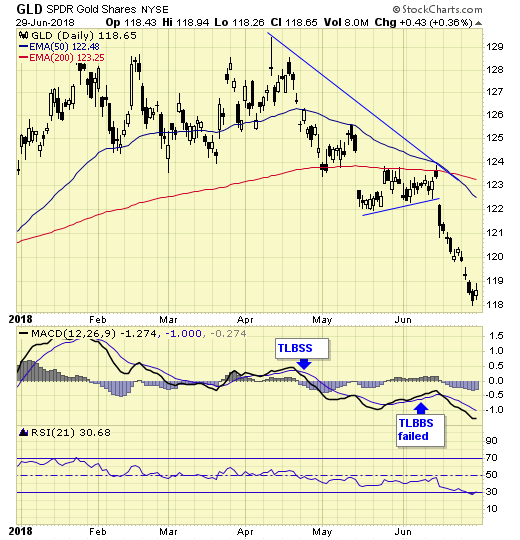

SPDR Gold Shares (NYSE:GLD) – on sell signal.

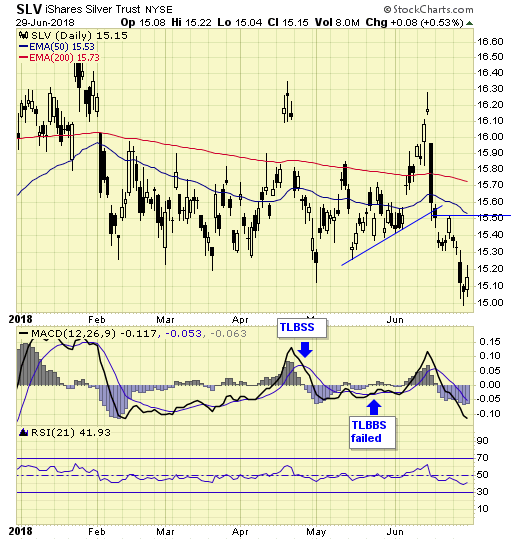

iShares Silver (NYSE:SLV) – on sell signal.

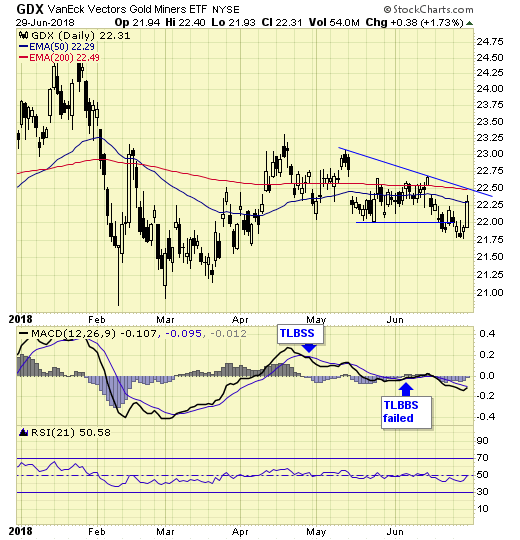

VanEck Vectors Gold Miners (NYSE:GDX) – on sell signal.

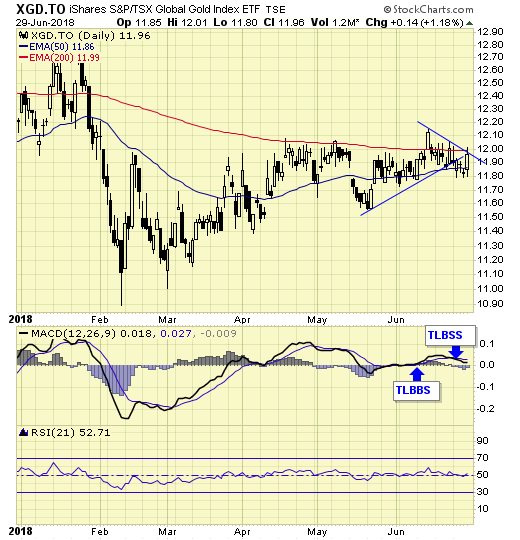

iShares S&P/TSX Global Gold (TO:XGD).TO – on sell signal.

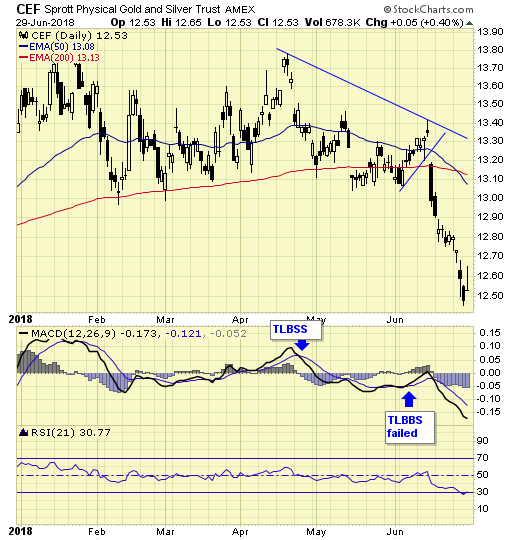

Sprott Physical Gold and Silver Trust (NYSE:CEF) – on sell signal.

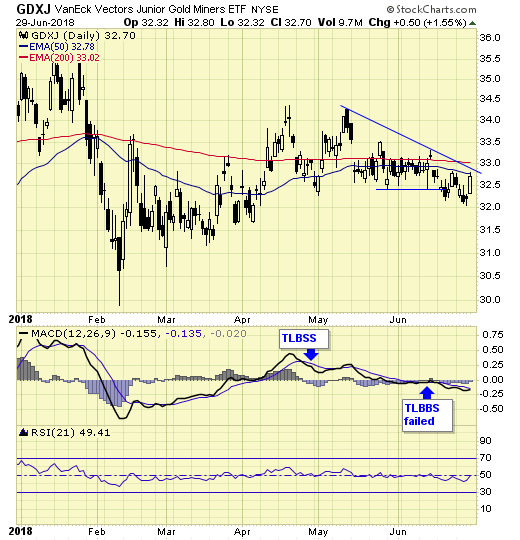

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) – on sell signal.

This week, I would like to share with you what we have been monitoring for our members.

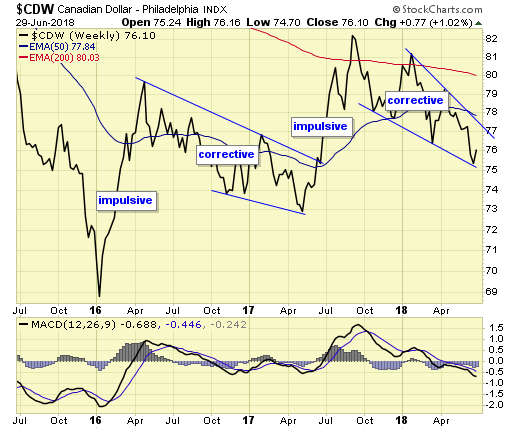

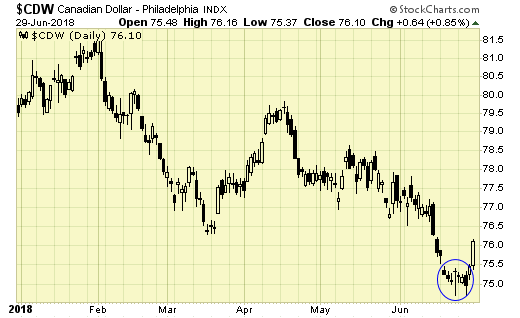

The corrective pattern in the loonie has reached both time and place for a corrective bottom. With this week’s reversal off lower support, we expect to see a new recovery high in the Canadian dollar in coming months.

We alerted our members to a potential bottom in last week’s update, and this week, a pivot low is confirmed.

What does this have to do with gold stocks?

They are not in locked steps on a daily basis, but do have similar price patterns overall.

Summary

Long term – on major buy signal.

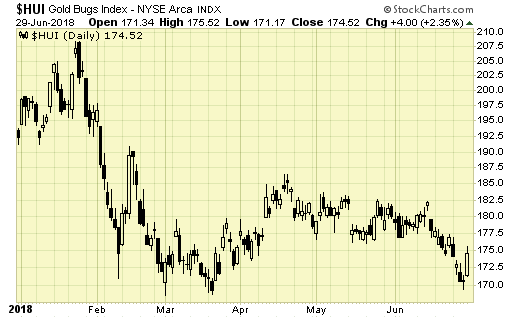

Short term – on sell signals.

Gold sector cycle is down.

COT data is supportive for overall higher metal prices.

Conditions are now favorable for higher prices in coming weeks and months.

We are holding long term positions.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.

We also provide coverage to the major indexes and oil sector.