I cracked a rib a week ago. Don’t ask. Every time I breathe deeply, turn my body or laugh I am reminded that a tiny portion of my body, namely my damned rib, is involved in the process.

It got me to thinking how much our present crop of bureaucrats are like my busted rib. Everywhere you turn they’re there to inflict pain and remind you that life can indeed be painful.

After the ’08 crisis the government and regulators swooped in and decided it was time to have a crackdown. The government is always having a crackdown on something, terrorists in sandals, oven mitts and marigolds, or some other absurdity. Never, ever do they accomplish what they profess. They’d be better off cracking down on talking dogs, or cloudy days.

After ’08 the regulators pretended to go after the banks, and we pretended to believe them. That’s how it works. Behind the scenes however the little guy trying to deposit a few thousand bucks into a bank now has to jump through hoops that defy common sense, and now foreign banks simply won’t take US citizens. Why would they?

Investors participating in private deals have to jump through hoops and entrepreneurs raising capital have to be super careful about who they talk to – lest they not be accredited.

Over the last few months our private group, Seraph, led the Series A on a private company based in the US. Because the deal was a US deal we used a Delaware LLC structure as an SPV. 130 pages later, tens of thousands of dollars in costs and investors could participate. What on earth the Patriot Act, which took up about 30 pages on its own, has to do with my investing my own money into a private company, I have no idea. We’ve done deals from Mongolia to Iraq, to New Zealand and many more so we have some metrics to compare.

In New Zealand, where there is zero capital gains tax or dividend tax, we can set up and run an SPV with a 3 page document where all shareholders are registered and 100% transparent online and it can be done for less than a nice dinner in New York.

KYC has never been a problem but increasingly is becoming a problem for US citizens. The onus is no longer just on US citizens to report but now on anybody that said citizens land up transacting with. Thanks FATCA!

Compliance has become so onerous that brokers and custodians are refusing to take stock in private placements. The compliance costs are simply too high for them to make it worth their time.

What happens when brokers won’t register the stock? Investors find it too time consuming and painful, and when that happens they simply don’t invest capital, and when that happens pray tell how small and medium sized business which has always been the lifeblood of every healthy economy fund growth?

Governments hold a near monopoly in absurdity but what I wanted to discuss today is what they’re doing in the hedge fund world and how the regulatory overreach will be ensuring monopolies are created as smaller funds are eliminated.

The reason I discuss this topic is because I’ve spent the last few months doing extensive due diligence on different corporate structures and the compliance issues associated with them. It’s been a truly enlightening experience and I’d like to share some of my findings with you today.

It started with a conversation I had with a gentleman running a multi-billion dollar hedge fund. He explained to me in detail why his firm is scrapping the hedge fund model and moving to a simpler less onerous business model – a private limited holding company which will be domiciled in Hong Kong.

This was followed by dozens of conversations with fund managers, service firms, lawyers, accountants – all from multiple jurisdictions. What I learned was that the majority of hedge fund managers were either ignorant of a good many of the obligations they had and were therefore operating “illegally” especially with respect to capital raising activities.

Another group knew of various regulations but in their own words told me that if they had to abide by them they’d go out of business. The cost of compliance would mean them closing their doors. The only way for these guys to survive is to get substantial assets under management (AUM) in order for the 2% of fees charged to be able to cover all the additional expense.

Another good friend who runs a fund here in SE Asia commented to me that if he was going to do it all again there is absolutely NO WAY he would setup as a hedge fund: “I can’t keep up with all the laws and requirements, its impossible to remain compliant if you’re a small shop.”

It also matters less and less where the hedgies domicile. A Cayman fund, for example, cannot openly solicit European investors unless it pays a fee and becomes registered to do so in the European Union. Ditto the US.

To give you a sampling of some of this lunacy. New IRS laws designate a hedge fund a PFIC or “Private Investment Company” should the fund have not transacted for a period of time, which is worded in such a fashion that this period of time is discretionary upon the IRS.

The implications are severe due to the way the IRS treats PFIC’s. To provide some colour let us for a moment consider we’re running a hedge fund and let us further consider that the market looks particularly frothy and we want to go to cash and sit it out for a few months. Bam! Capture!

Inactivity will automatically designate us a PFIC. No forms need to be filled in, no minutes of any meeting documented, nada. We’re now in a new regime. Brilliant. Furthermore we can’t get from PFIC status back. Nope, we’ll have to liquidate our entire asset base, paying the full, much higher tax rate designated to PFIC’s and then go set up a new fund because – hey, that was so much fun.

Hedge fund managers with their mind in neutral are in for a nasty shock as the clamp down on funds not operating based on existing regulations and requirements heats up. As Western governments head into 2015 with un-payable and increasingly unserviceable debt levels they’ll be looking for every last penny they can find. To understand how bad those debt levels are, I strongly suggest downloading our free debt report here. It’ll blow your mind.

Internally we ran some numbers on successfully running a hedge fund and honestly I can’t say it makes much sense to do so for under $50 million dollars which is really the absolute bare minimum to make it work economically. Below that all your compliance and regulatory costs will be costing you a disproportionate amount of AUM. It’s simple enough math. I actually don’t think it makes much sense unless you can hit $250M and then if you can why would you bother?

Sure a fund structure can be more attractive to investors due to a perception, rightly or wrongly of greater transparency but the cost of accessing that capital is rising sharply. For the successful funds out there they are typically turning away capital so why on earth would they bother having all the pain? I don’t invest in funds but if I did I would be questioning a fund manager who can simply by changing his corporate structure immediately boost returns to shareholders.

Let’s take a look at some numbers.

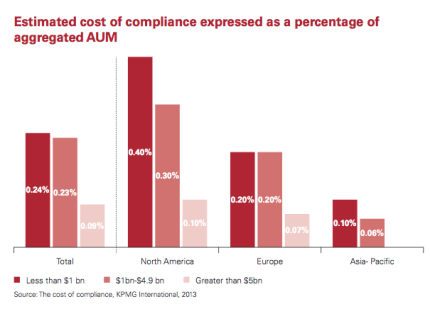

We can see that smaller funds spend far more on compliance as a percentage of AUM than their larger competitors, and further that North American fund managers are spending 4X more than their Asian counterparts and 2X more than their European friends.

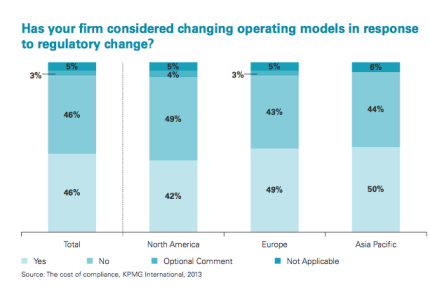

In a report published by KPMG an extensive survey was done and it was found that 52% of European fund managers said they had considered moving their fund domicile and management company to other jurisdictions as a result of regulatory changes. Furthermore 50% of fund managers with assets of $5 billion and up said they had considered exiting markets or lines of business as a result of regulatory pressure.

What is happening is that there is going to be a coming wave of hedge funds which will be incorporating as companies. Limited liability companies, partnerships, anything but the heavily regulated hedge funds.

Regulatory and compliance requirements have exploded since the GFC resulting in costs associated rising sharply. This has had the effect of barriers being created for smaller operators and in order for hedge funds to survive assets under management (AUM) have to be substantially larger to offset the increased costs.

This is a trend whereby we will be seeing less hedge funds entering the market and at the same time the large funds will likely merge and buy up smaller funds in order to produce better economies of scale due to these rising costs as margins are compressed. At the same time, as one very smart hedge fund manager who is in the $1B plus range said to me: “Why bother, just use a holding company.”

Someone is going to make a bunch of money servicing hedge funds who will be restructuring their entities as the compliance hammer comes down…