Here’s your 5-minute overview of the forex, crypto, and stock markets with hot stories that may have an impact on your investment strategy.

Forex Market Overview

Let’s start with the Forex Market. Though last week was filled with trade tensions between the United States and China, the Dollar was able to play up its role as a “safe-haven” currency and outperform many of its competitors. The Swiss Franc, another go-to currency during times of uncertainty, also enjoyed a strong week, and so did the Japanese Yen.

Trade tensions will likely continue this week, which will cause most forex markets to become more volatile. We will also pay close attention to the political developments coming out of Europe.

As the future of Brexit continues to remain uncertain, the Pound will likely continue to struggle. Elsewhere on the continent, minutes from the European Central Bank—planned to be released this week—may impact the future value of the Euro.

Meanwhile, negative backlash from the US-China trade dispute has caused the Aussie Dollar to remain in the red. The new election result in the Land Down Under, on the other hand, may lend a helping hand to Mr. Aussie. As May comes to a close, we will likely see an uptick in forex trading.

Taking a Closer Look at AUD/JPY

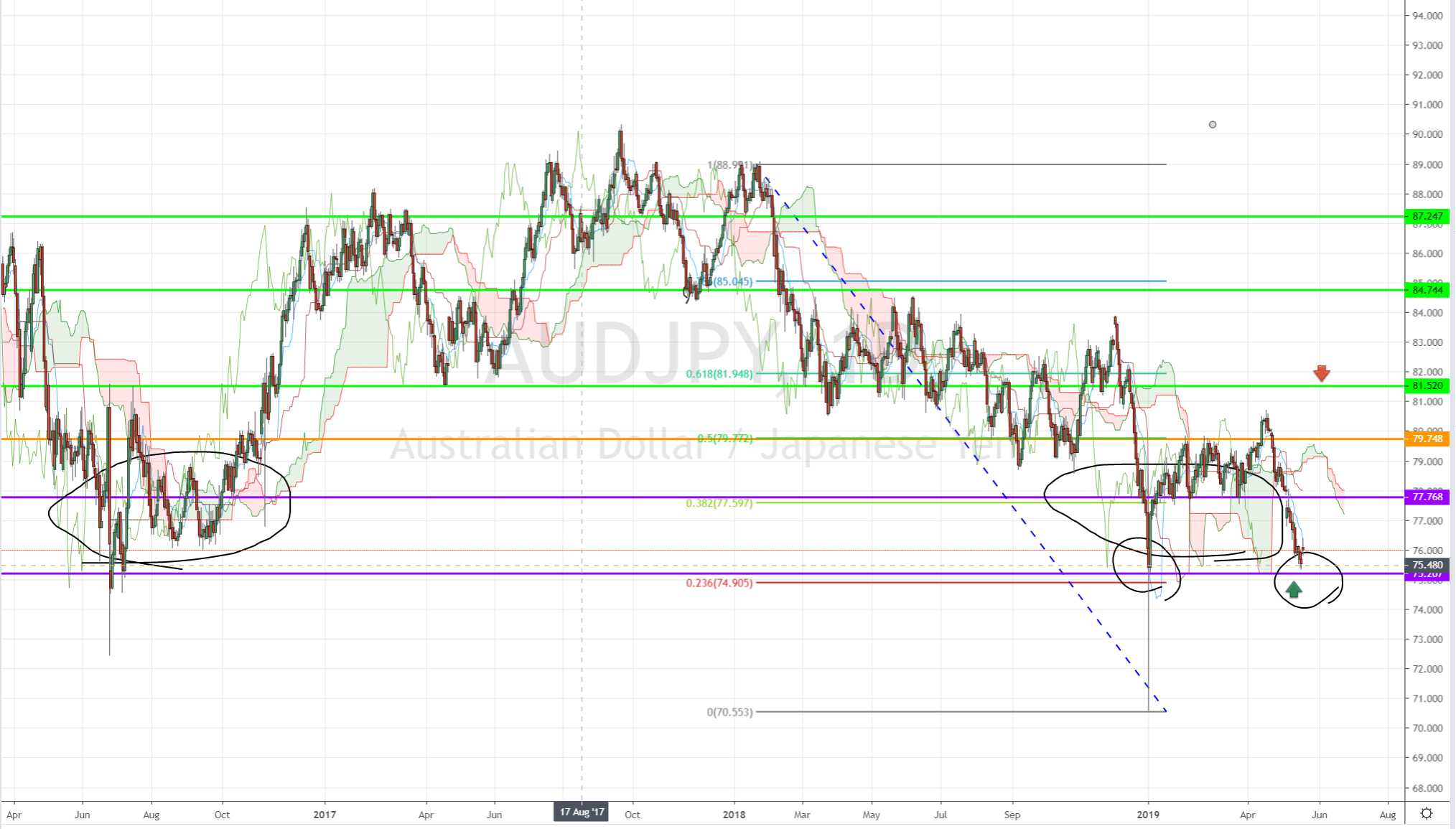

The 75.20 support level I talked about a couple of weeks ago appears to have held the AUD/JPY pair from dropping any further. With this, we may see a Double Bottom bullish reversal chart pattern forming on the daily chart. On the other hand, this could be a risky observation as the future Ichimoku Cloud remains bearish on the daily chart, while on the 1-hour chart, it has broken above the cloud with the future cloud moving up.

AUD/JPY Forming a Double Bottom Chart Pattern

The pair may also be forming another Double Bottom if you look at the bigger picture. Call it a double, Double Bottom if you will. For a detailed investment strategy on AUD/JPY and other pairs, visit the PIG.

Crypto Market Overview

After experiencing a minor price dip at the end of last week, Bitcoin quickly bounced back to once again break the $8,000 mark. Though Bitcoin has experienced a few waves of volatility, traders have noticed that the coin has maintained its gains much more reliably than it has in years past.

The crypto community is eagerly awaiting the June launching of SprinkleXchange. The company, based in Bahrain, is an Ethereum-based stock exchange hoping to soon begin listing companies. Other exciting crypto news came from Europe, where the Central Bank proclaimed the crypto industry poses “no major threat” to financial stability. In response, many European-based coins experienced a minor bump in value.

Meanwhile, the Token Summit 2019 saw the gathering of some of the top names in cryptocurrency. While the gathering was generally productive and exciting, there were also plenty of questions regarding crypto’s future in the United States. Moving forward, industry advocates will push for clearer, more productive legislation.

Stock-Market Overview

Most of last week’s stock news relates to the ongoing trade tensions between the United States and China. After both nations announced they would be imposing additional tariffs, all major indexes in the United States experienced a notable drop.

On Monday, most indexes opened with an initial drop and have slowly climbed back over the course of the day. This suggests that the effects of the tariffs may finally be slowing down. Additionally, the United States has moved closer to reducing steel tariffs with Canada and Mexico.

Ford opened the week by announcing its plans to lay off roughly 7,000 employees. This is roughly 10 percent of the company’s global workforce. Elsewhere, the FCC signaled that it would likely approve plans for Sprint and T Mobile to merge together. If approved, this would be one of the largest telecom mergers since the initial breakup of Bell Telephone.