Equifax (NYSE:EFX) reports hackers accessed up to 143 million US consumers’ information.

Equifax discovered the breach on July 29. Yet just at the end of last week, the public was notified of the breach. In the interim, three Equifax executives dumped about $1.8 million in Equifax shares.

Hey, why not? It’s only a “small percentage” of their holdings.

Credit reporting firm Equifax reported on Thursday a breach in which cyber criminals gained access to personal information on as many as 143 million U.S. consumers.

The firm said the “cybersecurity incident” resulted in hackers accessing names, Social Security numbers, birth dates and other personal information on as many as 143 million consumers. The U.S. population is estimated to be around 324 million, according to the Census Bureau.

Thousands also had their credit card numbers and dispute documents accessed.

Equifax said in a statement that hackers “exploited a U.S. website application vulnerability” to gain unauthorized access to the files between mid-May and July. However, the company’s investigation has turned up “no evidence” that hackers accessed the company’s core consumer or commercial credit reporting databases.

Don’t Worry, It’s Not “Core Data”

Hackers got 143 million credit card numbers, social security numbers, and birthdates.

Don’t worry, that’s not core data.

Time To Dump Stock

Bloomberg reports Three Equifax Managers Sold Stock Before Cyber Hack Revealed.

Three Equifax Inc (NYSE:EFX). senior executives sold shares worth almost $1.8 million in the days after the company discovered a security breach that may have compromised information on about 143 million U.S. consumers.

The credit-reporting service said late Thursday in a statement that it discovered the intrusion on July 29. Regulatory filings show that three days later, Chief Financial Officer John Gamble sold shares worth $946,374 and Joseph Loughran, president of U.S. information solutions, exercised options to dispose of stock worth $584,099. Rodolfo Ploder, president of workforce solutions, sold $250,458 of stock on Aug. 2. None of the filings lists the transactions as being part of 10b5-1 scheduled trading plans.

The three “sold a small percentage of their Equifax shares,” Ines Gutzmer, a spokeswoman for the Atlanta-based company, said in an emailed statement. They “had no knowledge that an intrusion had occurred at the time.”

Equifax said in its statement that intruders accessed names, Social Security numbers, birth dates, addresses and driver’s-license numbers, as well as credit-card numbers for about 209,000 consumers. The incident ranks among the largest cybersecurity breaches in history.

Equifax shares tumbled 13 percent to $124 in extended trading at 7:49 p.m. in New York.

SEC Investigation Coming

A SEC investigation is undoubtedly on the way. Any findings will be swept under the rug. The absolute worst that likely to happen is a tiny fine. I suspect nothing at all will happen.

Out of the Blue

Here is the key point: “None of the filings lists the transactions as being part of 10b5-1 scheduled trading plans.”

That’s OK. $1.8 million is only a “small percentage”.

Nothing will be done about this. Instead, every now and then, the SEC will make a case out of someone like Martha Stewart. At the very least, enforce the laws, or don’t. This type of action creates mistrust.

At the very least, enforce the laws, or don’t. This type of action creates mistrust.

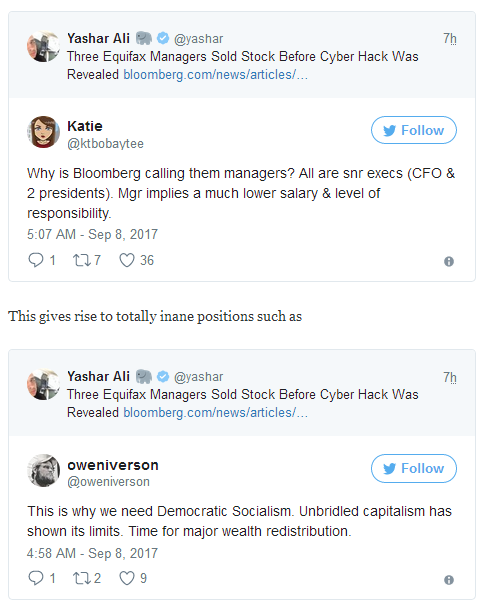

Equifax Tweets

I propose something else.

Why Not Make Insider Trading Legal?

Insider trading laws do not apply to members of Congress. They can be on any committee about to issue a ruling on anything and take advantage. Hey, why not spread the wealth?

That may sound sarcastic, but it’s not. Insider trading is not going away.

What precisely is wrong about having information and acting on it?

Had there not been insider trading laws, the public may have found out about this long ago. Instead, insiders dumped shares over time and no one knows how many of their friends got tipped off as well.

If you think I am making a self-serving proposal, think again.

I do not know a damn thing and likely never will. If nothing else, end the hypocrisy of it all.