Recently I had a conversation with a client that related to implementing dividend ETFs in her portfolio. She is an avid reader of investment content and came across a unique fund that has several alluring qualities for income-oriented investors.

The ALPS Sector Dividend Dogs ETF (NYSE:SDOG) is one investment that I had heard of, but never fully researched until she brought it to my attention. This ETF was introduced just over two years ago and has since amassed over $800 million in total assets. With that quick success, the fund must have a unique strategy or compelling value proposition that makes it stand out above similar offerings in the category.

Sure enough, this ETF takes a unique approach by selecting five holdings from each of the ten sectors within the S&P 500 Index with the highest dividend yields. Each holding is then equal weighted so that every company has a similar pull on the total return of the fund. The end result is a portfolio of 50 large-cap stocks that includes a high degree of diversification among every S&P sector.

Often times dividend funds are skewed towards specific area of the market such as utilities, consumer staples, or energy companies. However, SDOG is provides you with the opportunity to own equal segments of the economy in one single package. In addition, because they select from some of the largest and most liquid stocks in the world, the holdings are generally high quality companies. This includes well-known dividend payers such as: Intel Corporation (NASDAQ:INTC), Lorillard Inc (NYSE:LO), and AT&T Inc (NYSE:T).

SDOG has a current 30-day SEC yield of 3.32%, which slightly exceeds the 3.15% yield of the category benchmark iShares Trust DJ Select Dividend (ARCA:DVY). In addition, both funds share a similar expense ratio of 0.40%.

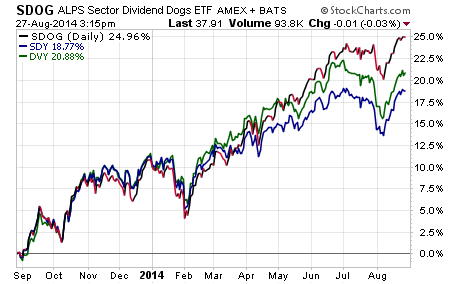

Over the last year, SDOG has actually outperformed DVY and the SPDR S&P Dividend (NYSE:SDY) by a fair margin. This ETF has returned nearly 25% over the last 52-weeks with dividends factored back in.

This outperformance in SDOG is likely due to larger exposure to technology, healthcare, and telecommunications sectors, which have performed strongly over that time frame. DVY is overly weighted towards utilities, while SDY has significant exposure to the weakened financial arena.

The one drawback to this strategy that I find less appealing is that dividends are paid on a quarterly basis. I typically prefer equity income funds that offer monthly dividends to smooth out the payment stream and allow for greater frequency of distributions. One competitor I recently profiled that does offer monthly income is the Global X SuperDividend (NYSE:SDIV).

Nevertheless, SDOG should certainly be on your watch list of dividend paying ETFs that include a reasonable expense ratio, higher than average yield, and unique index construction methodology. This fund can certainly be used as a core holding within the context of a conservative income portfolio to gain market correlation and yield.

The original Dogs of the Dow Theory focuses on selecting 10 of the highest dividend paying stocks in the Dow Jones Industrial Average on an annual basis. SDOG does an admirable job of taking that one step farther to include a more diversified and balanced subset of companies.

Disclosure : FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.