Germany is known for their engineering and precision, especially around its cars. (XETRA:BMWG), Mercedes and (XETRA:PSHG_p) all bring to mind these qualities as well as speed. All are great cars to drive. Three top quality drives. And speaking of three drives, that phrase can be used to describe the German stock market too.

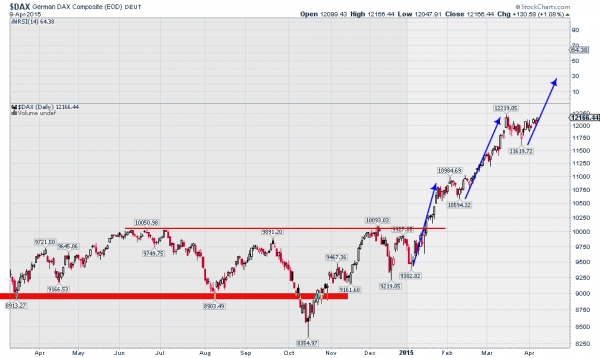

The chart above shows the German DAX Composite (ARCA:EWG), (HEWG) over the last year. You can easily see that since the ECB started talking about their own version of Quantitative Easing last fall the market has rocketed higher.

But if you focus on the start of the move through the resistance at 10100 around the beginning of the year, a distinct pattern emerges. The first blue arrow higher covered about 1600 points in the DAX before some consolidation. Then the second leg that began in mid February covered about the same 1600 points before the recent consolidation. With a move over 12200 the next leg, the final one of a Three Drives harmonic pattern, gets under way and targets about 13200 above.

So only 2 questions remain. Which car is associated with which leg higher? And will there be a need to add an Audi to the mix for a fourth leg in the future?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.