by Jesse Cohen

The changing of the guard at the Federal Reserve will be a big focus for investors this week, as both the next head of the U.S. central bank, Jerome Powell, and the outgoing chair, Janet Yellen, are scheduled to speak.

There will also be a steady stream of speeches from a handful of regional Fed presidents, as the central bank goes into its pre-FOMC blackout mode on Saturday.

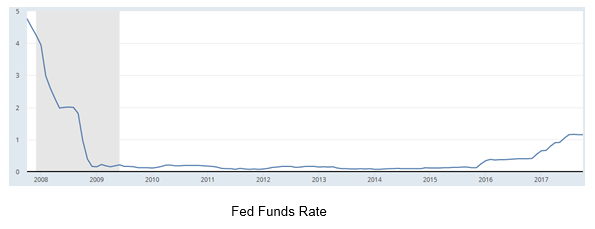

The Fed is scheduled to hold its final policy meeting of the year on December 12-13, at which it is widely expected to raise the Fed funds rate by a quarter of a point to a range between 1.25%-1.50%, according to Investing.com's Fed Rate Monitor Tool.

However, markets appeared doubtful about the central bank's ability to raise rates as much as it would like next year due to concern over the sluggish inflation outlook. The Fed’s preferred inflation metric, the Core PCE Price Index, has drifted down to 1.3% this year, well below a 2%-target.

At the moment, the Fed has penciled in three more rate hikes in 2018, but if there are shifting opinions on the likely trajectory of monetary policy, these five speeches in the coming days are when we are most likely to find out.

1. Fed Chair-Designate Powell's Confirmation Hearing

Governor Jerome Powell, selected by President Donald Trump to take over the Fed when Janet Yellen's term ends in February, appears before the Senate Banking Committee at 9:45AM ET (1445GMT) today for his confirmation hearing, which should provide some insight into how he plans to lead the Fed.

While Powell could face some scrutiny from Republicans who don't care for the central bank to begin with, and Democrats who want a tighter rein on Wall Street, his confirmation is all but assured. Market participants will scrutinize anything the next Fed chair has to say about monetary policy and inflation prospects.

Powell is widely expected to hew close to Yellen on policy, sticking to a script that calls for gradually hiking U.S. interest rates while keeping policy loose enough to support economic growth.

2. Outgoing Fed Boss Yellen Testifies

One day after Powell's confirmation hearing, outgoing Fed Chair Janet Yellen testifies on the economy on Wednesday at 10AM ET (1500GMT) before the U.S. Congress's Joint Economic Committee on Capitol Hill.

The testimony usually takes place in two parts: first Yellen will read a prepared statement (a text version is made available on the Fed's website at the start), then the committee will hold a question-and-answer session.

In candid remarks last week, Yellen stuck by her prediction that U.S. inflation will soon rebound, but said she is “very uncertain” about this and is open to the possibility that prices could remain low for years to come. She also fretted that persistently low inflation would leave the Fed with few tools to combat the next recession—what Yellen called a “very dangerous state of affairs.”

The outgoing Fed boss announced recently that she will leave the central bank once Powell is sworn in, as her four-year term comes to an end in February, opting against staying on as governor, which would have extended her involvement with the central bank until 2024.

During her tenure, which began during February 2013, Yellen oversaw the first rate hike in seven years in December 2015, as the Fed sought to normalize policy after the extremely accommodative measures put in place during the financial crisis.

3. NY Fed President William Dudley

In addition to Powell and Yellen, market players will focus on remarks from influential New York Fed President William Dudley, who also is expected to exit his role next year.

The NY Fed boss is due to deliver opening remarks at the annual conference hosted by the Federal Reserve Bank of New York on the evolving structure of the U.S. treasury market at 9:15AM ET (1415GMT) Tuesday. The following day, Dudley will participate in a panel discussion about current economic issues at Rutgers University, in New Jersey, starting from around 8:30AM ET (1330GMT) Wednesday. Audience questions are expected.

Dudley, who has headed the New York Fed since 2009, will retire sometime in the spring or summer of 2018, when his replacement is found and approved.

Some call his position the second-most important job in the Federal Reserve system. The president of the New York Fed holds a special spot among the dozen Fed regional bank presidents. The incumbent always serves as vice chairman of the rate-setting Federal Open Market Committee and always votes at policy meetings; other regional presidents have a rotating vote.

4. San Francisco Fed Boss John Williams

Fed watchers will also be listening closely to John Williams of the San Francisco Fed when he speaks on Wednesday at the Economic Forecast Luncheon, in Phoenix at 12:45PM ET (1745GMT). While he is not a current voting FOMC member, he will obtain that privilege in 2018.

Regional Fed presidents are likely to play a more prominent role in setting policy under the leadership of Jerome Powell, given the significant amount of vacancies on the seven-member Fed board and the lack of action in Washington to fill those positions. There are currently four open seats on the Board of Governors, which means more regional presidents will be voting on interest-rate policy than presidentially-appointed governors.

Williams has been more eager to raise interest rates than some of his peers and is probably in the camp for four hikes next year. He made waves recently when he argued in new research that the Fed should tweak the way it approaches inflation, by moving away from its 2% goal and targeting a price level instead.

5. Fed Governor Randal Quarles

Fed Governor and newest central bank official Randal Quarles speaks about payment systems at the Financial Stability and Fintech Conference, in Washington DC on Thursday at 12:30PM ET (1730GMT).

The Senate approved Quarles as vice chair of bank supervision in October, a position created as part of the post-financial crisis reforms under the Dodd-Frank measures. His appointment to the seven-member Fed board marked President Trump’s first imprint on the central bank.

Quarles scored a friendly first impression on Wall Street when he made his public debut early in November at the Clearing House Association’s annual conference in New York, saying the Fed will seek to improve the transparency of its annual bank stress tests. He added that he believes the central bank needs to give serious consideration to what banking regulations need to be changed.

That would set him apart from Daniel Tarullo, the former Fed governor whose tenure lasted from January 2009 to February 2017. Tarullo routinely irritated bankers by pushing for tough industry rules after the 2008 financial crisis.

Besides this week's flurry of Fed speakers, more hints on the future direction of monetary policy could come from the central bank’s own Beige Book, a periodic report that’s basically a Fed checkup on the economy, due out Wednesday evening.

The Fed will also get one more look at its preferred inflation gauge, the core PCE price index, before the central bank’s December meeting. The October PCE report comes out Thursday, amid forecasts for a reading of 1.4%, up slightly from 1.3% in the preceding month.

The Fed uses core PCE as a tool to help determine whether to raise or lower interest rates, with the aim of keeping inflation at a rate of 2% or below.

Most Fed watchers are in agreement that the growing debate on inflation suggests there is a push to make the Fed more dovish next year, which would cast doubt on the pace of rate increases in 2018. The question is, just how dovish?