Before we examine how long bull markets can last, it should be noted the bulls have the fundamental and technical stars aligned for a year-end rally in stocks. From a probability perspective, the best time to invest is when charts and economic reports agree.

Last week, we outlined the importance of fundamental perception, since it sets asset prices. The International Monetary Fund provided another reason for economic perceptions to improve.

From Bloomberg:

“The positive assessment the IMF gave with regard to U.S. growth corroborates the improving economic indicators we have been witnessing the last two months in the U.S.,” said Konstantin Giantiroglou, head of investment advisory at Neue Aargauer Bank in Brugg, Switzerland. “The sentiment going into Christmas and New Year is good. We have an improving global economy and for the first time since the financial crisis we should see a synchronous recovery.”

Bull Is Long In Tooth, Right?

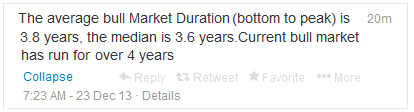

There are a lot of bright minds interacting on Twitter, which often leads to some interesting discussions about bull and bear markets. This morning, the tweet below sparked one of those healthy discussions (names removed to protect the innocent).

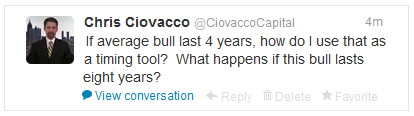

A Longer Than Average Bull Market

There is nothing wrong or inaccurate about the tweet above, stating the typical bull market lasts four years. History tells us the current bull market is in “above average length” mode. However, as noted below, how do investors use those stats?

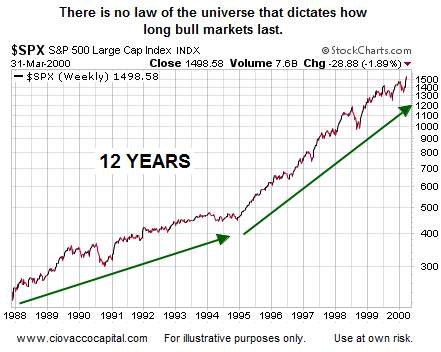

Twelve Years With No Bear

If we bailed on the bull market after four years of gains in 1992, we would have missed one of the greatest moves in stock market history.

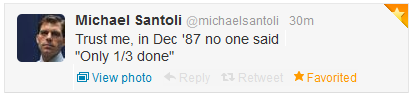

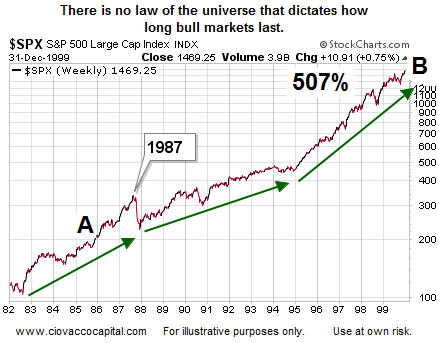

1987 – Only A Third Of The Way Home

The chart above sparked the following observation from Michael Santoli, senior columnist for @YahooFinance, frequent CNBC contributor, and longtime Barron’s writer:

Assume We Sold After Four Years

A long-term bull market began in 1982. If we sold at the end of 1986 (after four years of gains), we would have missed an additional 507% gain. The 507% is based on the S&P 500’s move between 12/31/1986 and 12/31/1999 (see points A and B below).

Investment Implications

The moral of the story is no one knows how long the current bull market will last, and nothing says it has to follow any historical path. The current bull market will last as long as it lasts. Rather than being distracted with predictions, our strategy remains the same.

If you want to shed some statistical light on the difficulty of stock market forecasting, see this video clip comparing football handicapping to stock market forecasting.

Apple Assists With Improving Economic Perception

As noted in last week’s article, our market model increased our exposure to stocks both Thursday and Friday, based on improvements in the market’s tolerance for risk. We continue to focus on market leading sectors, such as technology. The Apple news over the weekend should give a boost to our NASDAQ 100 shares (QQQ).

From USA Today:

Apple has reached a long-awaited deal to bring iPhone to China Mobile, world’s biggest phone carrier. The companies announced a multi-year deal, to begin selling the iPhone 5s and iPhone 5c in China on Jan. 17. Pricing was not announced. Apple shares will likely rise based on the deal and could help drive earnings per share through 2014, says Brian Marshall, an analyst with International Strategy & Investment Group. “The deal is long-anticipated but finally announced,” he says. “We think it’s a big deal.”

Our model moved back to a nearly fully-invested stance last week. Given the bullish alignment of the charts and recent economic data, it would not be surprising for the “nearly” to be removed from the previous sentence as early as Monday. We continue to hold our stakes in U.S. stocks (VTI), financials (XLF), technology, small-caps (IWM), Europe (FEZ) and emerging markets (EEM). This bullish allocation will be maintained as long as the market allows; that may be for several years or just a few more weeks. The good thing is if we pay attention with an open and flexible mind, we can adjust to either scenario without ever making or relying on a prediction.

Before And After Fed

This week’s stock market outlook video compares the health of numerous markets, sectors, and risk-on/risk-off ratios before and after last week’s Fed announcement. The analysis points to bullish set-ups as we head into year-end.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

This Bull May Have Legs

Published 12/23/2013, 10:47 AM

Updated 07/09/2023, 06:31 AM

This Bull May Have Legs

Fundamentals And Technicals Align

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.