Commodity currencies

These are interesting times for the commodities currencies in the G10 – the AUD, CAD, NZD and NOK are the worst performing currencies in the group as sentiment tanks and central bank divergences ramp up again.

An investment currency or a lump of mental?

Sentiment towards commodities as a whole has been plummeting as the Fed lift-off timeline narrows and the drive to the USD returns after six weeks of macro turmoil and questions about further demand resurface.

Energy prices are returning to March lows. Oil is leading the slide in energy liquids in the face of soft Chinese demand, Iran’s return to the fore of world delivery and the Saudis’ new record production levels. Norway and Canada are really feeling the pinch and their economies are showing signs of strain; this was clearly outlined by the Bank of Canada and its reasoning behind the surprise rate cut.

Industrial metals have slumped on Chinese data and may even be turning bearish. The Chinese equity rout is certainly not conducive to sentiment in industrial metals. However, the stimulus to stabilise the market is having the opposite effect – so there’s push and pull here. In the main, though, industrial commodities are likely to see downside risk on demand concerns.

Precious metals are making headlines for all the wrong reasons – low US (and global) inflation, solid US growth, USD strength, high levels of accommodation and technical levels are being triggered. Gold has been the major headline but palladium and platinum have seen bigger falls and that is unlikely to slow in the interim.

Soft commodities are really the only space to see some form of growth in the southern hemisphere this winter. Grains and soybeans have seen increasing demand. However, dairy prices have reversed, explaining the risk the RBNZ is seeing.

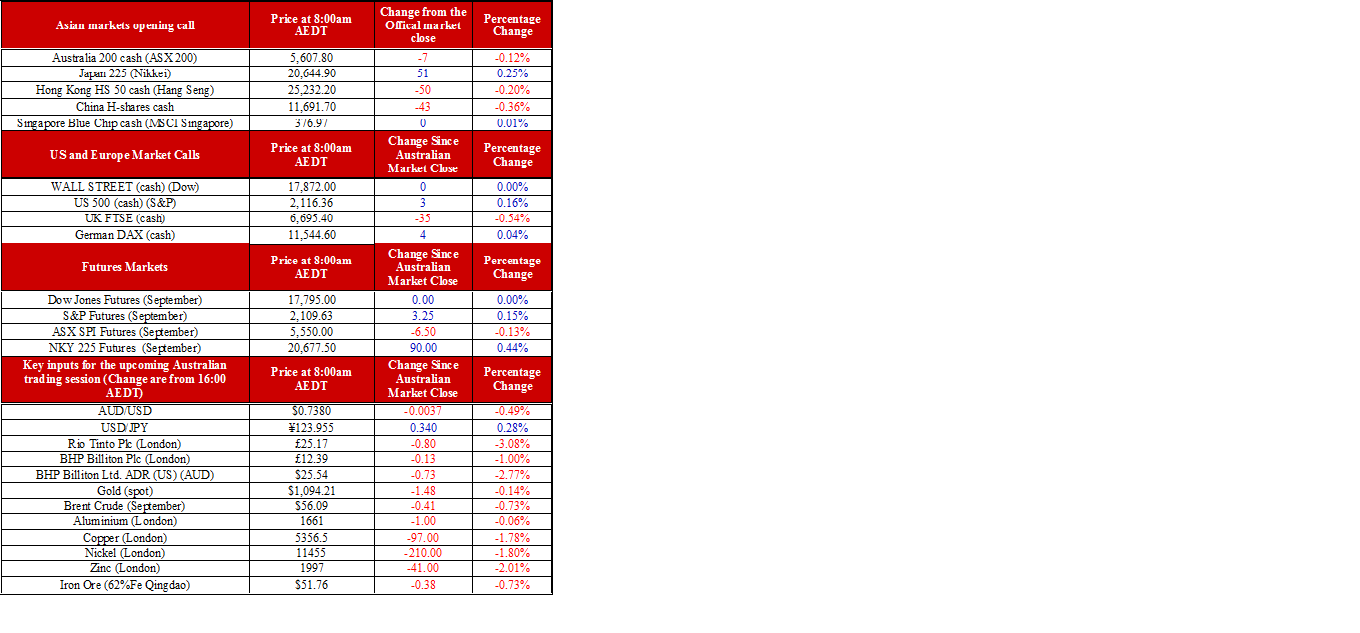

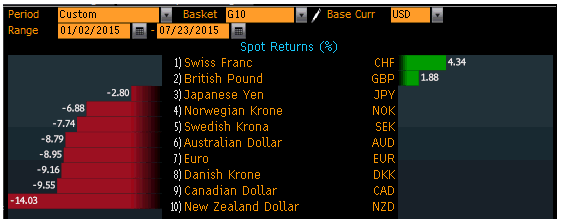

This isn’t just a winter theme – commodities have been under pressure all year and that is clearly reflected in the currency market. Nations with high levels of commodity exposure are the worst performers this year.

Disregarding the EUR’s self-made declines, the fact the CAD and NZD are rooted near the bottom of the list is no surprise.

Both nations’ central banks are almost at complete opposite ends of the monetary policy scale to the Fed. Gold, energy and soft commodities are key exports of Canada and New Zealand, and terms of trade are under pressure. A weak currency is therefore needed to offset the declines.

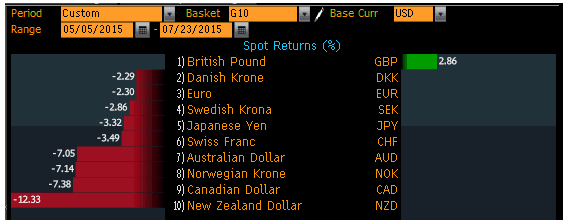

This differential and commodity rout certainly explains why the currency market is turning back to look at the AUD and possible movements from the RBA.

The collapse of the AUD in the past 90 days is in the main due to expectations of Fed lift off. However, there is a growing risk of further cuts to the cash rate from the RBA – this divergence in policy has been the single biggest driver of the 7% decline since May.

The fact iron ore is trending back to below US$50 a tonne and the impact that will have on terms of trade in Australia is a logical cause for further cuts.

Even if the RBA doesn’t move in the next three months, it’s clearly dovish and further falls in energy prices will only increase the risk to the economy. This increases the probability of a third cut in 2015.

Glenn Stevens’ address to the Anika Foundation yesterday was a sign he is being pressed to at least consider cutting once more and ‘further cuts are on the table’. However, the biggest resistance to further cuts is his question of their effect on further ‘real economic growth’ rather than their effect on financial speculation.

So that begs the question: will the AUD overtake the CAD and NZD in the next few months? It is certainly possible on the developments in commodities sentiment. Having said that, though, it may hold above as the RBA appears to be less likely to move rates in this period than its Canadian and New Zealand counterparts. What is clear is that being long USD remains the strategy of choice for the remainder of 2015.

Ahead of the open, the ASX is pointing down seven points to 5607.