What are you supposed to do when the stock market sells off? If you're a bear you pound your chest and hope that your short-term gains don't disappear before you can close your shorts. If you favor the upside -- at least on an intermediate basis if not longer term -- you should be looking for relative strength. Stocks that exhibit relative strength in a down market are the ones that are likely to move higher when downward pressures are removed.

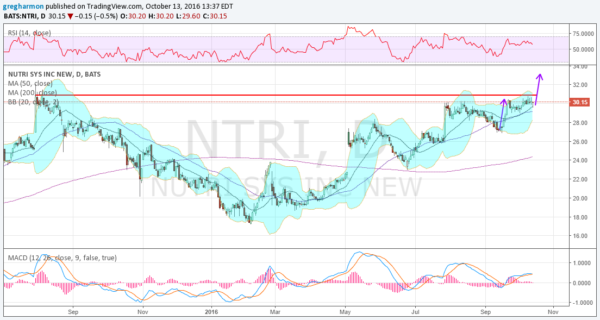

Nutrisystem (NASDAQ:NTRI) is one of those stocks. As the broad market indexes move through a 3-day pullback, it has not budged. Even better, it sits at its 14-month high. In a market that's up, you wouldn't be surprised to see this stock pause as it retested its July 2015 high. So what to do? Nothing -- at least for now. Instead, wait for it to push to a new higher high.

Nutrisystem has a good history since February. A steady trend up with higher highs and higher lows. the chart suggests that a push through resistance would give a target to 33.50 at least. The RSI remains in the bullish zone and the MACD is rising. All of which support more upside.