Central Bank races

As everyone waits for Mario, you may have missed that the Bank of Canada (BoC) and Reserve Bank of New Zealand (RBNZ) were both running hard in the central bank races.

BoC is stuck between a rock and a hard place with rates already at 0.5%. Further cuts are very tricky, and its heavy reliance on oil is not making things any easier for the BoC as the country flirts with another recession.

The RBNZ has ‘surprised’ (only two out of the 17 economists forecasted today’s cut) the market with a further 25 basis point (bps) cut, which sees rates in New Zealand (NZ) hitting a 2.25% record low.

The interbank market was pricing NZ rates to be 2.09% by year-end before the press release. However, after today’s announcements, the market will clearly start pricing in at least one more 25 bps cut and possibly two. Rates could be sub-2% in December.

Reactions to the RBNZ announcement:

- NZD/USD collapsed down 1.5% to $0.66

- AUD/NZD added 2% to $1.12

- AUD got slightly caught up in the RBNZ dovishness and moved off its highs. However, the perfect storm in the AUD is still in play

The race is on to devalue your currency ahead of the European Central Bank (ECB) and the Fed is well underway. As is the race to buy property in Auckland with rates this low.

Trade in Asia today will likely be quiet(ish) ahead of the ECB meeting; however, here are a few interesting stats about trade after the past 15 ECB meetings:

- In the past 15 ECB meetings, only two have seen the equity markets down in the preceding month. The stat is identical on a daily basis, with two days out of the past 15 ECB announcement days being negative.

- Four of the past 15 ECB meeting saw over 6% rises in equity markets the preceding month – not surprising since these four months were after the big stimulus releases – which makes tonight very interesting.

- However, December 2015 was one of the two negative months. The market fell 3% on the day and 5% for the month. Expectations were so overly built in that when Draghi failed to live up to expectations, markets sold off. That has caused a lighter level of positioning leading into tonight’s meeting which we believe increases the likelihood of a positive reaction.

We continue to watch EUR/AUD as it’s our preferred cross – the AUD’s ‘perfect storm’ scenario and the likelihood of further devaluations in the EUR make it an attractive pair.

Next week’s Fed meeting will also make for interesting trading scenarios and the fact that AUD/USD went through $0.75 overnight, a ‘hold’ from the Fed is likely to see a further unwind in the USD, which is more bad news for the rising AUD – $0.78 is not out of the question.

Gasoline draining oil

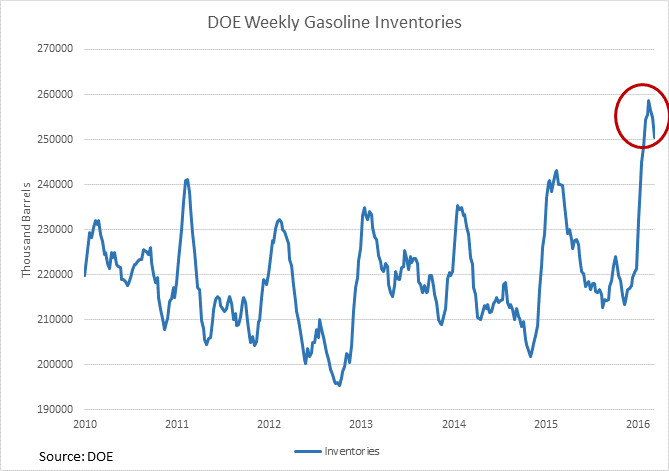

The release of the Department of Energy overnight shows US demand is on the up, seeing crude surging 4.9%. Oil stock piling added 3.8 million barrels, which was below expectations and well below the previous release of 10.37 million barrels.

But what is really driving the oil price is gasoline inventories (a leading indicator of demand), which declined by 4.5 million barrels three times what was expected and is now well off its highs.

If gasoline demand keeps draining inventories that quickly, crude prices will more likely average US$40 a barrel in Q2 rather than US$35 a barrel. Something to have on your radar as it will drive energy stocks and the oil price in the lead up to the northern summer.