As the broad indexes give the bulls and bears a bit off excitement and bravado each week, the leaders and laggards have been rotating through. This week it seems that the 3-D printers are in the batter’s box for an attempt to knock one out of the ballpark. Here are three that should print money. Short interest at 28% could help it higher as well.

3D Systems, DDD

3D Systems (DDD) has gone through a series of AB=CD movements that I have illustrated in the past. As it reached the previous high it has been consolidation in a channel and looks to be ready to break it higher now. It has support from a rising and bullish RSI and a MACD that is crossing higher. Notice that you could have made the same observations back on July 29th though. It takes a move and close over 50 to continue higher towards the Measured move at 63.50 and D objective at 61.40. This one has relatively low short interest at only 12%, ha ha.

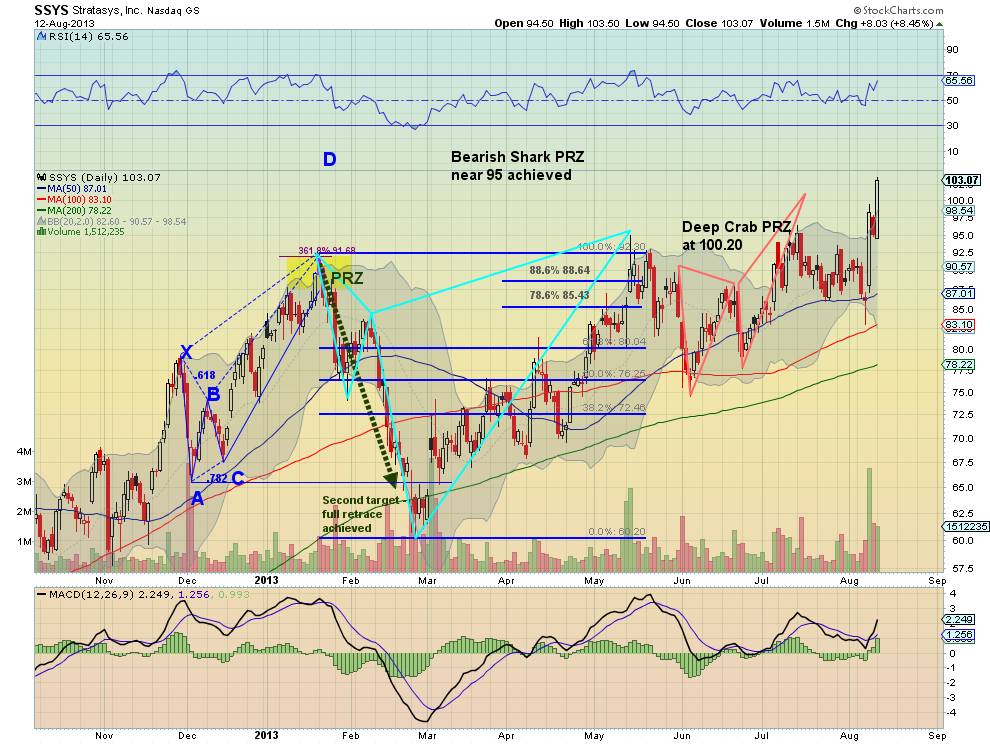

Stratasys, SSYS

Stratasys (SSYS) reported earnings Thursday last week and got running afterwards. The near touch at 100 stopped it for the weekend but it is resuming Monday and with a strong Marubozu candle in a mixed market. This also as support from the RSI and MACD for more upside and a Measured Move to 104 above as a potential first resistance. Short interest on this name is over 30%.

ExOne, XONE

ExOne (XONE) has only been public since February, and seems to be far to stable to be a 3-D Printer stock. It just continues to rise slowly more like an old school consumer stock like General Mills (GIS). After a brief pullback, it is now ratcheting higher in an ascending wedge. I just heard you all think bearish. But it can break higher as well, see the weekly SPY chart. A move over 72.50 looks very bullish and would have support from a rising RSI and MACD that just crossed up towards a Measured Move to 80.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Three D Printers Next Up To Bat

Published 08/13/2013, 02:43 AM

Three D Printers Next Up To Bat

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.