Gold Stocks remain in a correction, even if the Oct. 29 lows continue to hold into December. Corrections are a function of price and time, and often in this sector, a correction can continue in terms of time, well after a low in price is made. But I digress.

The most significant and most consistent moves to the upside usually occur after a crash or after a major breakout. Gold and silver stocks made tremendous moves after the COVID crash and remain in position for tremendous upside moves over the quarters ahead.

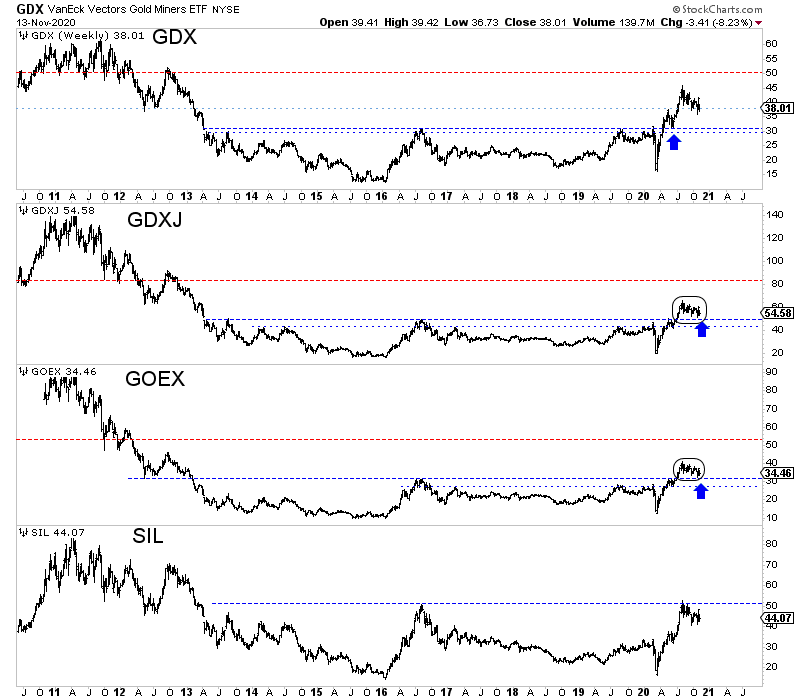

As you can see, the junior gold stocks (VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) and Global X Gold Explorers ETF (NYSE:GOEX) are simply correcting and retesting their recent multi-year breakouts.

The VanEck Vectors Gold Miners ETF (NYSE:GDX) already did so but on a smaller scale. It has less upside potential, while the Global X Silver Miners ETF (NYSE:SIL) is consolidating before it attempts a major breakout.

In short, when this correction is over, junior gold stocks have a good chance to run higher and higher towards the upside targets (red lines). Silver stocks (SIL) could break out and run with a minimal retest in between.

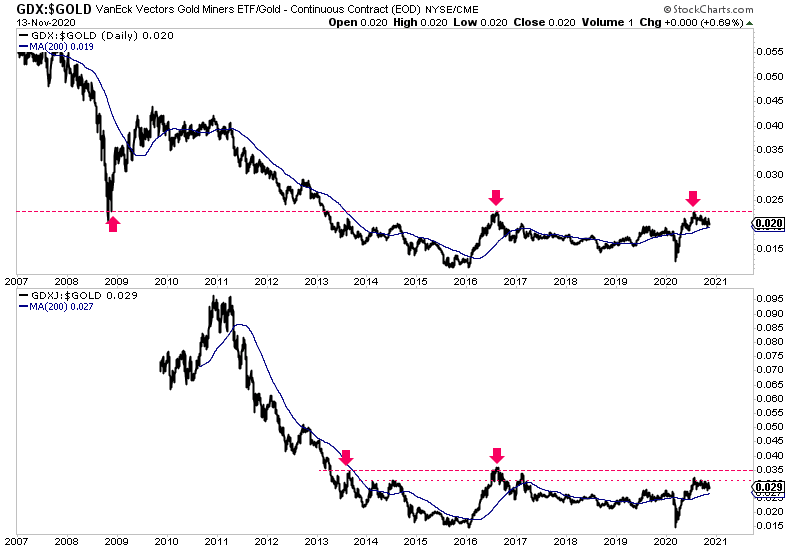

The above charts are very bullish, but they do not answer my question of when. To answer that question, consider the charts of GDX and GDXJ against Gold. These ratios have a great chance to break past the near 8-year resistance.

The GDXJ to Gold ratio, upon a break past its 2013 and 2016 highs, would have a measured upside target of 0.055, which is almost a double in the current ratio.

There will be a one-two punch of Gold breaking past $2,100/oz to new highs coupled with juniors (and all gold-stock indices) dramatically outperforming.

That is when momentum and speculation will explode. GDX will trend towards $100, and GDXJ will trend well past $100. The good news is that the move of gold stocks breaking out against Gold has not even started.

There’s still time, and there’s plenty of quality juniors trading at reasonable valuations. I don’t know when that move will start (probably sometime next year), but I do my best to keep readers abreast of developments every week.