Buy low, sell high - it's the mantra of every successful investor.

Me? I’m constantly looking for beaten-down stocks. But I don't want just any company that’s been crushed. After all, trying to catch falling knives will make a bloodbath out of your portfolio.

No, it has to be a stock primed for a big comeback. One that has strong and growing fundamentals. Investment legend Benjamin Graham preached this approach.

I like to call them “comeback stocks.”

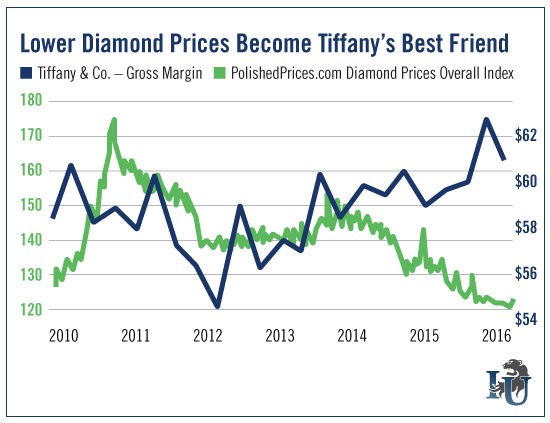

Today’s chart presents a perfect example of a beaten-down company that’s ready for takeoff... Tiffany & Co. (NYSE: NYSE:TIF).

As you can see in this week’s chart, Tiffany's gross margin has been steadily rising. It comes thanks, at least in part, to a whopping 32% drop in diamond prices.

See, those beautifully compressed pieces of coal make up a big portion of cost for Tiffany's. And as the price of diamonds decreases, the company margins increase.

Lower costs, higher profits.

So why is Tiffany down 18.5% year to date?

The company whiffed big time in its most recent quarter, missing on both sales and earnings. It also lowered its guidance for the year. (One positive note: Tiffany was able to lift its dividend 12.5%.)

A lot of the recent negativity is due to the stronger U.S. dollar. Many of Tiffany's stores are located abroad. A powerful greenback means less is brought home after local currencies are converted.

Now add in economic pullbacks in China and Europe. It’s easy to see why sales took a hit.

But these are temporary problems. With input costs on diamonds continuing to fall, this could be a perfect opportunity to get in on the stock.

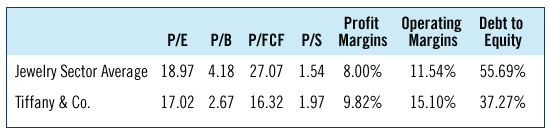

I looked at Tiffany's financials compared to its peers. Check out the table below. The company is outperforming its industry peers on several metrics.

Pay special attention to the value metrics like price-to-earnings (P/E), price-to-book (P/B) and price-to-free cash flow (P/FCF). When gauging a potential comeback stock, the lower these numbers the better.

The only spot where Tiffany is underperforming its peers is price-to-sales (P/S). But, as I said, that’s likely a temporary situation.

Don’t be surprised if Tiffany is a top performer in the second half of the year. The numbers indicate a comeback is right around the corner.