SPDR Gold Shares (NYSE:GLD) – on sell signal.

iShares Silver (NYSE:SLV) – on buy signal.

VanEck Vectors Gold Miners (NYSE:GDX) – on sell signal.

iShares S&P/TSX Global Gold (TO:XGD) – on sell signal.

Sprott Physical Gold and Silver Trust (NYSE:CEF) – on sell signal.

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) – on sell signal.

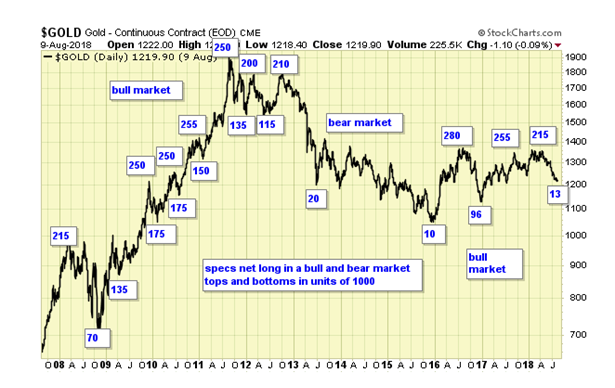

Speculation in Gold Futures is now at the lowest level since 2016.

Speculation in Silver Futures is also at a multi year low.

UUP, ETF for USD gapped up on Friday, question is, an exhaustion gap or breakaway gap?

Over the years, my observation on such a gap after an extended rally is often an exhaustion gap.

FXE, ETF for the euro may help shed some light.

Friday’s gap had the lightest volume relative to the two previous gaps, signs of selling exhaustion.

Summary

Long term – on major buy signal.

Short term – on mixed signals.

Gold sector cycle is down.

COT data is compelling for a major bottom.

From a contrarian point of view, the current extreme bearish sentiment is an excellent buying opportunity for long term investors.

We are holding long term positions.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.

We also provide coverage to the major indexes and oil sector.