Some high quality, junior gold miners are already turning higher as investors believe there should be increasing merger and acquisition activity in 2014. The majors have written down billions of uneconomic gold and silver mines. They have cashed up and are actively looking for the low Capex, high grade and economic assets in stable jurisdictions.

Investors should prepare by buying some attractive takeout targets with new discoveries that can be put into production with less capital expenditures. Despite the bearish sentiment on the junior gold miners some of our featured companies have been under major accumulation.

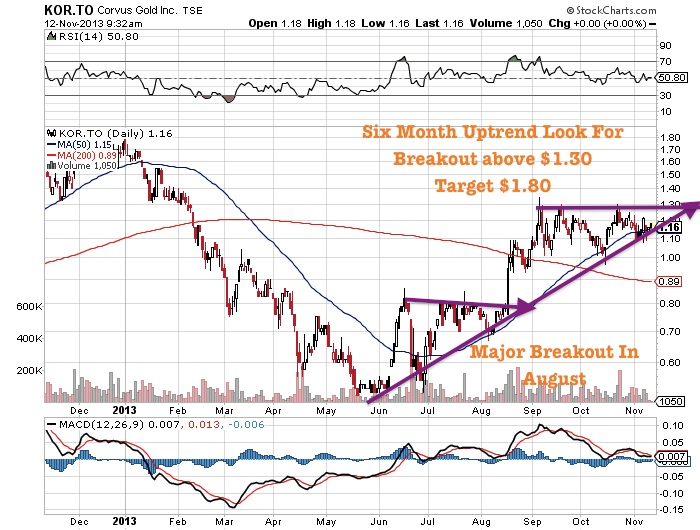

I highlighted this past summer in my premium service, Corvus Gold (KOR.TO or CORVF) and predicted a major high volume breakout. The stock has doubled off its lows and may be just beginning its move to potentially all time highs at $1.80. I have followed this company for close to two years and my premium subscribers witnessed a triple surpassing my target from our initial alert in 2011.

Corvus may now bounce off its 50 day moving average at $1.15 and breakthrough resistance at $1.30. The next target would be all time highs at $1.80.

This was a major winner for my readers in a very tough market in 2012. Anyone can pick winners in a bull market, but picking the top performers in a bear market is the real test of an analyst.

I’ve been to the North Bullfrog Project and know the top-notch management team who have a track record of finding huge gold mines. They put their money where their mouth is and own over 10% of the outstanding shares. Corvus appears to once again be leading the junior gold miners as they are making high grade discoveries at its North Bullfrog Project in Nevada.

This should have a major impact on the economics of the mine. A revised mine plan is currently being developed taking into account the high grade discoveries. Remember this project has excellent infrastructure and is heap leachable meaning the potential capital expenditures is low.

Corvus shares are in strong hands with management owning about 10%. The four top shareholders which includes the prestigious Toqueville Fund and the mining giant Anglogold Ashanti control around 50%. There are only about 13 million shares in float out of a relatively small 69 million shares outstanding with no warrants. This means if the gold market comes back into favor and Corvus continues to lead there could be more explosive moves ahead.

A few weeks ago, Corvus announced assay results which showed a major extension of the high grade Yellowjacket zone to the North and West. Corvus thinks this may be just the beginning as there are many more targets on the property. Jeff Pontius recently said in the October 29, 2013 PR, “This multimillion ounce potential, linked with the excellent project infrastructure, secure mining friendly jurisdiction, projected simple oxide gold recovery and currently estimated low development cost, highlights the exceptional asset controlled by the Company.”

I am monitoring for a technical bounce off the 50 day at $1.15 and a breakout above $1.30 as the increasing accumulation and improving fundamentals should cause Corvus to continue its outperformance.

Disclosure: Author/Interviewer is long Corvus and the company is a sponsor on my website.