Retail earnings are hot this week, with L Brands Inc (NYSE:LB) set to unveil its second-quarter report set to hit after the market closes tomorrow, Aug. 22. Ahead of the event, the stock is down 2.1% at $32.39, after RBC Capital lowered its price target to $35 from $40, citing a lack of value for LB brand Victoria's Secret.

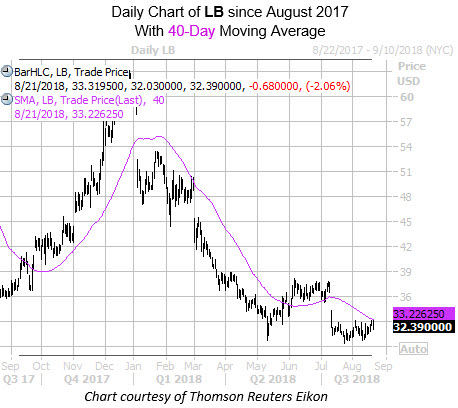

A long-term underperformer, LB has shed more than 46% year-to-date, and touched a six-year low of $30.42 on July 25. The stock recently rallied into overhead resistance at its 40-day moving average, which, according to data from Schaeffer's Senior Quantitative Analyst Rocky White, may indicate that it could be an attractive time to bet on LB's next leg lower.

Per White, L Brands shares are now within one standard deviation of their 40-day moving average, after a lengthy stretch below this trendline. There have been nine similar signals of this kind in the past three years, after which LB went on to average a one-week loss of 1.28%, with just 22% of those returns positive. One month later, the stock was lower more than half the time, down an average of 1.98%.

Switching gears to LB's earnings history, the stock has closed lower the day after the company reported in four of the last eight quarters, including a 13.9% drop in early March. On average, the shares have moved 5.9% the day after earnings over this time frame, regardless of direction. This time around, however, the options market is pricing in a larger-than-usual 9.2% move for Thursday's trading.

Options traders have been anticipating a move to the upside. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows the the equity's 10-day call/put volume ratio of 2.46 in the 93rd annual percentile. In other words, LB calls have been purchased over puts at a faster-than-usual clip in the past two weeks -- though with a healthy 8.2% of the stock's float sold short, some of this could be due to hedging.

Regardless, L Brands stock has consistently rewarded premium buyers over the last year, per its elevated Schaeffer's Volatility Scorecard (SVS) reading of 93 (out of 100). In other words, LB has tended to make outsized moves in the past 12 months, relative to what the options market was anticipating.