Last week, which was shortened by civic holidays in Canada and the U.S., was nevertheless full of surprises. On Thursday the European Central Bank trimmed 25 basis points from its key interest rate, confirming the view shared by most market participants. On the same day and to everyone’s surprise, the People’s Bank of China lowered its lending rate by 31 basis points and cut the interest rates on deposits by 25 basis points. These measures, which were taken to stimulate the European and Chinese economies, leave us concerned as per the health of the global economy.

The key interest rates of the world’s largest economies are practically at zero and the printing press was activated many times already. So what is next? Furthermore, U.S. and Canadian employment data were released on Friday. Some 7,000 jobs were created in Canada, confirming analysts’ expectations, while the 80,000 jobs created south of the border disappointed the market once again. Buyers, take advantage of the current levels, and sellers, your turn is coming soon!

Canada

Few indicators of any importance will be released this week. The only one worth mentioning is Housing Starts for the month of June. Analysts are expecting 200,000 housing starts across the country. The purchase of a home remains the single largest investment that people make in their lifetimes. That being said, changes in the level of housing starts provide a good indication of economic activity in Canada.

United States

On Wednesday the Trade Balance for May will be announced, followed by the minutes of the last meeting of the Federal Reserve, while on Friday the Michigan Consumer Sentiment Index will be released. It is expected to be 73.5, up 0.3 from the last reading. Given the poor job creation numbers mentioned above, we believe that this figure will disappoint analysts.

International

Many indicators are expected this week that should give a reading of the health of the global economy. First up, on Monday, is Germany’s Trade Balance for May, followed by the same figure for China on Tuesday. On Wednesday we will be given German CPI data for June. On Thursday the Bank of Japan will announce its decision on its key interest rate, and a speech will follow. The expansionary measures taken last Thursday by the People’s Bank of China—for a second month in a row—suggest that poor results are in store on Friday when China releases GDP data for the second quarter and Retail Sales figures for June.

The Loonie

“Let us not be deceived we are today in the midst of a cold war.” – Bernard Baruch

There is a sense that the conflict between Iran and the U.S. has been going on forever and that lately the international press has taken a growing interest in their antagonism. The war of words carries on unabated. Is this just another facet of the Cold War? There are clear parallels: arms race and the nuclear threat. Although this time, Russia is not front and centre. However Iran, an important ally of the ex-USSR, is at the heart of the conflict. In addition, Iran is again threatening to close the Strait of Hormuz, a maritime corridor for ships carrying one third of the world’s oil. Tensions are on the rise, and the risk of a confrontation appears increasingly real.

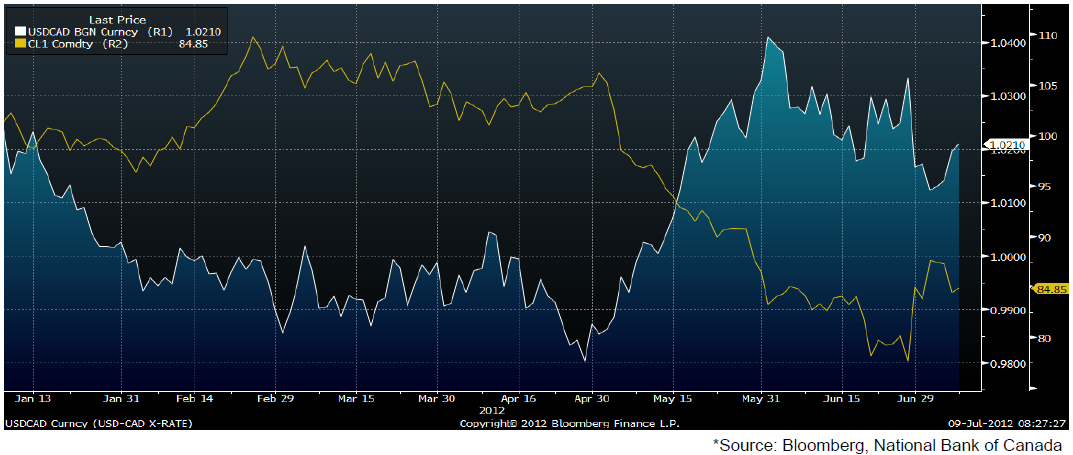

Should the conflict degenerate over the coming months, the price of oil will surely rise and the CAD will follow without a doubt. However, it is difficult to predict trends in the price of oil for the rest of the year, given the events around the sovereign debt crisis that continues to afflict the eurozone. Furthermore, the global slowdown puts downward pressures on the demand for oil. Recently, prices for black gold have fallen sharply. The economic slowdown has been hard on commodity prices, and oil has not been spared. Since the end of April, the price of oil has fallen nearly 20%. The following graph shows changes in the price of oil and its relationship with the loonie.

To fully grasp the information in this graph, consider only the movement of these two indices over the last month: the correlation between oil and the Canadian dollar has been close to 78%. This is not negligible. We can therefore conclude the following: the Canadian dollar is sure to respond to further changes in oil prices. One thing is for sure, volatility will be put. On one side, the drop in worldwide economic activity will bring the price of oil down. On the other hand, geopolitical tensions between the United States and Iran will attempt to spur the price of oil. We will be propelled into an environment of uncertainties and crude oil will go through times of high fluctuations. Which side will conquer?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

This Week's Market Reacts To Last Week's Market Surprises

Published 07/10/2012, 08:07 AM

Updated 05/14/2017, 06:45 AM

This Week's Market Reacts To Last Week's Market Surprises

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.