While the mainstream financial media focuses on the U.S.-China trade-war – macro-speculators are eyeing global yield curves – which are now signaling trouble.

But according to this ‘adjusted’ U.S. yield curve – a recession may be coming much sooner than many expect.

Let me explain. . .

First – here’s some context: back in early December 2018, the U.S. yield curve inverted for the first time since the Great Recession of 2008 (the 5-Year bond yielded less than the 3-Year bond).

Then – after a month of turmoil – things looked slightly better in the first quarter of 2019 (at least in the market’s eyes). And the yield curve slipped out of the inversion.

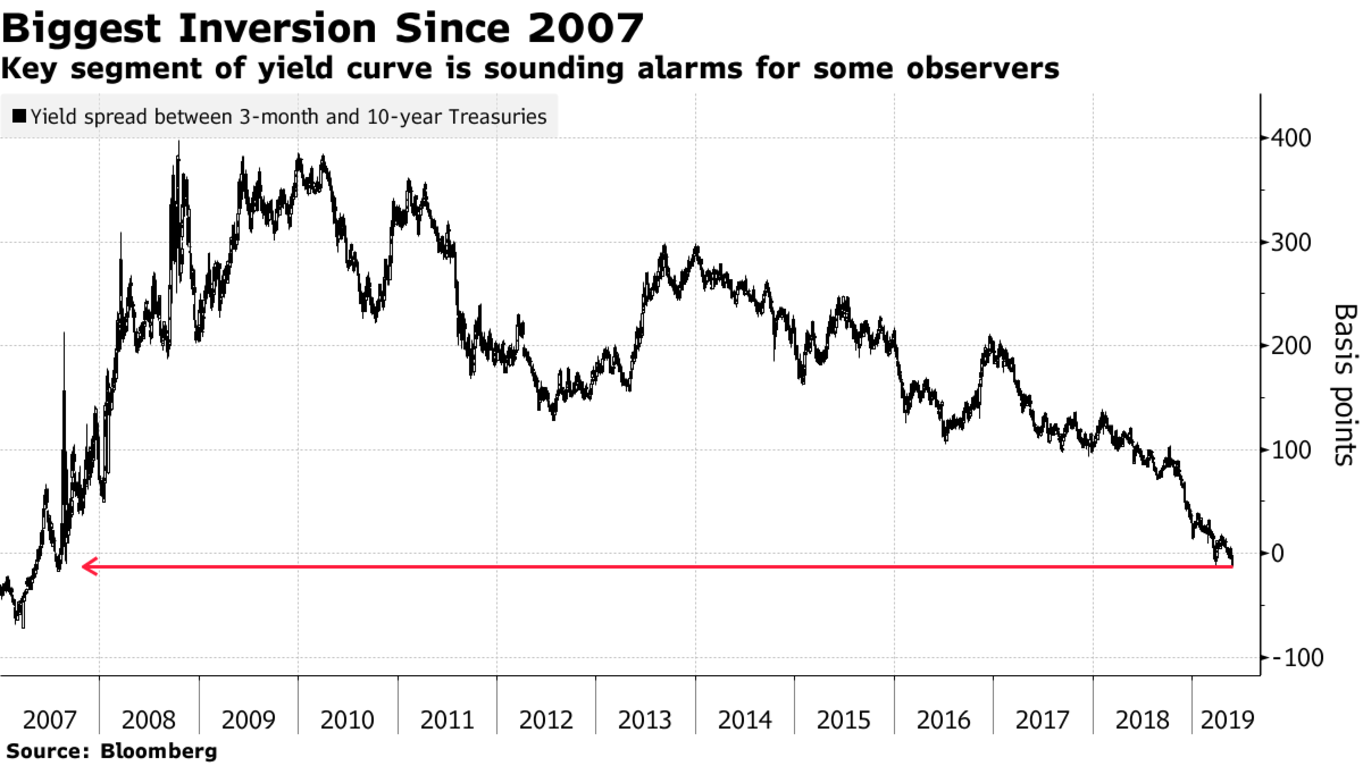

But now – just a few days ago – a very important segment of the U.S. yield-curve – the spread between the 3-month bill and 10-year bond – inverted its most since 2007.

Meaning – the 10-Year bond now yields less than the 3-month bill. . .

Now – this is a deep inversion.

And – historically – when this part of the yield-curve inverts – a recession follows over the next 8-24 months.

(This has held true for the last seven straight recessions in the U.S.).

And since it just happened – the market’s beginning to price in the possibility of a recession happening sometime next year.

But – here’s the problem. . .

If you adjust the yield-curve (which Morgan Stanely has) to account for years of the Fed’s quantitative easing (QE – aka money printing) and quantitative tightening (QT – aka sucking money out of the system) – then you would see that the yield-curve’s actually been chronically inverted for the last six months.

Thus – this adjusted curve suggests that the risk of a recession may happen sooner than many believe (by at least six months).

Also – this curve tells a much different story than what the mainstream financial media’s been sharing.

For instance – the mainstream has preached that the recent escalation in the U.S.-China trade-war is what sent yields sinking into inversion.

But – according to Morgan Stanely – this part of the yield curve (the 3-month-and-10-year) actually inverted back in December. And has stayed inverted ever since.

This really shouldn’t come as a surprise. . .

Because ever since late-2018 – there’s been disappointing economic data coming out from around the world (especially from major economies).

Whether it’s weak German manufacturing – or plunging world-trade volumes – or deteriorating economic data from China.

So – in summary – the recent ‘big inversion’ wasn’t so recent after all.

And if history means anything here – then the risk of a recession showing up may happen sooner than many expect.

I’ve written before that – contrary to public opinion – there’s strong evidence indicating yield inversion actually triggers slowing growth and recessions. (For instance – major banks and lending institutions begin curtailing new loans and refinancing as lending profits deteriorate).

But – regardless of a recession happening sooner or later. I believe market volatility will pick up over the next several months.

And that the market may be in for a big surprise.