The consensus headline figure for Friday's NFP release is 234K, but I will be paying far less attention to that number than the Average Hourly Earnings figure which will be released at the same time. That's because the Fed has been watching wage growth for signs of rising inflation.

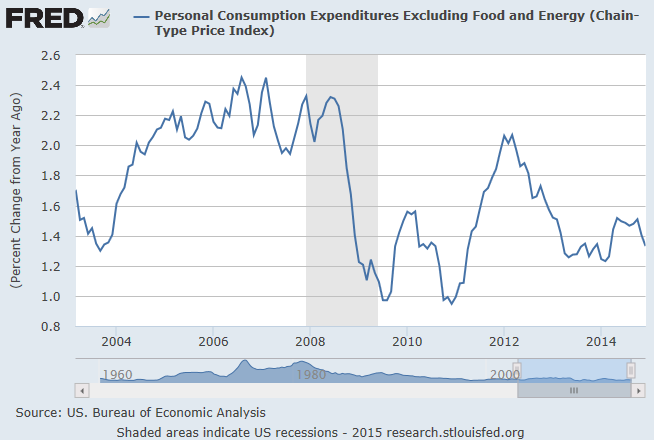

Core PCE, which is the Fed's favorite inflation metric, was released on Monday and it unexpectedly dived:

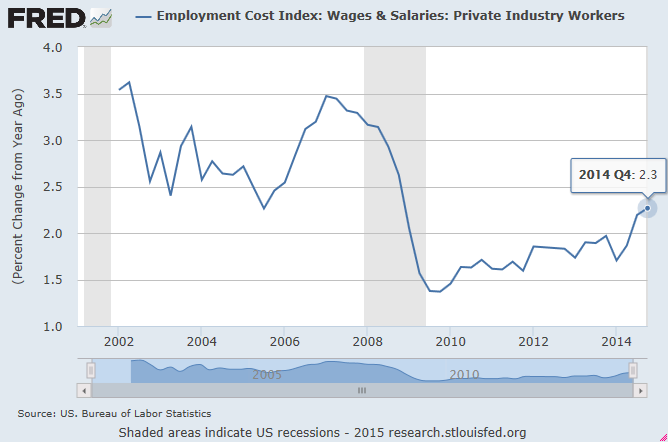

If rates are on track for a June liftoff, which seems to be Yellen`s base case scenario, we need to see some justification in the form of wage pressures. The 4Q 2014 Employment Cost Index, which is arguably a better measure of wage inflation because it is a fixed-weight measure and adjusts for shifts in employment categories, came in at 0.6% (vs. 0.7% for 3Q). While that does represent a deceleration in the ECI, the YoY change was 2.3%, which is well above the Fed's 2% inflation target.

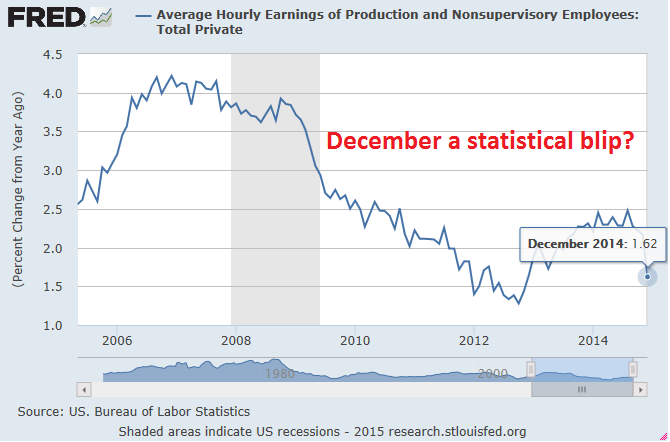

By contrast, Average Hourly Earnings is not a fixed-weight measure of wages and therefore it does not represent an apples-to-apples comparison of wage pressures. As an example, higher growth in low-wages jobs will depress Average Hourly Earnings compared to the ECI. Nevertheless, it is a monthly series and provides more frequent readings than the quarterly ECI.

The December YoY change in Average Hourly Earnings was unusually low. I will therefore be watching the January release carefully to see if December was a statistical blip (and to see if December gets revised upward.)

On one hand, inflation measures are falling. On the other hand, the news of pending strikes in the oil industry are a sign of the strengthening bargaining position of labor and a sign of resurgent wage pressure. Other signs of wage pressures are showing up in the restaurants and hotel sector:

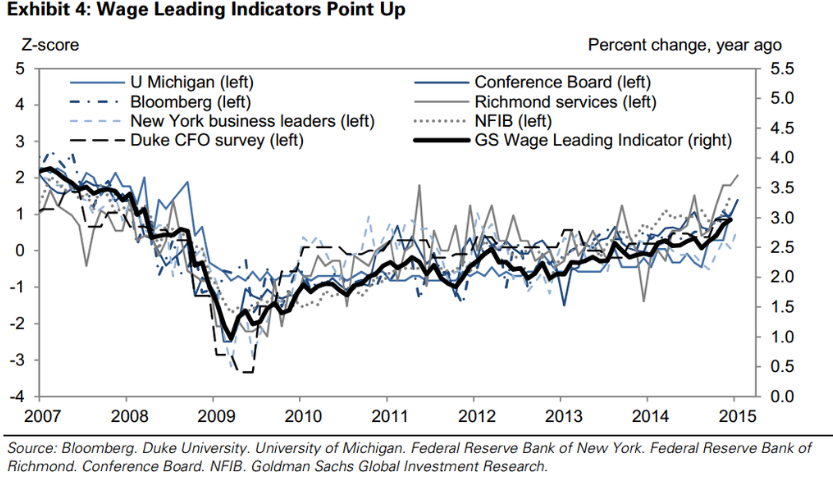

As per Goldman Sachs, wage pressure indicators are all pointing up, but the Fed needs more confirmation from the data. That's why Friday`s release of Average Hourly Earnings in the NFP report will be the most important number to watch.

This may turn out to be inflation's last stand, or the beginnings of a resurgent wage inflationary spiral that solidifies a June target for a Fed rate hike.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.