The financial system is preparing for an inflationary shock.

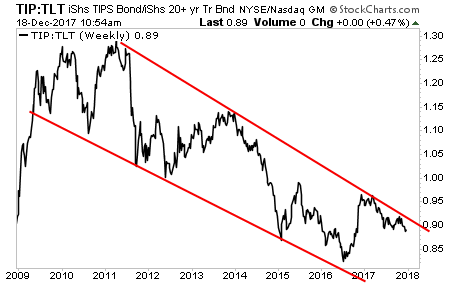

The single-best means of measuring inflation vs. deflationary forces in the US financial system is the TIP-to-Long-Treasury (TLT) ratio. When this ratio rallies the system is predicting inflation. When it falls, the system is fearing deflation.

Running back to 2010, we’ve been in a long-term deflationary downtrend on this ratio.

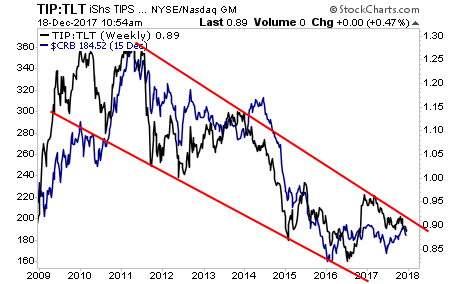

This deflationary pull has dragged down the entire commodity complex over the same time period.

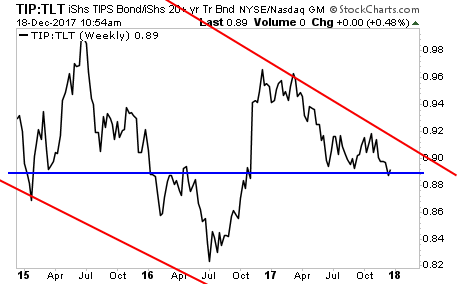

But this is about to end. In the short- term, the TIP:TLT ratio has MASSIVE support at current levels. And given the clear descending wedge pattern it’s formed, the odds are favoring a sharp breakout to the upside sometime in early 2018.

This is going to ignite a HUGE rally in commodities and other inflation hedges. Our big theme for 2018 is INFLATION. And we’re already producing numerous winners from this trend.