A few months ago all the talk in the equity markets was about the FANG stocks -- Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and the company formerly known as Google (NASDAQ:GOOGL), which made up the acronym. These stocks were the market's generals, its leaders. If they were up then the market rose, if they were down, it fell. Then a funny thing happened. They stopped moving in lockstep. Since then, I haven't heard much from the FANGs.

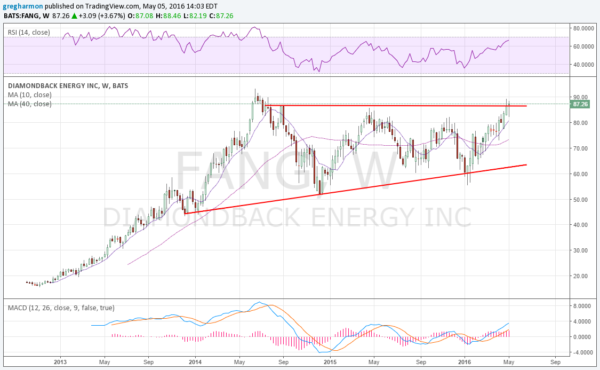

But on Thursday, FANG showed up on the bullish scan again. Not the group of 4 stocks, but Diamondback Energy (NASDAQ:FANG). And this stock looks ready to strike. The weekly chart below shows the price action since its IPO in October 2012. After a strong initial run higher to a top in June 2014, FANG moved back and forth in a tightening consolidation. Since then, its price action has built an ascending triangle.

A break of that triangle to the upside gives a target to 125. And it looks to be trying to do that right now. It reported earnings on Wednesday and jumped over the resistance levels in place since 2014. A close over 86.50 on Friday and continuation over 90 would seal the trade to the upside.

FANG Technicals

The Momentum is strong and building. The RSI is in the bullish zone and rising. The MACD is rising and bullish. The price is following the 50-day (10-week) SMA higher as it did on the initial run up. And that 50-day SMA crossed up through the 200-day (40-week) SMA in a Golden Cross about 3 months ago. With 10% of the float short, this energy company has fuel to push it higher.