SPDR Gold Shares (NYSE:GLD) – on buy signal.

In a bull market, the 200ema often acts as support for pullbacks and corrections, where investors accumulate positions for the long term.

iShares Silver (NYSE:SLV) – on buy signal.

VanEck Vectors Gold Miners (NYSE:GDX) – on sell signal.

iShares S&P/TSX Global Gold (TO:XGD) – on sell signal.

Central Fund of Canada Ltd (NYSE:CEF) – on sell signal.

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) – on sell signal.

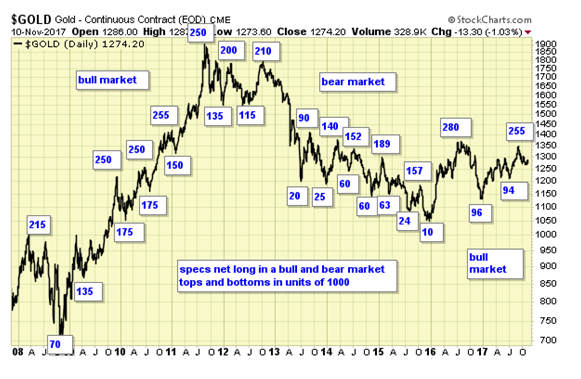

Speculative activity favors overall higher gold prices.

Speculative activity favors overall higher silver prices.

A pullback in the dollar is supportive to the metals.

Summary

Long term – on major buy signal.

Short term – on mixed signals.

Gold sector cycle is down.

COT data is supportive for overall higher metal prices.

We are holding long term positions.

Disclosure: We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.

We also provide coverage to the major indexes and oil sector.