Investing.com’s stocks of the week

I feel like this market is rocking everyone to sleep with sweet lullabies while its taking many so call “momo and leading stocks” to the wood shed. I believe many are turning a blind eye at some of the subtle changes that are happening underneath the surface which has been the right thing to do for a long time. However, I believe that these subtle changes are not as subtle anymore and are happening more frequently. Recently it seems like the momentum names are getting smoked once a week every week. As of right now FB, YELP, TRLA, PRLB, SCTY, LNKD, TSLA, Z are all below their 50-day moving average.

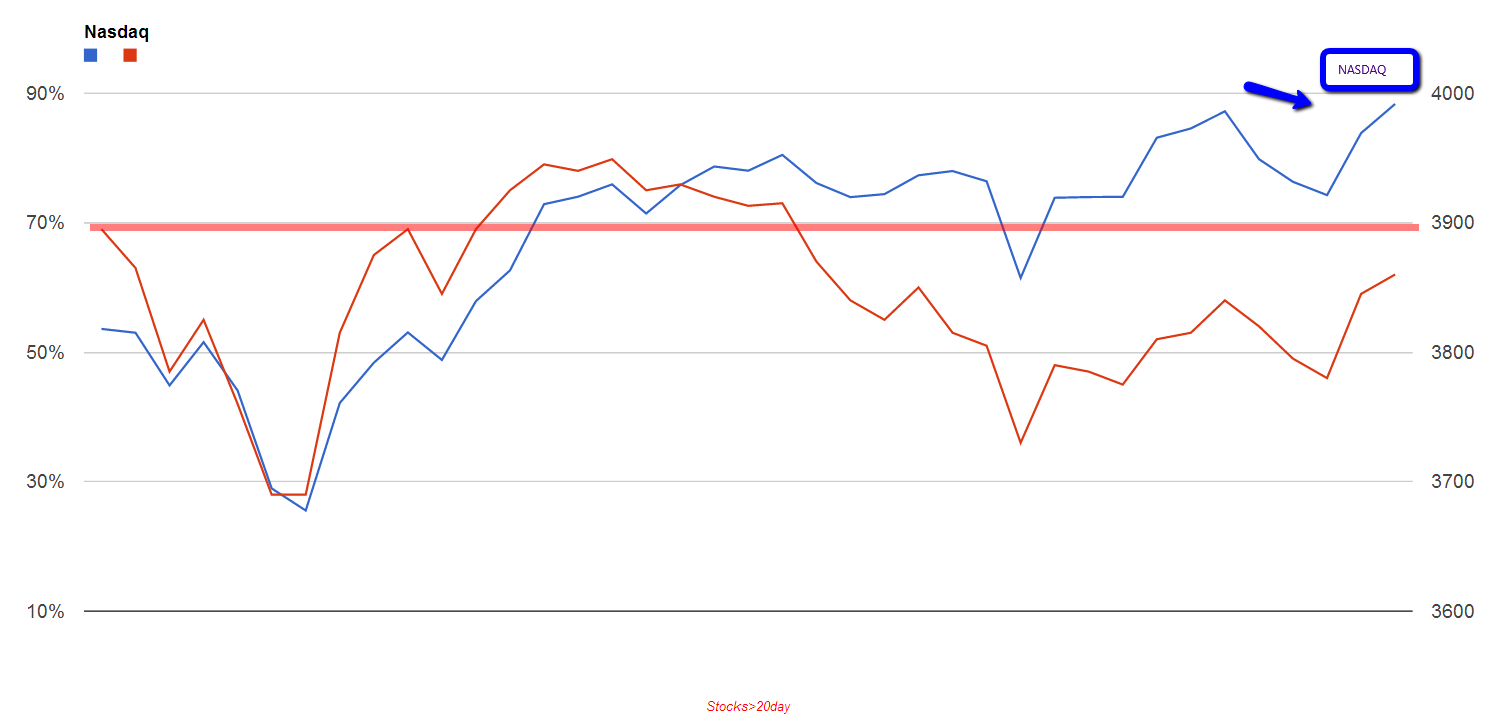

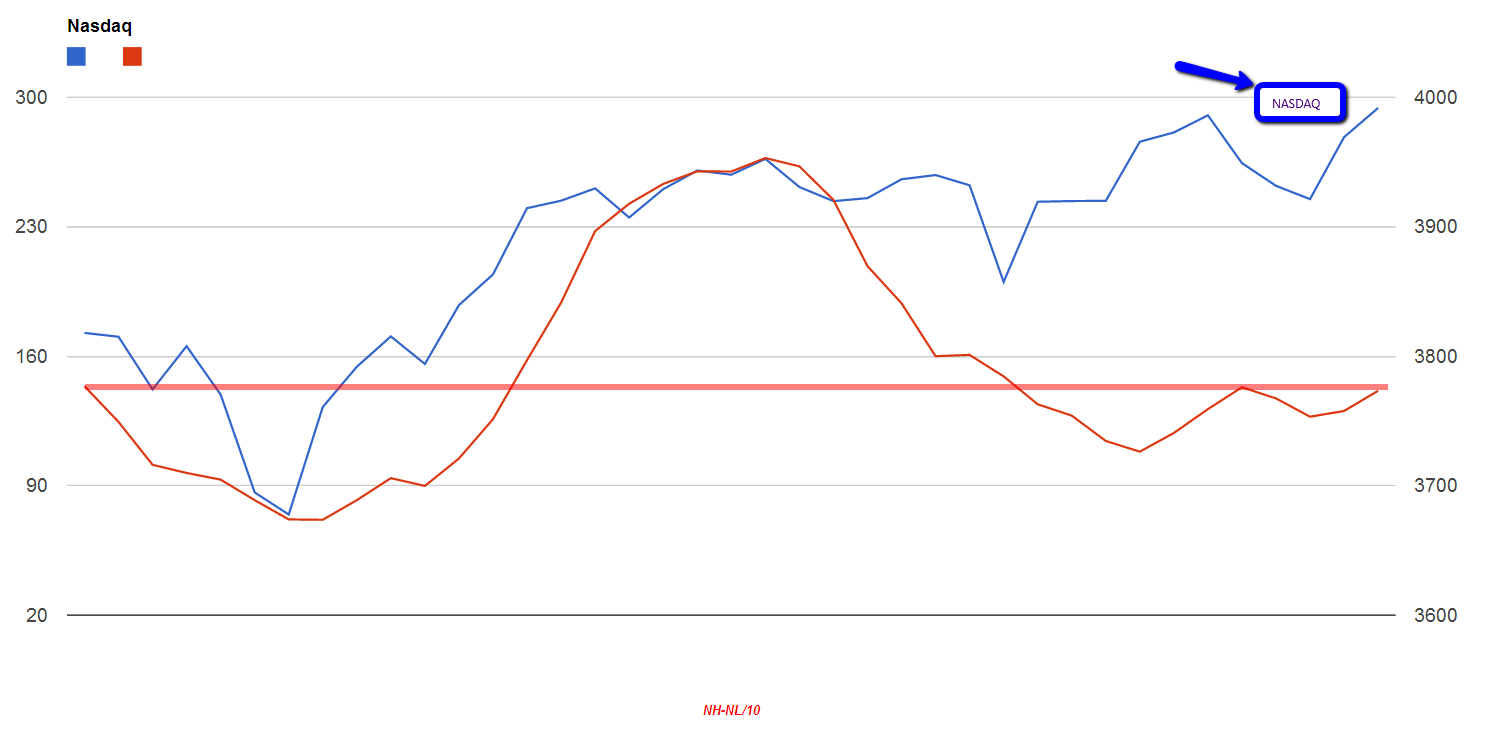

Some might say–look we have rotation going on, and that might be the case. But, on 10/1/2013 the Nasdaq closed at 3817.98 and 69% of all stocks were trading above their 20-day moving average, on 10/22/13 the Nasdaq closed at 3929.57 and 80% of stocks were trading above their 20-day moving average, Friday we closed at 3991.65 and 62% of stocks were trading above their 20 day. The NYSE new high-new low/10 (10-day ma) stood at 143.8 on 10/1, at 227.60 on 10/22 and at 143.80 on Friday. Either we are rotating or not rotating or the rotation is not keeping up.

The only reason why I bring this up today is because I believe this is actionable in the short term. We all know we have had a market that has ignored all negative divergences known to mankind but every now and then when it has become to blatant it has been actionable. I would look at DIA, SPY, QQQ, XIV and the 2x, 3x etfs and take a short bet with a defined physical stop.