In this Weekly Market Report we shall examine the highly controversial municipal bond fund market through a popularETF. Municipal bonds have been highly debated among the so called experts as to whether or not these vehicles are safe investments for the future. As a technical trader, knowing where these ETF's will have support and resistance that can be traded either long or short is our goal. Traders and investors that want to know more about these ETF's should simply read over a prospectus of each fund in order to find out exactly what makes up these trading vehicles.

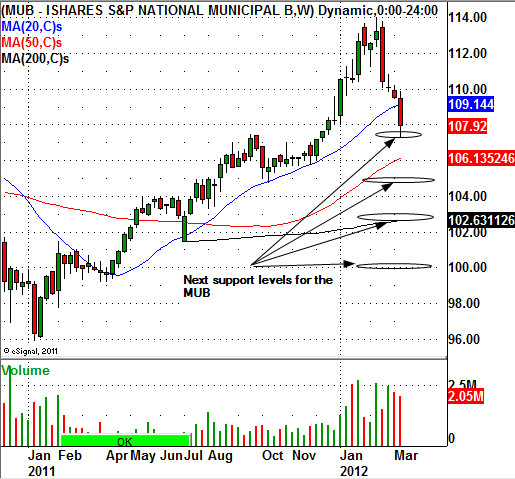

The iShares S&P National AMT-Free Municipal Bond Fund ETF (NYSEARCA:MUB) is the most popular mini-bond ETF around at this time. The current yield on the MUB is 3.24 percent which is pretty good these days. The MUB topped out on February 14, 2012 at $113.98 a share. Since that time, the MUB has come under some selling pressure trading as low as $107.25 a share last week. Traders should watch for short term support around last week's low. Should that level fail to hold up as support the next important support will be around the $105.00, $102.75, and $100.00 levels. Should the MUB increase in price from its current level, traders should watch for near term resistance around the $109.80, $110.60, and $111.39 levels. The MUB is currently trading below the daily chart 50, and 200 moving averages. Although the MUB is short term oversold this chart formation puts the ETF in a weak technical position at this time.

Some other mini-bond ETF's that are gaining in popularity include PowerShares Insured National Municiple Bond ETF (NYSEARCA:PZA), SPDR Nuveen Barclays Capital Municpl Bond (NYSEARCA:TFI), and the Market Vectors Long Municipal Index ETF (NYSEARCA:MLN). All of these muni-bond ETF's have a very similar chart pattern at this time. They are all short term oversold, however, they remain in a weak technical formation on the charts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

This Is Your Municipal Bond, ETF Trade

Published 03/20/2012, 03:57 AM

Updated 07/09/2023, 06:31 AM

This Is Your Municipal Bond, ETF Trade

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.