkable relative strength as evidenced by the iShares MSCI All-Asia excl Japan (AAXJ):S&P 500 SPDR Trust (SPY) price ratio.

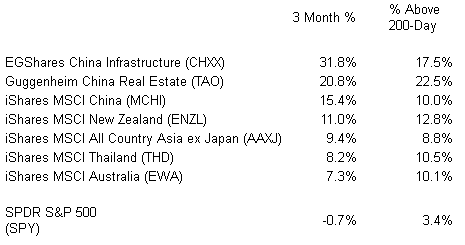

Below are eight Asia Pacific ETFs that reached new heights on Monday (12/10). Most of these vehicles are more than 10% above their 200-day simple moving averages, suggesting that they may be “technically overbought.” It follows that the best value in the grouping may also be the most diversified one… iShares MSCI All Asia excl Japan (AAXJ).

New 52-Week Highs For Popular Asia Pacific ETFs

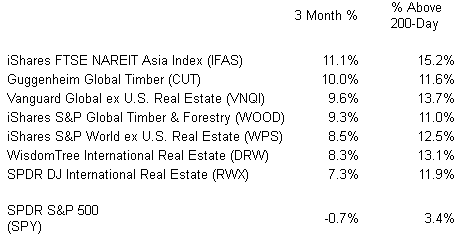

2. Real Estate via REIT ETFs and Timber ETFs. Central bank policies worldwide have have sapped the life out of developed world government yields. At the same time, however, they have lowered mortgage rates, bolstered real estate demand and “reflated” market-based, income producing securities.

One of the largest beneficiaries of the threefold trend is the global/international real estate investment trust. They offer dependable yields that are superior to treasuries. What’s more, when real estate enthusiasm is high, they tend to provide capital appreciation potential. Not surprisingly, global and international REIT ETFs that diversify across the biggest names in the REIT business have been providing a diversified approach to tremendous total return.

With a number of REIT ETFs appearing overvalued fundamentally, and others looking overbought technically, some investors have turned to lumber. In truth, if a global real estate recovery is genuine, and if emerging markets begin growing alongside that recovery, global timber ETFs will maintain their winning ways.

New 52-Week Highs For Popular Real Estate ETFs

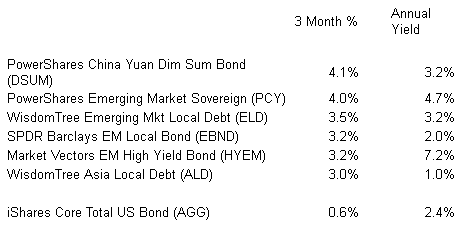

3. Emerging Market Debt ETFs. U.K. gilts, U.S. treasuries, JGBs and German “bunds” may still serve a panicky safe haven function. On the other hand, investors are increasingly seeking more bang from their income investing possibilities.

Enter emerging market income assets. Sovereign country debt or corporate bonds? Local currency or dollar hedged? Right this moment, those questions don’t seem to matter. If the ETF represents a higher comparable yield than a developed world alternative, it is “in demand.”

New 52-Week Highs For Emerging Market Debt ETFs

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Three ETF Groups That Outpace Benchmarks

Published 12/11/2012, 10:50 AM

Three ETF Groups That Outpace Benchmarks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.