Six summers ago, Donald Trump lamented privately to Republican donors that he expected Jay Powell to be a “cheap money” Fed chair. To the President’s chagrin, Powell had recently raised interest rates. Thus, making money more expensive.

Most real estate guys like Trump are allergic to high rates. Back in 2018 they were certainly no bueno for his growth-focused agenda. The President told Fox Business the Fed was his “biggest threat.”

He even admitted to the Wall Street Journal he “maybe” regretted appointing Powell. Appointer’s remorse! Then came Trump’s biggest zinger of them all:

“The Fed is like a powerful golfer who can’t score because he has no touch—he can’t putt!”

Powell the three-putter. Ouch.

Fast forward to now and we have a rematch brewing between the still-Fed chair and the President-Elect. There appears to be no love lost. Will Powell blink first? A reporter asked him if he will step down if requested by Trump.

“No,” replied Powell firmly.

Can he demote you? “Not permitted under the law,” the defiant Fed head replied.

Powell’s quotes made the headlines, but beneath the surface Powell may have already laid an “Easter egg” that is ready to break and ooze yolk on Trump’s high-growth agenda.

No touch? Hold my beer, Mr. President-Elect.

Interest rates have rocketed since Powell cut rates in September. Wait—what?

That’s no typo. The 10-year Treasury yield has been on a tear since Jay Powell first cut the Fed Funds Rate. The three-putter still has the touch!

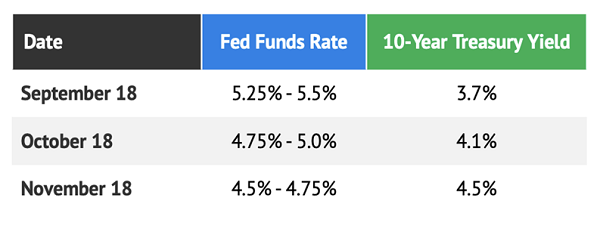

On September 18, Powell cut rates by 50 basis points. However, this was only the “short end” of the yield curve. The 10-year yield meanwhile (the “long end”) popped from 3.7% to 4.5% in a matter of weeks!

Oh, the irony! Bond investors laughed at Powell. Why are you cutting rates when inflation is not dead yet? They demanded more return for their 10-year investments as a result.

How did Powell respond to this hint? He cut rates again.

Does the Fed chair have the yips? Is he missing putts on purpose to zing his old/new boss? Or is he simply bad at interpreting inflation data?

The US economy grew by 2.8% in the third quarter. The Federal Reserve Bank of Atlanta estimates it will expand by 2.7% in the fourth.

These are hardly numbers deserving of rate cuts. Meanwhile inflation, as predicted right here at Contrarian Outlook, is proving to be stubbornly sticky. Year-over-year the consumer price index (CPI) rose by 2.6% in October, an increase from 2.4% in September.

Powell says 2% inflation is his goal. He’s never going to hit it if he keeps easing. Plus, we have three pillars of Trump 2.0 on the way: economic growth, tariffs and lower immigration. Three more boosts for higher prices.

The rearview mirror (GDP and CPI) points to a need for higher rates for longer. The road ahead (Trump 2.0) hints that long rates will rise. The 10-year Treasury yield climbed from 1.9% on Election Night 2016 to an eventual high of 3.2%, a big move that upset the bond market (because when rates rise, especially longer-duration rates, bonds drop).

If history rhymes then bonds, especially the vanilla kind issued by the US Treasury, will not appeal to investors this time around either. Would you want to lend to Uncle Sam for a decade at just 4.5% annually given the backdrop we just discussed?

Fortunately, we contrarians can be more creative than basic investors. The outlook for bonds points to an increase in volatility, which is bullish for bond-trading platform MarketAxess Holdings (NASDAQ:MKTX).

MKTX returned 239% during Trump 1.0. The company hiked its payout four times for a cumulative 100% gain—that’s right, a quick dividend double!

This stock hasn’t been discovered by the AI automation fanboys—yet. MKTX was founded in 2000 by financial technology (“fintech”) entrepreneur Rick McVey. Rick smartly saw that closing bond trades via phone calls was crazy. He brought fixed-income trading into the twenty-first century with a suite of automated tools to modernize bond trading.

I love buying technology companies that are still run by their founders. Entrepreneurs, by nature, always look ahead. They innovate anticipating, not following, the next move.

Wall Street operates on a quarterly treadmill cycle. It’s often a slow death for companies led by run-of-the-mill managers. The quarterly calls are a necessary evil, but they aren’t where future bread (profits) is buttered. That comes from innovation.

Last year, Rick and his team launched Adaptive Auto-X. It’s the latest in fixed-income technology, an algorithmic-driven trade execution tool.

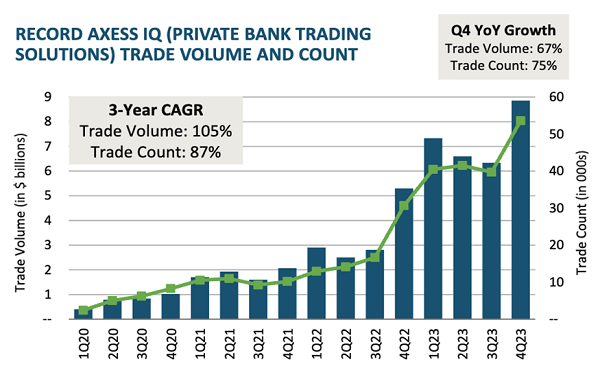

Auto-X should help MarketAxess capture more market share in bond trading. The company’s market share has grown from 20% to 20.9% over the past twelve months. Meanwhile, trade volume continues to grow:

And just wait until Powell and Trump start dueling again. Will bond traders want more speed or less? Obviously more, which means increased trading, which brings bigger profits for MKTX! This dividend grower may return 239% again—no matter how many putts it takes Powell to get inflation right (or wrong).

While the future looks bright for MKTX, the same should not be said for any old dividend stock.

In fact, most dividend stocks trade like bonds, which means they will be in serious trouble if interest rates head to the moon. Many retirement portfolios will be crushed in the process!

Instead of blindly buying bonds and stocks that trade like them, we should smartly consider “dividend magnets” that will be pulled higher with the Trump 2.0 agenda. This is the time to make our fortune.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."