With all the talk of the so-called Great Rotation, evidence points to investors still pumping billions into fixed income. And in spite of a fairly broad conviction that rates will be rising in the near future, investment portfolios are loaded with Treasuries. Demand for US government paper continues to be strong in spite of the worst risk/return profile in decades and implied real yields deep in negative territory .

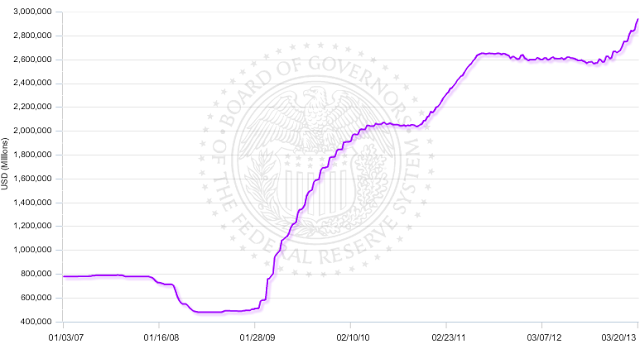

The obvious explanation is the public sector purchases by the Fed as well as other nations with significant dollar reserves. Traders continue to call the 10-year Treasury the "widow-maker", given how painful it has been to short that paper. Nobody wants to get in front of the freight train in the chart below.

But there is another reason. As investors move into equities while market indices hit new records, investors need an effective hedge. And over the past few years, long-dated Treasuries have delivered precisely that.

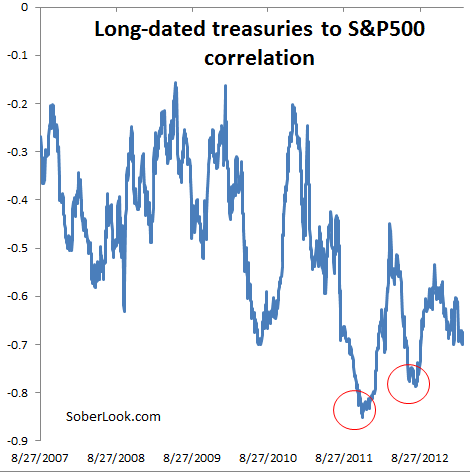

As discussed in this post, the right mix of Treasuries with equities dramatically reduced the daily volatility of the portfolio. That quality of longer dated Treasuries persists through today. The anti-correlation between the Barclays Long U.S. Treasury Index and the S&P500 index remains quite strong (-0.7).

What's particularly interesting about long-dated Treasuries as a hedge is that the anti-correlation increases during periods of stress in the financial markets. In fact, the hedge effectiveness was the strongest during the Italy fears flareup in the fall of 2011, followed by another dip last summer when Spain was in the crosshairs (keep in mind the chart above shows correlation over the previous 90 days). Very few hedging instruments have the "optionality" that kicks in at the time when one really needs it. Equity options and credit instruments (such as CDX) were not nearly as effective, particularly given the cost of decay/negative carry.

Investors are therefore willing to pay the premium of negative real rates and limited upside of Treasuries in order to minimize portfolio volatility. It's unclear if this relationship will hold or ultimately revert to historical levels. For now however, as Europe continues to spook investors who are piling into equities, Treasuries remain in demand as an effective hedge.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Though Terrible Investments, Treasuries Still Effective Hedge

Published 03/25/2013, 05:55 AM

Updated 07/09/2023, 06:31 AM

Though Terrible Investments, Treasuries Still Effective Hedge

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.