- Nvidia: Shares jumped after Q4 earnings beat expectations, driven by strong AI chip demand, with projections exceeding estimates despite challenges in China.

- Walmart: Posted better-than-expected Q4 earnings and hiked dividends.

- Rivian: Shares fell 25% due to a Q4 earnings miss, reduced production forecasts, and job cuts, reflecting challenges in the electric vehicle market.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

In this week's earnings recap, we delve into the latest quarterly reports from four industry giants Nvidia (NASDAQ:NVDA), Walmart (NYSE:WMT), Rivian Automotive (NASDAQ:RIVN), and Booking Holdings (NASDAQ:BKNG).

Nvidia: Stock Wanders Into Overbought Territory

Nvidia stock soared over 16% on Thursday following the announcement of its Q4 results and outlook, which surpassed expectations, fueled by the ongoing demand for AI-driven chips.

CEO Jensen Huang highlighted the growing excitement around artificial intelligence, which has significantly increased Nvidia's market value over the last year. He said:

"Demand is surging worldwide across companies, industries, and nations,"

Year-to-date, Nvidia's stock has seen an impressive rise of over 58%, with a 239% increase throughout 2023, with the company consistently beating Wall Street predictions for five consecutive quarters.

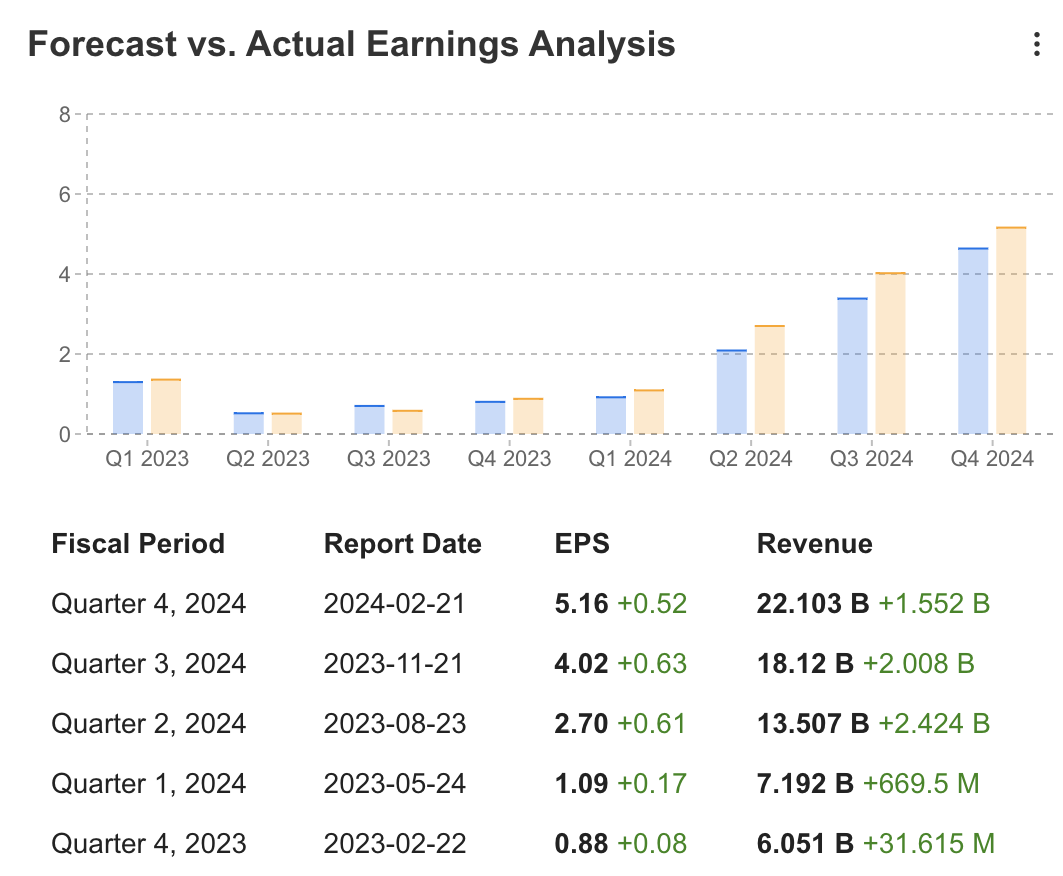

Source: Investing.com

For Q4, Nvidia reported an EPS of $5.16, outperforming the anticipated $4.61, with revenue hitting $22.1 billion, above the expected $20.55 billion.

The data center segment was particularly strong, recording about $18.4 billion in revenue, thanks to the growing demand for generative AI and the successful adoption of Hopper products and networking solutions.

Gaming sales also remained strong at $2.87 billion, driven by robust GPU sales during the holiday season.

Looking forward, Nvidia expects Q1/25 revenue to be around $24 billion, plus or minus 2%, exceeding the consensus estimate of $22.01 billion.

This quarterly beat is notable even as sales to China saw a significant drop in Q4 due to U.S. government licensing restrictions.

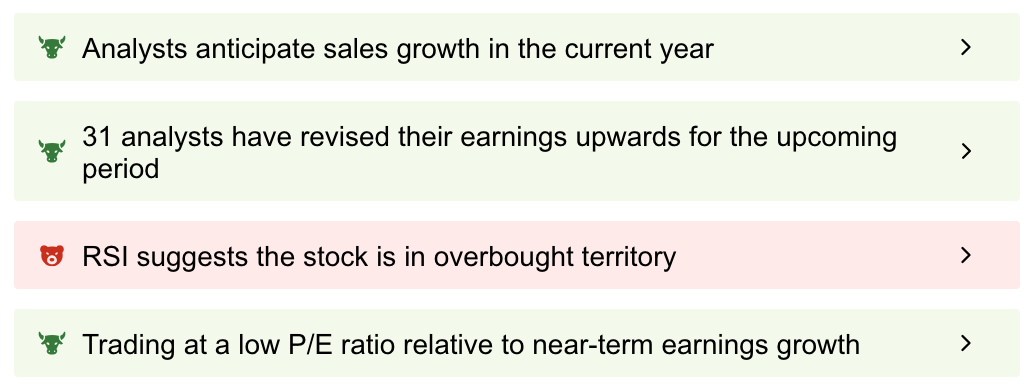

Our ProTips summary on the InvestingPro provides a quick company overview.

It highlights several positives, such as expected sales growth this year, earnings revisions upwards by 31 analysts for the upcoming period, and trading at a low P/E ratio relative to near-term earnings growth.

However, it also notes potential concerns, like indications that the stock might be in overbought territory based on RSI metrics.

Source: Investing.com

Nvidia is ranked for Great Performance in the Pro’s Financial Health, which is determined by ranking the company on over 100 factors against companies in the Information Technology sector and operating in Developed economic markets.

Source: Investing.com

Walmart: Could the Stock Continue Surging?

Walmart (NYSE:WMT) shares saw an increase of over 3% on Thursday, reaching a new all-time high following a better-than-expected Q4 performance, despite a conservative outlook.

The retailer reported Q4 EPS of $1.80, surpassing the analyst estimates of $1.64, with quarterly revenue reaching $173.4 billion, exceeding the expected $170.81 billion.

Amidst high interest rates and inflation, consumers have been cautious with their spending, often opting for more affordable purchases over expensive items. This shift in consumer behavior has notably benefited Walmart's low-cost offerings.

Looking ahead to fiscal year 2025, Walmart anticipates a sales growth of 3% to 4%, compared to the analyst forecast of a 3.4% increase.

This somewhat conservative projection reflects the current economic transition, yet the market response post-announcement suggests investors recognize it.

Additionally, Walmart announced an increase in its quarterly dividend to $0.6225 per share, up 9.2% from the previous $0.57, with an annual yield of 1.5%.

Following the announcement, Goldman Sachs reaffirmed its Buy rating and a price target of $193 for Walmart, citing the retailer's continued share gains and improved profitability as key growth drivers.

The firm believes Walmart is poised for sustained earnings growth, supported by its expanding high-margin businesses and productivity gains.

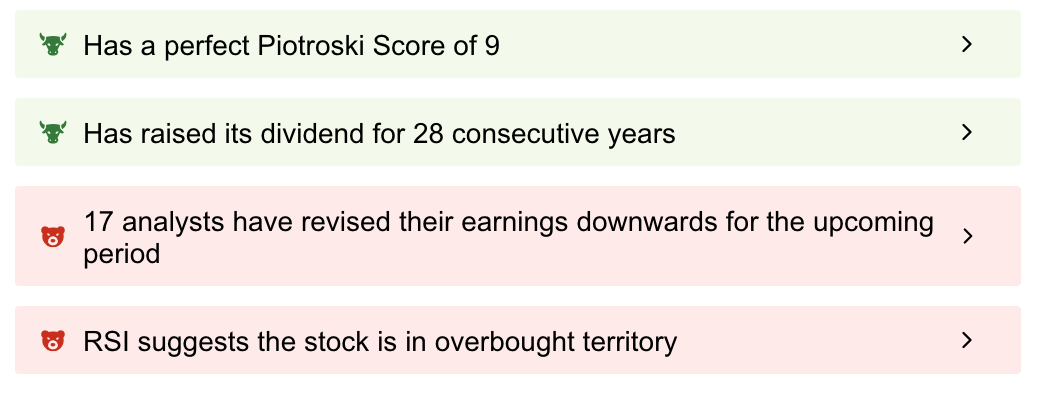

Our ProTips presents a mixed view of Walmart. Positively, the company boasts an excellent Piotroski Score of 9 and has consistently increased its dividend for 28 years.

On the downside, 17 analysts have adjusted their earnings forecasts downward for the upcoming period, and the RSI indicates the stock might be in overbought territory, signaling potential caution ahead.

Source: Investing.com

Rivian: Challenges Mount for the Automaker

Rivian Automotive (NASDAQ:RIVN) shares plunged over 25% on Thursday following its Q4 EPS miss, job cuts announcement, and lowered production forecasts, highlighting the diminishing demand for electric vehicles.

The electric vehicle manufacturer reported Q4 EPS of ($1.36), below the analyst prediction of ($1.35), with revenues reaching $1.32 billion, surpassing the expected $1.28 billion.

Throughout Q4, Rivian produced 17,541 and delivered 13,972 vehicles in Q4/23.

Faced with economic and geopolitical challenges, including the effects of record-high interest rates, Rivian adjusted its 2024 production outlook.

The company now anticipates producing 57,000 vehicles in the coming year, falling short of the anticipated 66,000 by analysts.

Furthermore, Rivian announced a plan to reduce its salaried workforce by approximately 10% as part of its response to these challenging market conditions.

Booking Holdings: Stock Down Pre-Market on Earnings Miss

Booking Holdings (NASDAQ:BKNG) experienced an over 8% decrease in its share price during pre-market trading on Friday, following the announcement of its EBITDA and bookings outlook that failed to meet market expectations, despite delivering stronger-than-anticipated results for Q4.

For Q4, the company reported an EPS of $32, exceeding the analysts' forecast of $29.66.

Additionally, its revenue reached $4.8 billion, surpassing the expected $4.71 billion. The company's gross travel bookings for the quarter amounted to $31.7 billion, representing a 16% increase from the same quarter the previous year.

Looking forward to Q1/24, Booking anticipates revenue growth to fall between 11% and 13%, with gross bookings expected to increase by 5% to 7%.

The company's adjusted EBITDA is projected to be in the range of $680 million to $720 million, indicating a 19% growth year-over-year and a 1 percentage point increase in EBITDA margin.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

InvestingPro users got this news and reacted in real time! Join now and never miss out on another buying opportunity.

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.