US-China trade relations have clearly deteriorated and our baseline scenario is now that the two countries will not reach a deal this side of the 2020 election. In this scenario, we see two possible paths. One is no deal but a status quo without much further escalation (35% probability). The other is an all-out economic war in which we see a significant escalation of the trade war (25% probability).

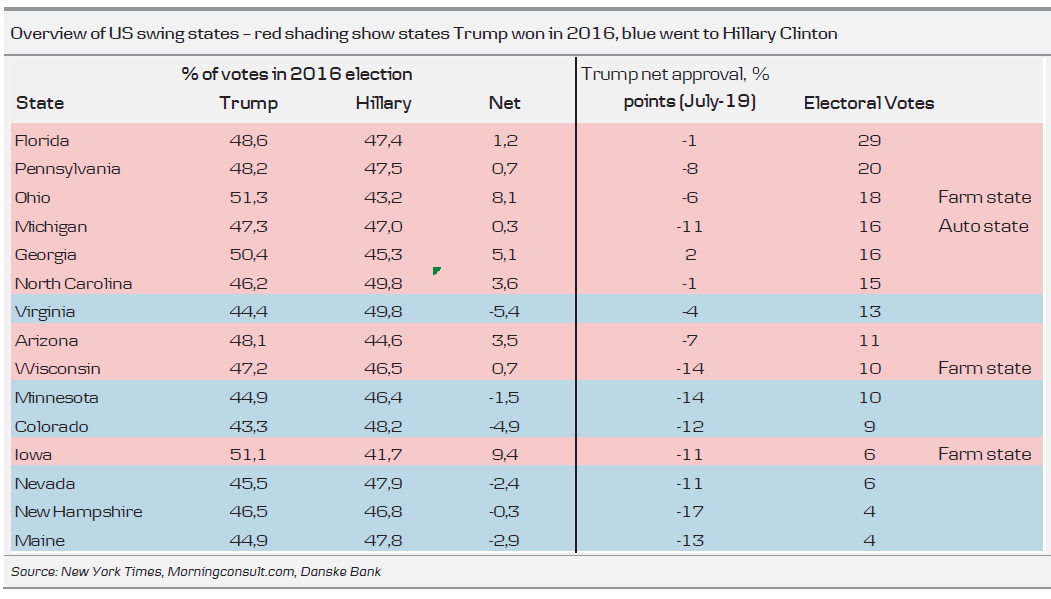

We also still envision a scenario (40% probability) in which Donald Trump scales back his demands on China to reach a deal in 2020, in which China buys significant amounts of agricultural products. Trump's big headache with respect to the 2020 election is the substantial pain the trade war is inflicting on US farmers. These are decisive voters in key swing states, where his showing in the polls is currently weak.

Overall, we see a clear increase in downside risks to growth over the coming year. The main restraint on Trump's economic attacks on China is the potential damage to US markets and the economy resulting from Chinese retaliation.

US-China relations reached a new low point this week, with the US designation of China as a ‘currency manipulator’. This followed a sharp move in USD/CNY above 7 as the expected tariff increase on 1 September triggered selling pressure on CNY.

For now at least it seems that both the US and China have thrown in the towel in terms of reaching a trade deal. The gap between them is simply too big to be bridged and the relationship between them on all fronts has eliminated the trust in each other on both sides. Trade talks in Shanghai last week showed no movement on either side of the table. The recent development has left significant uncertainty over where this trade war is heading. When faced with high uncertainty, we believe working with scenarios is normally a good idea. Below we sketch out three potential scenarios for where we could go from here (one can imagine many more but for clarification we stick to three).

Scenario 1 (35%): no deal but not all-out economic war

Generally, we now see a 60% probability that we will not see a deal this side of the election. In this case, we see two possible scenarios. One is a path where the deadlock continues and the rhetoric is still very tough but the status quo is broadly in place with only limited further escalation. US export controls on Huawei stay in place but the US does not increase tariffs on Chinese goods further.

What would be the rationale for such a scenario? First, Trump may reach the conclusion that it is not possible to do a trade deal at all because China is simply not moving enough. China’s demand for a total roll-back of tariffs without being willing to write part of the deal into its laws may be too much for him to swallow. China may also simply not want to make a deal. It may have reached the conclusion that it is better off by aiming to weaken Trump’s electoral base, hoping to negotiate with a Democratic President on the other side of the election.

The US confrontation on all fronts, including Hong Kong, Taiwan, Xinjiang, South China Sea and The Belt and Road Initiative, may have led China to conclude that it should not give Trump anything that could help him to get re-elected. While the Democrats will also take a tough stance and are more likely to build a broad alliance to put pressure China, this is unlikely to be more challenging than what it faces with the current administration. China may also fear that Trump could reinstate tariffs after the election.

Then what could be the force that stops the trade war from escalating further if no deal is on the table? If the US economy keeps weakening and markets stay weak, it might restrain how much further Trump tightens the screws on China. Retaliation and rising fears of recession could weaken the US economy and stock markets too much for Trump still to sit on a strong economy and markets when he heads into the 2020 election. Given how strong the economy is, most political analysts agree that his approval ratings should be much better under normal circumstances. Hence, he cannot afford to lose this platform of a strong economy when facing voters.

In contrast, we believe China is unlikely to escalate on its own, as it has been very consistent in not shooting first, mainly returning fire when it is being shot at.

Scenario 2 (25%): no deal and all-out economic war

Another possible outcome in a no-deal scenario is one where Trump decides to escalate further. He might believe that he will gain the most among voters by switching to a strategy of being as tough on China as possible, or that by going ‘all in’ and putting China under significant pressure it will cave in and give the concessions he wants (which it does not). This could result in an all-out economic war that entails a significant broadening of export controls, an increase in tariffs from 10% to 25% on USD300bn of Chinese exports and possibly sanctions on Chinese financial entities restricting their access to USD and US assets. It could also entail a currency war in which Trump uses the Treasury Department’s Exchange Stability Fund to weaken the USD against the CNY.

These measures would be a very significant escalation that we believe would throw the global economy into a recession and not least hurt the Chinese economy. Even a significant policy stimulus globally would not be able to avoid a recession. The negative effects in this scenario are also the main argument against such a path, because it would also do significant damage to the US economy and markets. However, we cannot rule out Trump overestimating the strength of the US economy and choosing an election platform of ‘teaching China a lesson’ and proving that he is the toughest candidate on China.

Scenario 3 (40%): deal reached during 2020

The final scenario is one where things are deadlocked for a long period but Trump does not give up on making a deal with China. Although Trump reacted strongly this week by labelling China a ‘currency manipulator’, he has not yet taken further measures, such as keeping export controls on Huawei. His economic adviser Larry Kudlow smoothed things out a bit yesterday by saying the US still looked for trade talks with China in Washington in September and that Trump could be flexible on tariffs. It does not seem as though the White House has completely closed the door to a deal and, as such, we believe it shows that it still prefers a deal over no deal.

If Trump’s election polls don’t look great moving into 2020, he might at some point decide to meet China halfway and go for a deal where, among other things, he gets big agricultural purchases from China and lower tariffs on cars. The current polls in some key swing states do not look very good. In the farm states Ohio and Wisconsin, his approval ratings have dropped quite a lot since the election in 2016. Michigan is also an important swing state, as it is the centre of the car industry. His ratings are also poor here. He won all of the above states in 2016 and he cannot afford to lose them in 2020. He needs more than 270 electoral votes to win the US election and he got 303 in 2016 because he managed to conquer most of the important swing states – some of these with a very tight margin. All else being equal, he would lose his majority if, for example, Ohio and Michigan flipped to the Democrats.

A deal also depends on whether China still wants to make a deal with Trump. This is not clear to us anymore.

Uncertainty rules

The only thing that seems certain currently is that the outlook is more blurred than ever. We have switched our baseline scenario to a no-deal outcome with a 60% probability, as we believe China increasingly prefers this scenario and it will be hard for Trump to make a soft deal given the pressure from Congress. However, should polls continue to look weak for Trump as we move further into the election campaign, he might blink and decide to make the deal anyway, as it could help him in some very important swing states.

Overall, though, we see the risks as having increased compared with our current global growth scenario of stabilisation in global growth in Q3 and a moderate recovery starting in Q4. In the worst case of a sharp escalation, we believe we would head for global recession. In the softer version of a no-deal scenario, we would be stuck with tariffs for a long time and a high level of uncertainty, which would keep the global economy hostage to the trade war. Growth stays subdued around current levels for longer and any recovery pushes well into 2020.

We intend to take a close look at our global growth forecasts in coming weeks.