Everyone knows there are winners and losers in any bear market, including the recent commodity rout. Low crude oil prices have definitely hurt explorers and producers. Airlines, on the other hand, appear to be thriving.

According to the International Air Transport Association (IATA), a global airlines trade group, the industry is set to post a collective $33 billion in net profits this year—a record—on fuel cost savings and stronger passenger flight demand.

Want to know how significant a record this is? In 2014, profits came in at $17.4 billion—about half of what they are today. What’s more, profits are expected to be even larger next year.

World demand grew 6.7 percent from a year ago, the IATA says, and is estimated to rise a further 6.9 percent in 2016. And with oil likely to stay relatively low, the group forecasts that airlines will spend $135 billion on fuel in 2016, down nearly a quarter from $180 billion in 2015.

This, coupled with improved fuel efficiency, is expected to contribute toward the group ending next year with estimated total net profits of $36.3 billion.

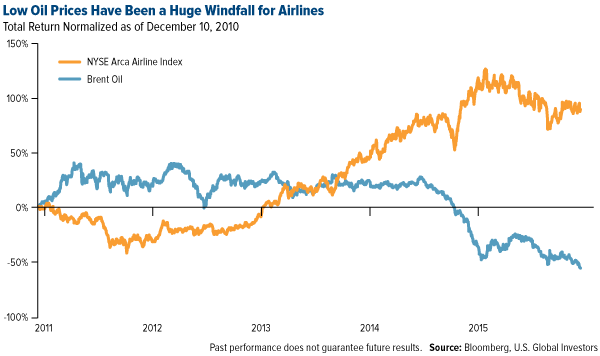

You can see below that global airline stocks have soared in recent years, especially in response to flagging oil, airlines’ largest expense.

In the past, airlines were notorious for their inefficiency and tendency to destroy capital. These claims were probably exaggerated, especially by Warren Buffett, who has repeatedly decried the industry as a money-loser. What a lot of people don’t realize is that Buffett didn’t do as badly as he claimed.

Former US Airways CEO Ed Colodny explained in 2013 that after Buffett’s shares didn’t appreciate, he wrote down his investment and got out when he could. “I think at the end of the day, he got all his dividends paid and his principal back,” Colodny said.

In any case, airlines are now going into their third year of the present secular bull market. These often last much longer. We believe this cycle is different, in that the U.S. airline industry could easily create $20 billion of free cash flow this year and next. Low fuel costs have been the cherry on top.

Where Does Oil Go from Here?

Indeed, 2015 was not kind to oil and other commodities, with many of them slumping to multiyear and, in some cases, multi-decade lows.

Back in August, the cover of Bloomberg Businessweek featured a whole gaggle of bears, which delighted bulls. (There’s an old belief that the market will soon do the exact opposite of what the press predicts.) Yet here we are four months out, and the commodities rout has only extended itself further.

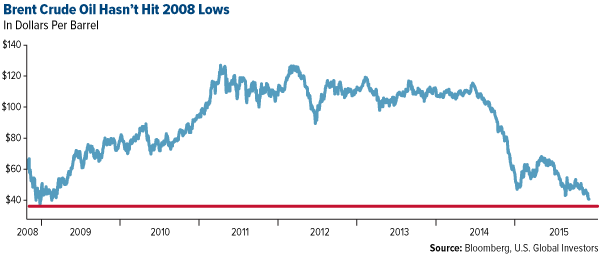

Crude oil is presently testing financial crisis support levels, making many investors wonder whether the bottom for black gold has been reached—or if more pain is to be expected.

There’s no shortage of analysts and experts right now sharing their (wildly divergent) predictions of where oil might be headed from here. Some are calling for $20 per barrel; others, such as legendary hedge fund manager T. Boone Pickens, $70 or more in the next six months.

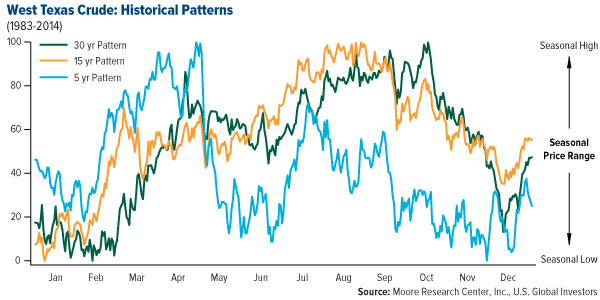

We can’t say whether Pickens is right or wrong. It’s worth pointing out, though, that crude has pretty closely followed its five-year trading pattern, with 52-week lows reached in late November, early December. The short-term trend shows oil rallying sharply starting in January, according to Moore Research analysis.

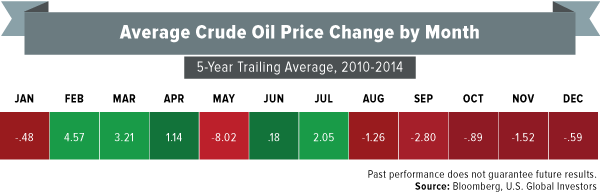

Here’s another way of looking at it. The following heat map shows that, in the last five years, the oil price historically popped in February after months of losses. What this means is that January might be a good time to buy.

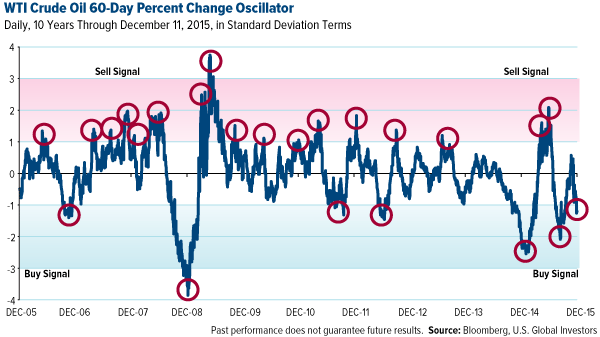

The oscillator below confirms that. Right now crude is down 1.2 standard deviations—already signaling a buy, but it might have further to fall, based on past incidences.

One of the more balanced perspectives comes from energy strategist Dr. Kent Moors, who tempers his optimism with a

dose of reality:

We are not racing back to $100 a barrel oil. Absent the outlier of a geopolitical event that impacts supply, more subdued rises are in order. But we certainly do not need triple-digit oil to make some nice investment returns, especially in a sector that has been so oversold.

I agree. I’m not interested in adding my own forecast to the ever-lengthening list so much as I am in finding ways to make money at current prices.

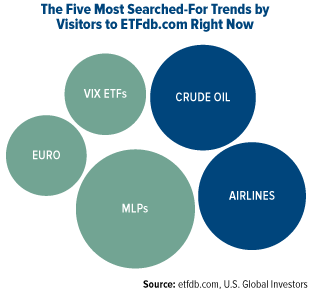

As are other investors. Based on the most searched-for trends on ETFdb.com right now, you can clearly see what’s on their minds.

OPEC Members Revolt against Saudis as Oil Slips

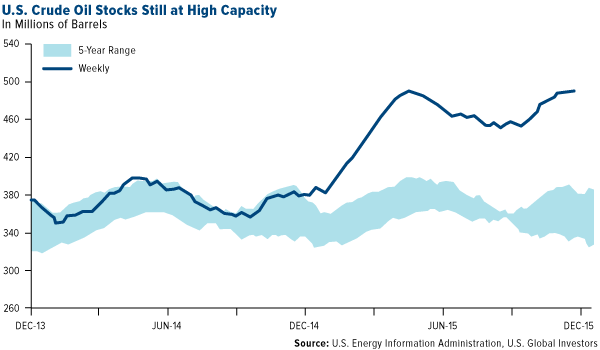

One of the main reasons why prices are so depressed, of course, is that the world is awash in the stuff. The Organization of Petroleum Exporting Countries (OPEC), responsible for about 40 percent of global supply, just had its most productive month since 2012, pumping 31.7 million barrels in November. That’s 1.7 million barrels over its “official” production ceiling.

Crude slipped below $37 per barrel on the news, a seven-year low, which is about as low as prices can go for most American companies to stay profitable. (As of this writing, WTI crude sits at $35.20, Brent at $36.83.)

As expected, OPEC announced after its last meeting that it would keep oil production levels the same in its bid to force higher-cost producers (re: American frackers) to trim their own operations. Solidarity among its members has weakened further, however, as it becomes clearer and clearer to them that they underestimated the resilience of American oil producers.

Five OPEC members—Venezuela, Nigeria, Libya, Iran and Ecuador—are now in open opposition to the Saudi policy of unchanged production. That the cartel as a whole exceeded its production ceiling last month suggests that each member-nation is making its own rules up anyway, regardless of what was decided.

It’s estimated that OPEC is already pumping about 900,000 barrels a day more than is needed next year. And with international sanctions against Iran about to be lifted—in exchange for an agreement to halt its nuclear program—the country has promised to increase its own production from 3.3 million barrels a day to as many as 4 million barrels a day by the end of 2016.

Venezuela in particular is in deep turmoil. Low oil prices have battered its currency and left its economy in tatters, with food shortages worsening every day. The International Monetary Fund (IMF) expects the South American country—which has the largest proven oil reserves in the world—to contract 10 percent this year and has declared it the worst-performing economy in the world right now.

In the recent parliamentary elections, rightfully fed-up Venezuelans responded by ousting members of Hugo Chavez’s United Socialist Party of Venezuela (PSUV), giving the opposition party, the more-centrist Democratic Unity Roundtable (MUD), a supermajority that could challenge President Nicolás Maduro.

This countrywide rejection of failed, far-left leadership is an encouraging sign that Latin America’s political ideology is finally shifting away from European-style socialist economic models of no growth. We’ve seen South American countries tax away growth and impose envy policies on the financial sector. Mining and oil executives have seen their cash flow confiscated by value-added taxes, leading to drops in capex and job creation.

But just last month we saw Argentina elect its first business-friendly president, Mauricio Macri, in decades. And now Venezuela is demanding change, so there’s hope.

As head of the cartel, Saudi Arabia hasn’t gone unscathed in the oil rout either. For the first time, the kingdom will tap international bond markets to make up for lost oil revenues.

Also in the hard-to-believe category is Alaska’s plan to institute an income tax for the first time in 35 years to “close a $3.5 billion dollar deficit the state is carrying,” according to Zero Hedge. The Last Frontier is known, of course, for giving all Alaskan residents an annual dividend based on oil revenue. In 2015, that amount was $2,072.

But since oil revenue has been cut in half, hard measures must be taken to keep the dividend running, Alaska Governor Bill Walker argues. “This plan keeps the permanent fund permanent,” Walker tweeted last Wednesday.

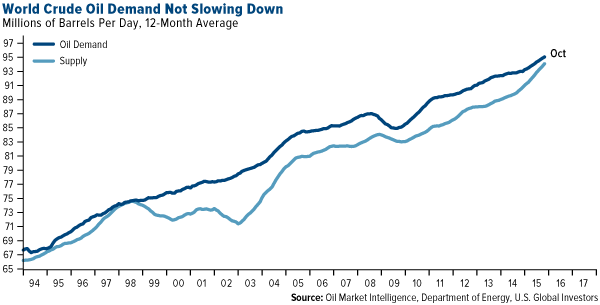

And Yet Oil Demand Is Still Outpacing Supply

Crude oil reserves here in the U.S. are currently at levels not seen since 1972. That’s with a 65 percent decline in rigs in operation from a year ago, a clear indicator of how efficient American producers have become.

But some analysts have suggested the oversupply isn’t as bad as we might think. Tom Kloza, head of energy analysis at the Oil Price Information Service (OPIS) told CNBC this week that it’s important to think of oil supply in the context of population growth: This is a glut in terms of the most crude oil we’ve ever had in North America. But if you measure it versus the population, it’s not altogether that much. We’ve had much more crude-per-population back in previous decades.

Kloza has a fair point. In 1970, at the height of U.S. oil production, the country’s population was just over 205 million and the total number of registered vehicles—passenger cars, motorcycles, trucks and buses—was 111 million, according to the Department of Transportation. Today the population hovers just north of 319 million and, as of 2013, the number of registered vehicles has more than doubled to 255 million.

It’s worth reminding ourselves that the U.S. isn’t the only growing country. Population is booming all over the globe.

People continue to have babies—Chinese couples even more so now that the one-child policy has been lifted—and the global middle class is swelling rapidly. This helps oil demand continue to rise, as well as air travel demand.

Disclosure: This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.