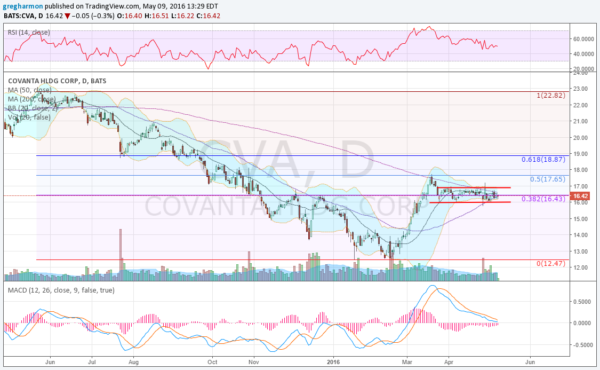

Covanta Holding Corporation (NYSE:CVA) has had a rough time for most of the past year. Last May it started a smooth ride lower from consolidation at 23 to a low in February at $12.50 -- more than 50% lower. And that consolidation at 23 was after a fall from the all-time high above 25.

The bounce that followed gave it a quick retracement of 50% of the down leg, which then took it to the 200-day SMA. The price rejected from there, though, and pulled back to the 38.2% retracement where it has been vacillating since then. Six weeks of sideways motion followed. And during that time the Bollinger Bands® have grown very tight -- often a precursor to a move.

As it churns, the RSI is holding in the bullish zone and the MACD has reset lower, still in positive territory. There's also a Golden Cross that will print this week, with the 50-day SMA crossing up through the 200-day SMA. A range of 90 cents defines this stock until it breaks out. Once it breaks 16.90, watch for a run to 18.87 or higher. A move below 16.00 points to a retracement to the lows.

Do you have the energy to wait and watch?