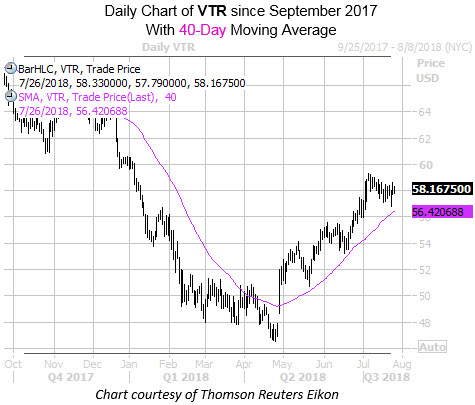

Shares of Ventas (NYSE:VTR), are slightly lower in today's trading, last seen down 0.3% at $58.16. The healthcare and real estate investment trust (REIT) stock has been trending higher since its late-April lows, and has picked up 22% over the past three months. What's more, the stock recently flashed a historical buy signal, suggesting it could be time to jump in on VTR's next leg higher.

After topping out near its January highs earlier this month, Ventas stock pulled back to within one standard deviation of its 40-day moving average. There have been five other times over the last three years where VTR has come this close to its 40-day after trading above it for a significant length of time.

Following those prior signals, the stock went on to average a gain of 6.22% over the next month, and was higher 100% of the time, per data from Schaeffer's Senior Quantitative Analyst Rocky White. A similar burst from current levels would put the stock around $61.78 -- its highest point since December.

Switching gears, Ventas is slated to report second-quarter earnings Friday, July 27, before the market opens. Looking at its earnings history, VTR has closed higher the day after five of the company's last eight earnings reports, including the three most recent. On average, the shares have moved 2% in the post-earnings session over this two-year time frame, regardless of direction. This time around, the options market is pricing in a slightly larger-than-usual 3.6% move for tomorrow's trading.

However, analyst sentiment has been heavily pessimistic toward the REIT name, with 14 out of 16 brokerage firms following VTR sporting tepid "hold" or "strong sell" ratings. Plus, Ventas stock's average 12-month price target of $55.31 stands at a 5% discount to current levels. Another move higher could encourage analysts to boost their outlooks, like Evercore ISI -- which raised its VTR price target to $57 from $55 yesterday.