The Dot-Com Bubble of 2000 was the first time that the internet and investing clashed, and the results could be described as "interesting." One result was the proliferation of novel investment strategies based on promising backtests (or more likely some severe data-overfitting).

A great example was the Motley Fool's "Foolish Four" investment style, which used a formula consisting of the following:

- Determining the yield and price for all 30 stocks in the Dow Jones Industrial Average (DJIA).

- Dividing the yield for each stock by the square root of its price.

- Ranking the stocks from highest to lowest based on the result from step two.

- Discarding the highest-ranking stock and purchasing the other four in equal weightings.

This approach turned out to be wishful heuristics masquerading as quantitative rigor. Astute readers will note that the steps are arbitrary and excessively convoluted. To their credit, the Motley Fool eventually discontinued this approach and provided a candid post-mortem assessment.

Still, methods like the "Foolish Four" still exist today. A great example is the "Dogs of the Dow" strategy, which has a website that looks like it's time-traveled here from 2005. Let's look at how this strategy works and how it can be implemented via a unique ETF from Invesco.

What are the Dogs of the Dow?

The Dogs of the Dow strategy popped up in 1991 via a book and website by Michael B. O'Higgins. The term "Dogs" refers to the most undesirable, highest-yielding stocks in the DJIA. All else being equal, a decline in share price increases yields, so high yields can be an indicator of recent underperformance.

Each year, the strategy selects the 10 DJIA stocks with the highest trailing 12-month yields and purchases them in equal amounts. The strategy relies on the blue-chip, large-cap nature of the Dog stocks to play defensive, benefitting from the high dividend yield while waiting for an eventual rebound.

According to the "Dog Years" section on the website, the strategy has outperformed the S&P 500 slightly since 2000. Starting in 2000 would have benefitted the DJIA immensely given the Dot-Com Bubble and its resilience compared to the S&P 500. 2022 was also a year where the DJIA outperformed.

Since then, the strategy has evolved into other variations, such as the "Small Dogs of the Dow" and "Dogs of the Dow X" to name a few. Despite its dated origins, the strategy still has a popular following due to its intuitive appeal and wide array of resources for new investors.

A Dogs of the Dow ETF?

There's no ETF that explicitly utilizes the Dogs of the Dow strategy, but there is one that comes close: the innocuously named Invesco Dow Jones Industrial Average Dividend ETF (DJD). With just over $300 million in assets under management, this ETF is one of the smaller ones in Invesco's lineup.

DJD takes a unique approach to the DJIA index by weighting its components by the 12-month dividend yield, much like how the Dogs of the Dow strategy does. The stocks are then weighted based on their relative yield, with the ETF currently having 28 holdings.

The main difference is that DJD uses a yield-weighted approach to all Dow stocks with dividend payments, while the Dogs of the Dow Strategy equal-weights the top 10 highest-yielding stocks. This makes DJD more diversified and less volatile.

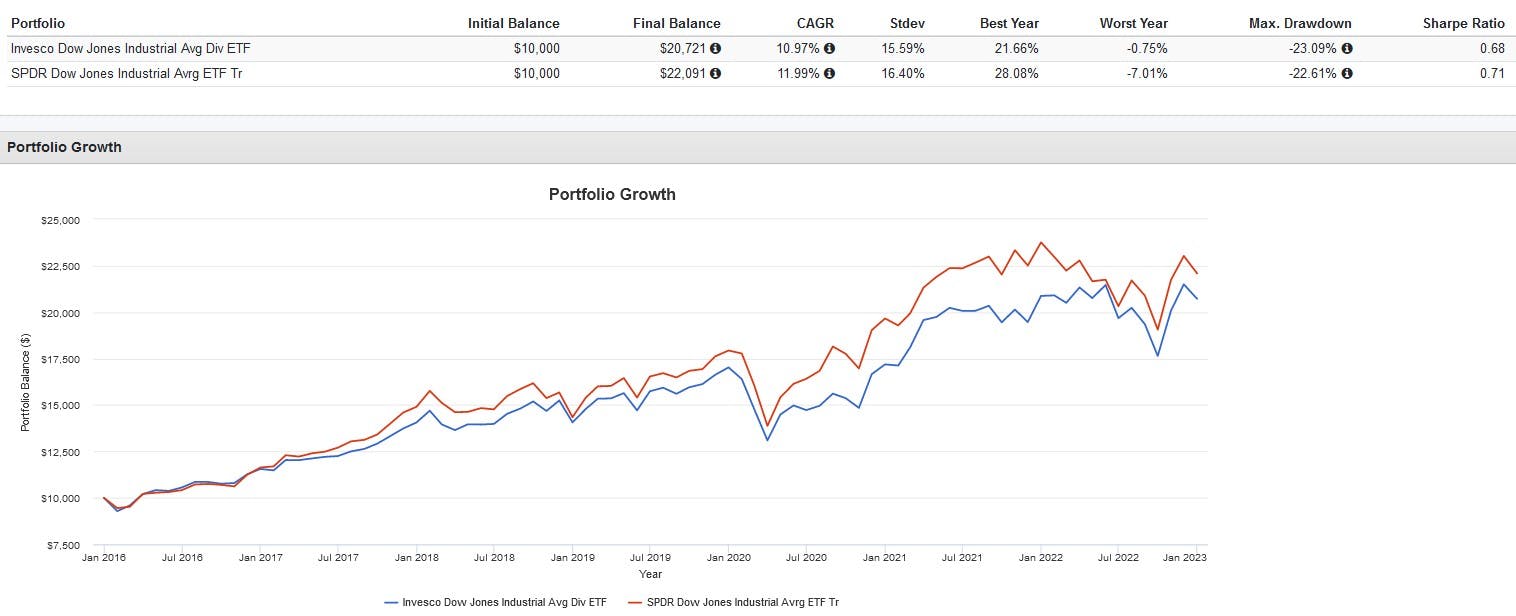

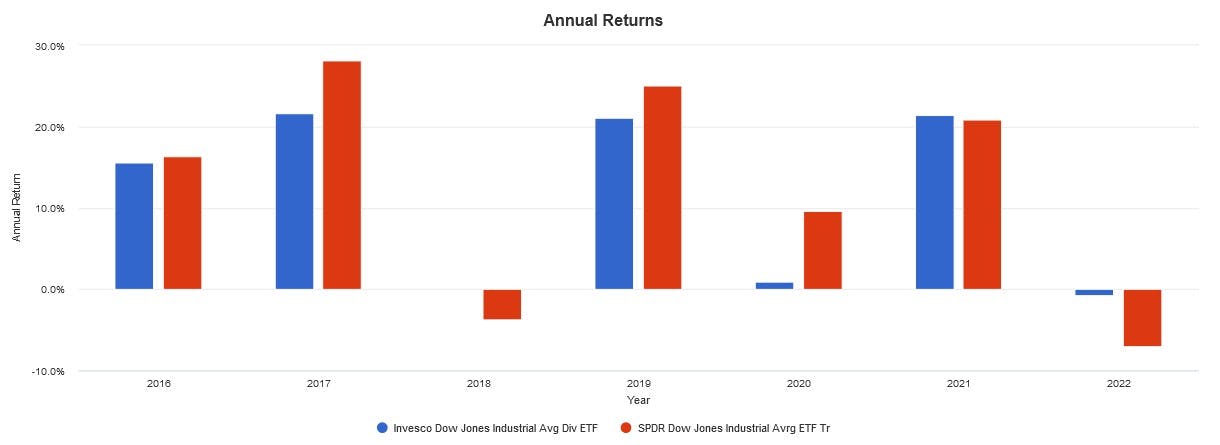

Historically, DJD has under-performed its passive market-cap weighted index counterpart, the SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA) since its inception in 2016, but did strongly outperform in 2018 and 2022, showing its defensive capabilities.

Investors interested in comparing DJD's current holdings to the 2023 Dogs of the Dow list can do so via the embedded links. Finally, DJD is very inexpensive for a niche dividend ETF, costing just 0.07%. It also has a fairly attractive 12-month distribution yield of 3.10%.

This content was originally published by our partners at ETF Central.