If I told you about a stock that's delivered gains of nearly 20% to investors for the past five years, then I imagine you'd be a little skeptical. After all, the past five years have been some of the most tumultuous years in recent memory. And even if it weren't, 20% a year is a pretty tough benchmark to meet.

Warren Buffett, Carl Icahn, Bill Ackman -- these guys would all kill to even come close to that, not to mention probably take on a lot of risk in the process.

They wouldn't have to, though, if they had just invested in one of the world's largest engine manufacturers. And best of all, as a technological leader in fuel efficiency and natural gas engines, it's poised to keep up the pace.

I'm talking about Cummins Inc. (NYSE: CMI).

With annual revenue of about $18 billion, the company makes diesel engines for construction vehicles, cars, buses and trucks. It also makes natural-gas engines, engine components and electric power-generation systems.

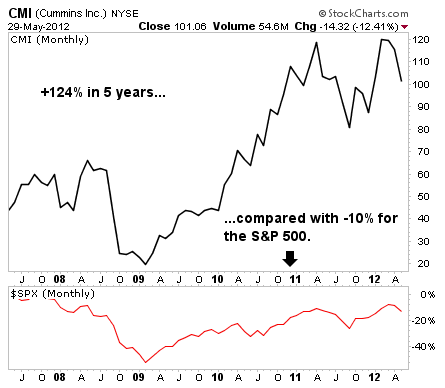

Shares of Cummins have climbed 124% during the past five years -- good for an annualized rate of return of 17.5%. Tack on the annual dividend yield, which has averaged 1.3% during the past five years, and you get a total return of 18.8%.

That's nothing short of amazing, particularly when you consider the five-year period I mentioned included the financial meltdown, the deep recession of 2007-2009 and the sluggish recovery we're currently experiencing.

To understand how the stock managed to accomplish this -- and why I think it's a candidate to keep outperforming for at least the next few years, we have to look back 10 years ago…

Cummins thrived during bad times for several reasons, starting with a smart move made 10 years ago when the company decided to restructure diesel engine-making operations, since they accounted for the bulk of revenue just like they do today (currently 52% compared with 18% for engine components, 16% for power-generation systems and 14% for sales/service). Initiatives included workforce reductions, re-allocation of older manufacturing equipment rather than disposing of it and canceling unnecessary information technology programs. The result was a 13% reduction in the break-even point for diesel engines, meaning Cummins now only has to sell around 260,000 units a year to break even, compared with 300,000 before the restructure. These restructuring initiatives have saved about $97 million a year in operating costs, analysts estimate.

Besides becoming leaner, Cummins was fortunate not to have much exposure to Europe and its severe economic problems of the past four or five years. Because management saw better opportunities elsewhere, the company has been focusing less and less on the region: European sales provided 18% of total revenue in 2007, compared with only 9% currently. Half of revenue now comes from economically healthier emerging markets like Asia and Latin America, where Cummins has become a major player through partnerships with the largest truck and truck-component makers in those areas.

In October 2011, for instance, it announced a joint venture with the LiuGong Machinery Co. to produce the Cummins diesel engine for pickup trucks at a new plant in the Guangxi Province of southern China. The plant is scheduled to open in 2013 with an initial production volume of 50,000 units a year. Earlier this year, Cummins announced a joint venture with Latin American distributor Grupo Laeisz to sell and service Cummins diesel engines and power generators in Costa Rica and El Salvador. Grupo Laeisz has already been distributing Cummins products in Honduras for about 40 years.

Prospects are also strong in North America, which generates 41% of total revenue. This is particularly good news because business in China, Latin America and some other emerging markets are expected to slow somewhat in the coming years.

Cummins' financial results are already reflecting these trends. In the first quarter of 2012, for example, sales rose 16% to $4.5 billion, compared with $3.9 billion in the same period last year. The improvement was due in large part to soaring demand for heavy-duty commercial truck engines in North America, where sales of these engines rose to $892 million -- a whopping 84% jump from the $485 million generated in the first quarter of 2011. Overall, North American sales climbed 40% to $1.9 billion, compared with $1.4 billion in the first quarter of 2011.

In addition to favorable geographic diversification, Cummins also has the advantage of being the largest manufacturer of natural gas and hybrid bus engines in the United States, which could lead to major revenue growth if the United States further increases its commitment to cleaner energy sources. [See: "This Company Could Kill the Gasoline Engine…"] For instance, only about 12,000 public transit buses -- 17% of the country's 70,000 buses -- run on natural gas, leaving plenty of room for further expansion. A similar situation exists with school buses, of which there are roughly 700,000 just in the United States.

Risks to consider: Cummins is subject to stringent oversight by the Environmental Protection Agency and other agencies capable of imposing new environmental regulations that increase costs to point of hurting profits.

I think Cummins is a good bet to keep growing quickly because of its wise decision to largely avoid Europe and focus on economically sounder emerging and North American markets. I also like the stock because consumers rely heavily on the types of products it makes to function on a daily basis. Still, analyst projections for earnings per share (EPS) to climb 18% annually for the next three to five years seem overly optimistic in today's economic environment, especially for a cyclical stock like Cummins. I'd be much more comfortable projecting half that, or 9% EPS growth.

BY Tim Begany

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

This Stock Has Gained Almost 20% A Year in This Economy

Published 05/31/2012, 03:35 AM

This Stock Has Gained Almost 20% A Year in This Economy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.